How to launch a blockchain tech startup

What are the blueprints needed to start your own blockchain tech startup? How can you navigate through the tech tools, software, hardware, platforms, resources, projects, processes, methods and strategies necessary for success?

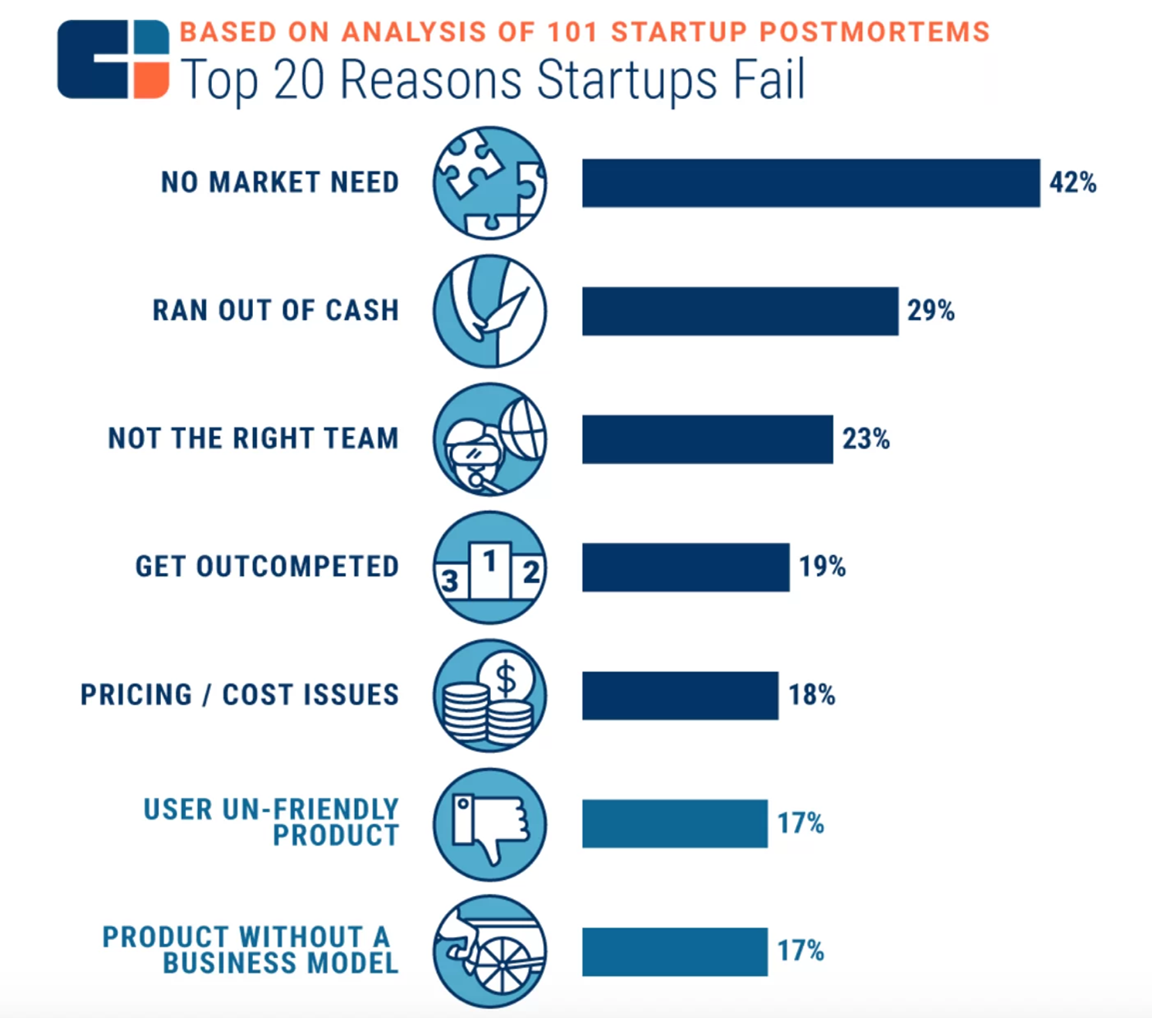

In the first article we learnt the basics of blockchain and digital assets - now, let’s examine how founders can develop a successful blockchain tech startup business. But before we consider the blockchain aspect, always remember above all else - deliver real customer value and solve a genuine problem. The number 1 reason startups fail is 'no market need'.

