Enterprise blockchain 101 for B2B startups

Enterprise blockchain has seen huge advances in its application over the past year, and as we enter 2021, startup founders in virtually every sector are considering whether they should be incorporating this technology into their product.

Burgeoning businesses in industries as diverse as financial services, trade finance, supply chain, insurance and healthcare are starting to realise they have to understand what blockchain is and how it will impact their business in the coming years.

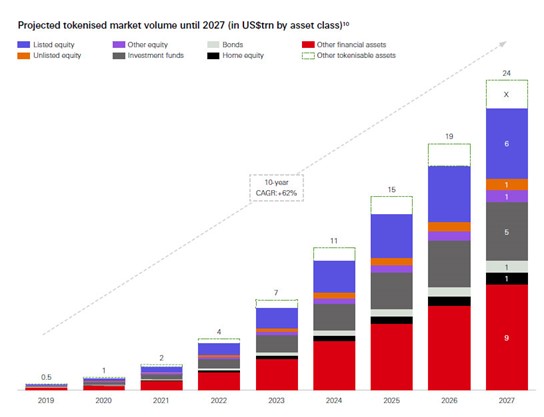

A World Economic Forum survey noted that 10% of global GDP will be stored on blockchain by 2027, and there are some businesses segments that are going to be totally transformed by this technology. Startup founders need to understand this or risk becoming extinct.

So, let’s start with the basics.

What is blockchain?

The most well-known blockchain is the Bitcoin blockchain. Bitcoin functions as censorship-resistant digital cash, and is a new payment rail, though its usefulness for payments is tempered by its price volatility.

While many people are now becoming familiar with such cryptocurrencies, the infrastructure that underpins them is where the true potential lies for the enterprise market and hence to B2B startups.

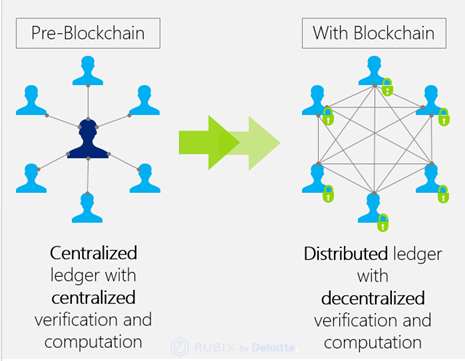

The underlying blockchain itself - the platform through which such cryptocurrencies are built - can support real world applications for a huge variety of customer use cases. At its core, blockchain allows the sharing of value and information across multiple different parties directly and without the need for a central database.

Enterprise blockchain platforms are those that have been purpose-built for the business world, fine tuning the original concept to make it fit for purpose outside of its original cryptocurrency application.

[Source: https://mlsdev.com/blog/156-how-to-build-your-own-blockchain-architecture]

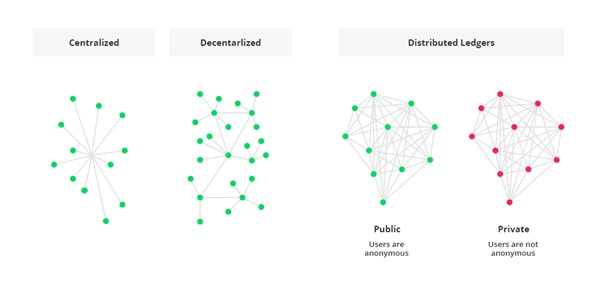

Decentralisation is a process of delegating the functions to many entities, in contrast to a centralised system controlled, governed, and operated by a single entity.

Source: https://www.researchgate.net/figure/Centralized-and-decentralized-networks-3_fig1_325681952

There may be advantages for decentralisation across resiliency (no central point of failure), data security and privacy (avoidance of data 'honeypots'), and process flexibility (customer-to-bank, instead of linear process dependencies on an intermediary).

While public blockchains utilise the benefits of decentralisation, they also mean anyone has access to the network and transactions are broadcasted out to everyone. This can mean privacy is compromised and scalability is limited, rendering them largely unsuited for global businesses.

To illustrate this let’s look at a real world use case. Every morning more than 600 operators from 100 banks in Italy open their laptops to start instantly transacting. Given banks continuously transfer cash between each other, they have to make sure they agree on the balances through reconciliations. In the pre-digital world, that involved ticking lists of transactions. Now let’s enter the blockchain era.

The Spunta Banca blockchain solution is live with over 90% of the Italian banking sector to reconcile differences between them.

In just its first six months since inception the blockchain has processed 204 million transactions. The next step is to run the application at full capacity 24/7, with an estimated total volume of over 8 billion transactions or per year. To put this into context, Bitcoin’s blockchain in the entirety of 2019 managed only 117 million transactions.

In a private permissioned blockchain there are restrictions on who can participate in the network and in what transactions. This is a key consideration for enterprises that need keep both their and their customers’ data private and secure.

What B2B startups need to make sure is the blockchain they are utilising contains several key traits essential to large corporations:

- Data privacy standards

- Functional requirements of business (e.g. production ready, higher transaction volumes, definitive settlement, legal prose)

- Improved customer technical support

Such private permissioned blockchain platforms deliver decentralisation, cryptographic security, transparency, and immutability, as information can be verified and value exchanged without having to rely on a third-party authority.

How can this help a startup?

As things stand, day-to-day business transactions for companies in every sector tend to be complex and costly, because they are:

- Prone to human error or fraud - each participant has its own separate ledger

- Inefficient - intermediaries are needed for validation.

- Susceptible to frequent delays and losses - paper-based and data stored locally by each party.

