Five steps to securing funding for your business

Whilst the UK is home to a large number of innovative startups, and has even been proclaimed the ‘unicorn’ capital of Europe, it also has a disappointingly high gender funding gap. According to a report commissioned by the British Business Bank, for every £1 of VC investment, less than 1p went to all-female teams and only 10p to mixed-gender teams. The initial reaction may be to point fingers at the VC industry, however interestingly the report also noted that in fact only 5% of all pitchdecks received are from all-female teams.

Therefore, perhaps the real issue to be tackled is how do we get more female-led businesses appearing in the VC pipeline? There is a lot of help, support and advice out there for female founders, however I have condensed this down to five key considerations that you can take to maximise your chances of successfully raising capital for your business.

1. Set up a strong support system

For any founder, having a strong support system is paramount, but crucially having a thought-out blend of peers, mentors and advisers can also play a key part in securing funding. Here is what you should be looking for:

- Peers that have already gone through the fundraising process and can provide valuable insight and advice on how to approach VCs, and advise on what has worked for them and what has not. Finding peers in your industry is especially useful for this.

- Mentors that can advise on funding options, explain the fundraising process, help review your business plan and pitchdeck, advise on how much to raise and how much equity to offer.

- Advisers that can fill any skills gaps within your team. For example, if you are a highly technical person, obtaining some insight from a more commercial or creative individual will put you in a stronger position when approaching investors.

2. Women more cautious than men in choosing funding route

It’s vital to take the time to review and evaluate the best financing options for your business. It’s important to mention that there is a marked difference between the funding routes taken by men and women. According to The Alison Rose Review of Female Entrepreneurship (essential reading for anyone with an interest in the gender funding gap), women appear to be a lot more cautious than men when choosing funding routes.

The review states that 40% of funding for female entrepreneurs comes from grants rather than VC funding. Additionally, only approximately 1% of female entrepreneurs secured angel investment versus 10% of male entrepreneurs. So, what’s the big deal?

There are two key points to highlight here:

- On average the value of grants are 20-28 times lower than angel investment;

- Angel investment or more generally VC funding also comes with resources, mentorship, expertise, contacts - in short, you get a lot more than just money.

3. How to seek investors

Finding the right parties to approach and take funding from is a significant decision, and it can be difficult to know where to start. Here are some of the key things you need to think about:

- How much are you looking to raise? If you are still early days in your journey, it’s your first time raising external funding, or you are looking to raise a modest amount, perhaps going down the angel investor route may be most appropriate. Having said that, there are some VCs which focus on very early-stage seed deals, so this could still be an option.

- What sector is your business operating in? The point made above about angels and VCs bringing more than just money is only applicable if they actually have the relevant contacts and expertise. If you have a leisure and hospitality business, but approach a VC focused on pure tech, a) you are unlikely to receive funding and b) you would anyway be unlikely to benefit as much from their expertise.

To get started, you can have a look at the Angel Investment Network and at a list compiled by Beauhurt on the most active angel networks in the UK. You can also check out Angel Academe, who invest purely in women-founded tech businesses. On the VC side, you can take a look through the BVCA member directory (make sure you select 'General Partner' from the dropdown menu). This article by The Entrepreneur Handbook also provides a nice summary of venture capital firms in the UK, along with information on investment levels and example portfolio companies for each.

4. Seek a ‘warm’ introduction

Now that the groundwork is done and you have your target VCs in mind, you need to get your business in the pipeline. In order to maximise your chances, you need to understand where VCs actually get their deal flow from. There are three main sources:

- Existing connections, including angels, other VCs, entrepreneurs, bankers, lawyers, accountants, etc.

- Direct submissions, for example pitchdecks sent to a VCs generic email or via their website.

- Proactively sourced e.g. VC meets a start-up at a conference.

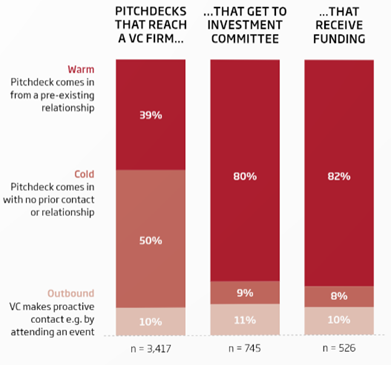

Looking at the previously mentioned report commissioned by the British Business Bank, the statistics around the source of the deals versus the number of deals that end up receiving funding is telling.

What this effectively means is that you are far less likely to receive funding if you submit a 'cold' application than if you get a 'warm' introduction. It is therefore vital to network within the VC industry and identify the relevant contacts who may be able to provide an introduction. A good tip is to have a look at VC industry awards, as these include categories and sponsors covering the whole VC ecosystem.

For example, the Growth Investor Awards or the EIS Association Awards. You may also consider attending a startup programme, such as the PwC FinTech scaleup programme which brings together startups, industry experts and corporates, allowing you to gain valuable support but also vastly expand your network with industry leaders.

5. Perfect your pitch

The last step is to ensure that once you are finally facing the investors, you deliver the best possible performance. Whilst you may know your business like the back of your hand, perfecting a pitch takes practice. There are now many VCs and organisations offering female founder office hours and pitch clinics. These are opportunities to practice pitching and ask for advice.

Last year, Playfair Capital and Tech Nation supported hundreds of female founders by running over 300 office hours with some of the UK’s leading venture capitalists. Following the success of this initiative, Playfair Capital are planning many more exciting opportunities for the year ahead - plenty more information on their website.

Finally, I would say be bold and be ambitious. You are in control.