Source: CB Insights

You can avoid this pitfall from the start by validating assumptions with customers, before building the blockchain layer. This also helps preserve cash runway and avoid the second main reason startups don’t succeed.

Testing and validating assumptions

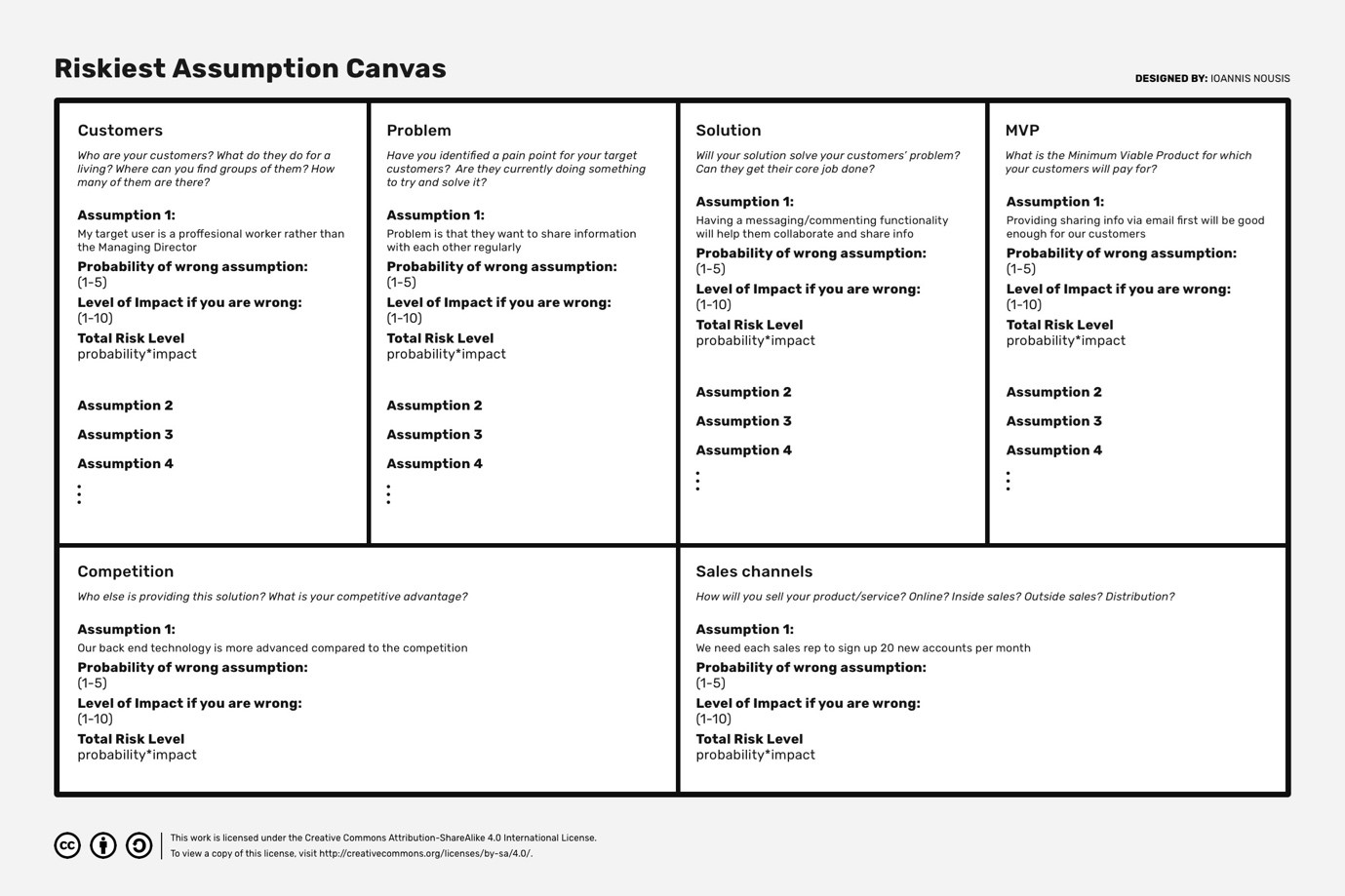

First and foremost, you must test and validate your business assumptions. Most tech founders and product developers turn to the Minimum Viable Product (MVP) methodology to measure progress toward an acceptable market prototype. However, an even better way to prove your product’s viability is the Riskiest Assumption Test (RAT).