Enterprise blockchain, on the other hand, allows for frictionless exchange of data and value, delivering:

- Secure and immutable transactions

- Fast and direct processes with no intermediaries or central database

- Automated and programmable workflow (via smart contracts)

Taking this one step further, let’s examine the major benefits blockchain can offer a startup:

- Major reduction in costs: Blockchain platforms make seemingly trivial improvements to business processes, and in doing so, they dramatically drive up levels of automation of previously costly manual procedures.

- Free up more time: Since all parties are utilising a shared ledger, there is no need to reconcile transactions and settlement can be immediate.

- Transact securely: Blockchain platforms ensure immutability of data with the ability to trace, to have provenance, to authenticate identity and have transparency in all transactions.

- New potential revenue streams: Traditional business models are transformed by blockchain technology, opening new opportunities. Identity, payments, trade finance, insurance, healthcare, capital markets and supply chain are just a few examples of use cases that can leverage these benefits.

Digital Assets

Now that we have explored the basics of blockchain, let’s dive deeper into one of the hottest current use cases: tokenisation

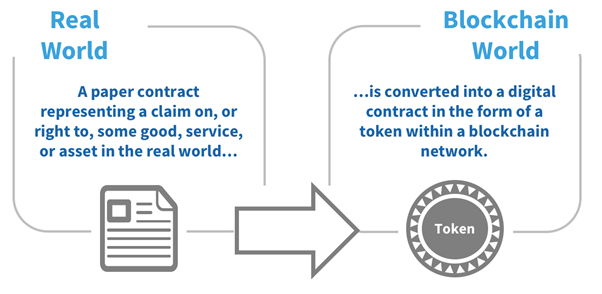

The terms 'digital asset', 'cryptocurrency' and 'token' are often used interchangeably, but are very different in a number of key ways.

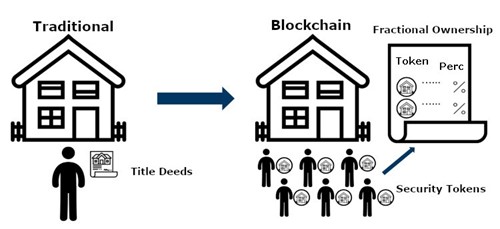

A digital asset is a catch all term for any asset (currencies, shares, real estate, art, cars and more) in a digital format that utilises cryptographic codes to protect information. This ensures authenticity by significantly reducing the possibility of counterfeiting.

Once digitised, the asset is legally represented on the blockchain as a token, which is highly divisible (and therefore liquid). Thinking of owning a Beverly Hills Mansion? Well with digital assets that’s now possible! At least 0.0001%, that is…

The key game changer here is that this goes far beyond traditional physical assets, as any value in the real world can be represented in digital form:

Now, a cryptocurrency is just one type of such digital asset. More specifically it’s a virtual currency which can be traded and utilised as a form of payment for goods and services. However, the examples of digitisation are limitless as are the potential growth opportunities ahead:

Source: https://www.gbm.hsbc.com/-/media/gbm/insights/images/potential-of-tokenisation-img1.jpg

Startup founders have even turned to raise money by issuing a digital asset security (think ICOs, token sales, etc). While potentially solving the liquidity problem that has plagued equity crowdfunding to date, this raises the largest hurdle facing digital assets: regulatory approval.

As the space matures, expect to see more governance protocols and regulatory backing to digital asset frameworks. This will allow everyone to safely realise the huge benefits presented.

Key considerations for founders

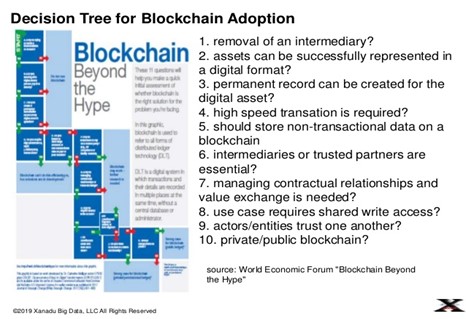

While the benefits are extensive, startup founders must understand the technology in depth before pursuing its implementation in real world use cases. Critically, enterprise blockchain must be viewed as a tool to deliver value to solve a real problem: the technology is the medium, not the goal.

As with any innovative technology, businesses must prioritise building invaluable products, generating customers and a revenue stream, and creating an outstanding user experience - rather than just deploying blockchain for blockchain’s sake.

Start-ups should identify what is missing in the market in which they operate, or even how a product or service can be improved that already exists, and then examine how blockchain could enable this transformation. An example framework for founders to help guide their decision-making process:

Source: https://www.slideshare.net/alexglee/blockchain-bm-development

Crucially in today’s fast-moving software industry, firms should simplify buildout as much as possible and get production-ready fast. The technology should be tested and validated first before building an MVP, and startups should stick to delivering as much value as possible with quick-to-launch features, then fine-tune them as necessary.

The promise of enterprise blockchain has made incredible headway since it first came to mainstream consciousness. We have seen uses cases in just about every industry imaginable and there is literally no sector which could not benefit from its core features.

As with any disruptive technology, understanding its premise and coming to terms with the idea of departing from the status quo will perhaps be the greatest challenge in unlocking enterprise blockchain at scale - but for startups looking to future-proof their business, the time to act is now.

Now that we understand blockchain and its game-changing potential, in the next article we will go into how to successfully build a blockchain startup.

How can we effectively navigate the tech, resources and projects to success? What are some examples of success stories and what can we learn from them?