The RAT is increasingly being leveraged by blockchain founders to prevent undue spending of time and resources on the wrong product or problem.

It follows the traditional 'Lean Startup Model' and will help you ensure you only build products and features that customers want and, importantly, will see enough value in to pay for.

Full details of RAT and its application can be seen in this ready-made canvas:

Source: UX Collective

Blockchain business models

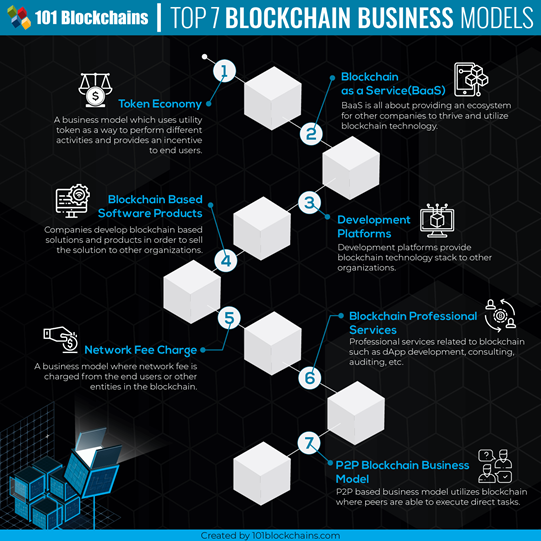

Once assumptions have been validated and you know which problem customers need solving, you can then devise a blockchain-based business model and Go-To-Market (GTM) strategy to acquire customers.

Many founders believe the main economic innovation of blockchain is the use of tokens, however, a blockchain platform can create significant economic value without having a native token at all. One of the most effective ways blockchain delivers value to participants is to reduce inefficiencies, saving both time and costs.

The graphic below explores some of the key enterprise blockchain business models most relevant to your startup project:

Source: 101 Blockchains

Importantly, you can see a common overlap of value creation with a blockchain business model in three main segments of 'economic blockchain value creation':

Decentralisation: Blockchain enables instantly verifiable value and information to be shared directly across multiple parties, without the need for a central entity. This reduces the costs of communicating and reconciling data across different sources.

Trust: Blockchain, together with smart contracts, reduces the cost of enforcement and risk of default. Participants can commit to future actions and outcomes using programmable code to enforce them.

Incentivisation: Blockchain incentivises by redistributing power and control across the participants. This allows stakeholders to capture and realise the value they create, improving incentives for further participation and inward investment.

Economic design framework

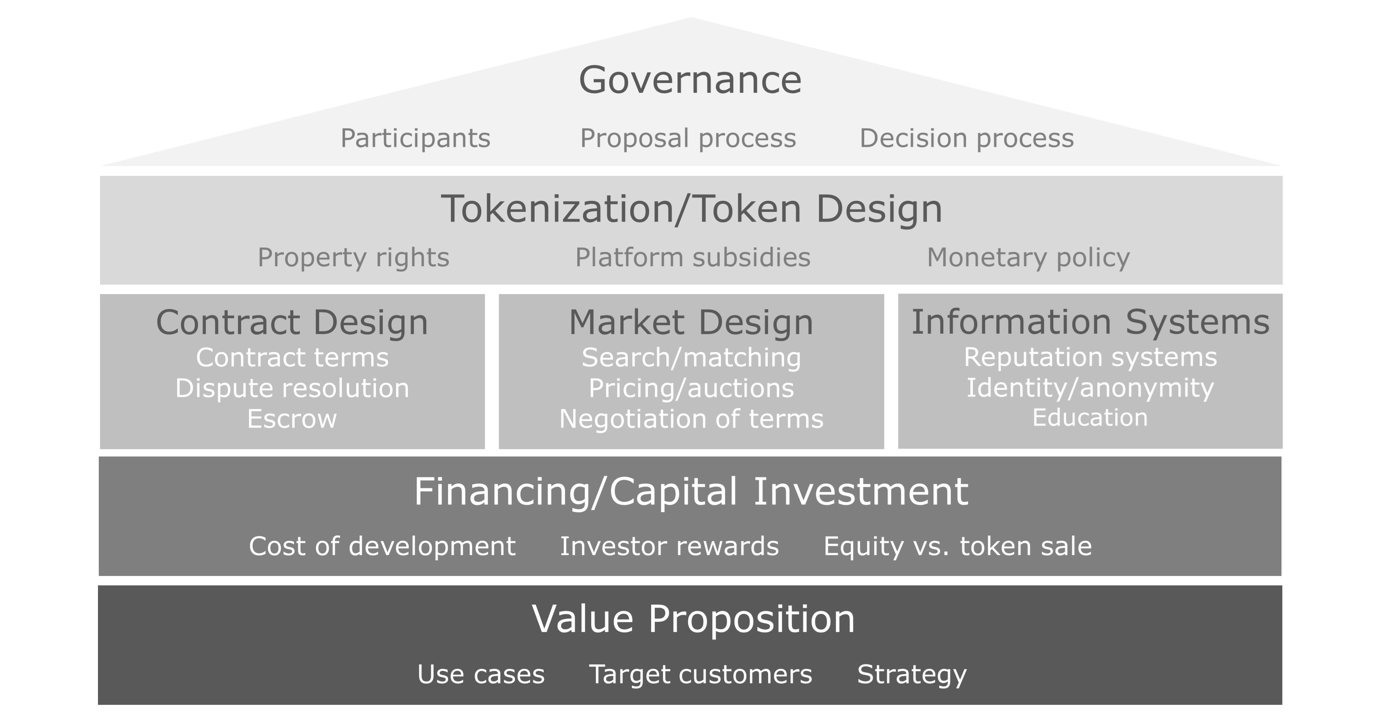

Putting this all together we can now encompass all the elements that make a successful blockchain startup (or indeed project) into an economic design framework:

Source: BLOCKCHAIN RESEARCH INSTITUTE

As you can see, the bottom most fundamental layer is the value proposition. Solve a real problem, validated by future paying customers, in a large addressable market, led by a team to successfully execute on the growth strategy. After the blockchain platform design is laid out, tokens may be integrated into the platform if needed.

Customer acquisition strategy

Once a blockchain business model has been determined, it is important for enterprise startup founders to attempt to secure their first customers.

This requires a GTM strategy that is targeted to your customers’ needs, aligns to their success and is scalable and replicable as your startup grows. Some of the typical reasons corporates cite as to why they struggle to work with innovate blockchain startups in the first place are:

- Solutions are not ready for the market and only work in Proof-of-Concepts (POCs) and pilot.

- Lack of deployment strategy that fits an enterprise’s data and infosec policy

- Misaligned engagement with the different business stakeholders

- Limited knowledge and applications of how the B2B sales cycle works

- Startup innovation caters to the enterprise 'innovation department', not the relevant business unit.

The above are some of the most common factors corporates find most frustrating when attempting to integrate blockchain startup solutions. Thus to gain adoption with large enterprise customers, in typically antiquated and regulated industries, the offering does not need to be simply 'transformational' or 'innovate' but also be production-ready and cater to all the relevant internal stakeholder needs.

Case study: Coadjute - Digitising the UK property market

Source: Coadjute

So let’s explore how we practically go from blockchain startup idea, to validation, product build out, B2B customer acquisition, growth and scaleup using the story of how Coadjute is digitising the UK property market. This illustrates how blockchain is dramatically impacting a real-world business process, enabling simpler, more secure transactions and halving the time it takes to move home

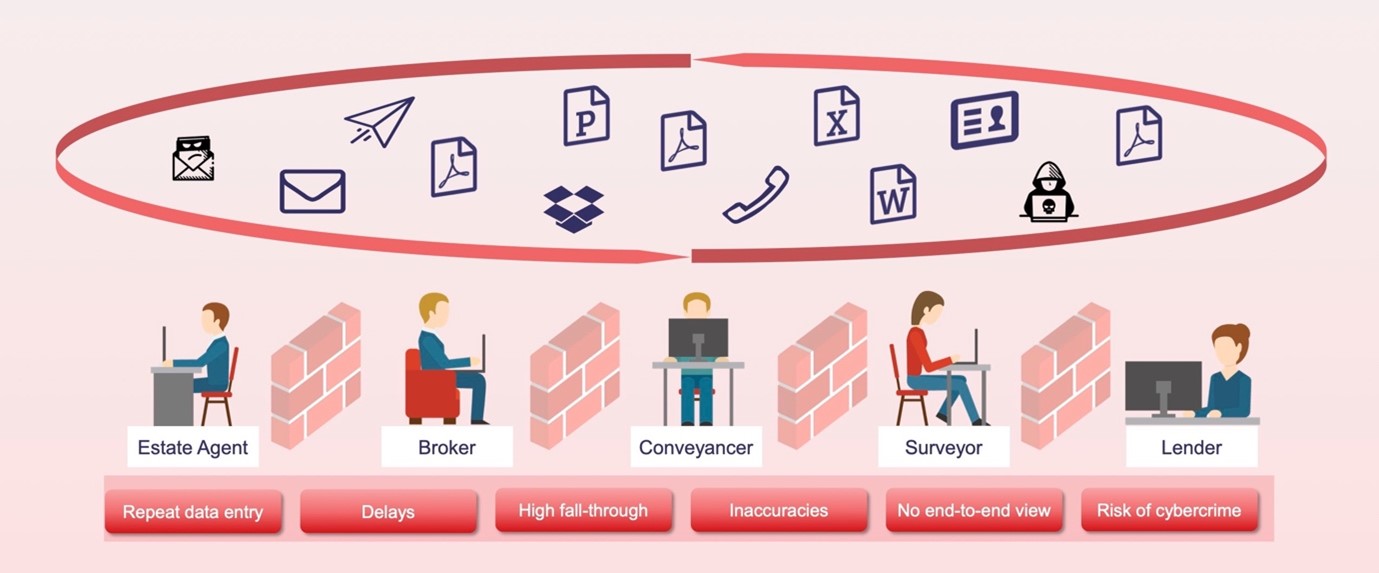

The typical property buying process in the UK is slow, complex and costly for both customers and the businesses facilitating the transaction. Coadjute’s blockchain platform connects the businesses that take part in property transactions, enabling buyers, sellers and professionals involved in the property process to synchronise confidential documents, events and transactions in real-time, and securely share messages and confidential documents.

Coadjute’s success has been due to the constant design and validation of its solution. It sought from the beginning to validate its idea with HM Land Registry and Natwest. It then followed this by also assessing the technical feasibility of its solution on Corda. This approach is a great example of how startups can successfully leverage blockchain technology. The network connects the platforms already used by different parties involved in the property transaction process so that its users can cooperate seamlessly across multiple systems, saving them time and money.

The Coadjute Network enables data to be synchronised across existing platforms, so there is one single source of truth about the property transaction, removing the need for manual intervention using phone calls and emails. Property data, messages, documents, digital identities, digital signatures and in due course, digital cash, can all be transmitted across its highly secure network.

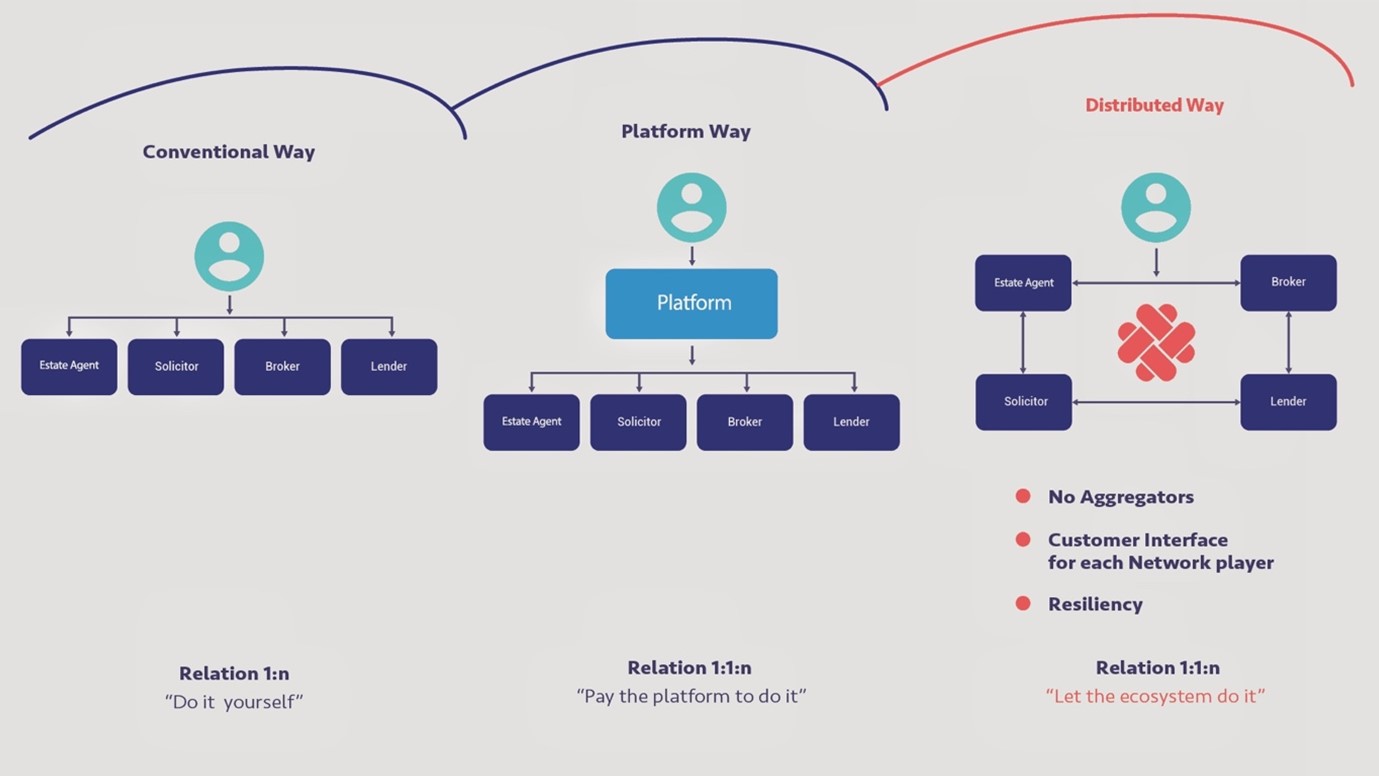

Source: Digital Asset Live

By building a distributed ledger network, participants are now able to connect, interact and transact directly. There is no central data aggregation, customer relationship shift or disintermediation. With Coadjute every platform and business that connects sends data peer-to-peer, so all of the data that is sent today over email is instead sent as part of a peer-to-peer inter-organisational business process.

Bringing this all together, what are some of the key elements of a successful enterprise blockchain project?

- Partner coalition: Coadjute set out for collaboration, not competition, from the start. This reassures incumbents their business will be supported as the network grows.

- Technology leadership: The use of blockchain came from trying to solve the long-standing industry problem of data sharing, rather than from the mindset of a technology company looking for a problem to solve.

- Low adoption barrier: Embedding into existing software platforms that property firms already use, allows for seamless integration.

- Strong team: Coadjute is led by a high calibre team of experienced professionals from the worlds of banking, property, government, and technology.

Looking ahead

In the final piece of this three-part series, we will explore even more real-world use cases to illustrate the breadth of startup blockchain solutions. We’ll see the diversity of industry verticals and geographies that are benefiting from leveraging blockchain to give startups a helpful guide to the many potential use cases available in this growing market.