Which cities can handle the upcoming recession?

The business finance experts at NerdWallet have revealed that London is one of the major cities least prepared to withstand a recession in Great Britain. This is concerning at any time, but even more so now that the country is expected to enter one soon.

While the Bank of England had predicted a recession at the end of this year, a new report shows that the UK economy unexpectedly shrank in August, instead of stalling as predicted by economists.

Using a variety of data points, NerdWallet determined that the inner boroughs of London could face more difficulty than other small cities and towns when it comes to an economic downturn.

Out of 25 cities and towns across the country, London scored 20th overall, ranking below smaller places like Coventry and Dudley.

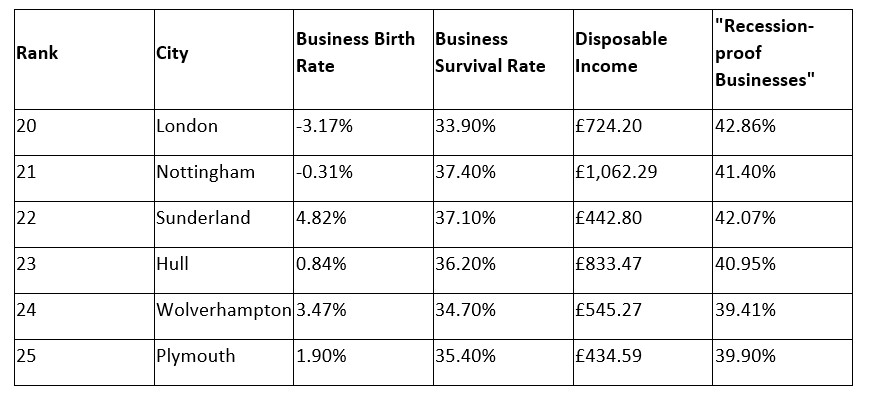

NerdWallet assessed the cities’ scores on several factors such as business birth and survival rate over five years, the disposable income available in the area, and the percentage of businesses in the active business population that could qualify as ‘recession-proof’.

While London naturally scored the highest for the absolute amount of businesses in the city, the capital was close to dead last on other factors. It had the third lowest business survival rate and second lowest business birth rate over five years, meaning that while there are almost 340,000 businesses in the capital, few businesses have made it through since 2017, and the amount of new businesses born in the interim has gone down over 3%.

Table showing the bottom of the table for cities most likely to withstand a recession

Experts also predict a further decline for September due to the national period of mourning and bank holiday for the Queen’s funeral disrupting business hours and operations.

Connor Campbell, business finance expert at NerdWallet comments: “For being such a renowned financial hub, it certainly was a little bit surprising to see London at such a low rank in this list. However, things start to make a bit more sense once we look a little closer. While industry giants’ headquarters from all sectors might be comfortably established in the nation’s capital, it’s the small businesses propping up the many local communities that will feel the impact of the next five quarters the most.

“Those are the businesses that will be hit the hardest by the current pressures on the cost of living and might be faced with a cost of doing business crisis of their own. High basic costs in London means less disposable income, in turn resulting in consumers that will be even less likely or able to afford to shop at smaller businesses who might need it the most.

“While it’s encouraging to see the Government stepping up to help businesses with their bills for the next six months, we are only just beginning to see how this will affect the smaller firms.”

Economists are attributing the UK’s negative growth to various factors, primarily the Russia-Ukraine conflict for its disruption of fuel prices, which has left a lot of households and SMEs struggling to pay for their energy bills.

Pandemic-related Government spending support to individuals and businesses has also mostly stopped or reduced, contributing to the economy’s slowdown.

While some businesses will receive some Government support until April of 2023, small and medium businesses will be the ones hit the hardest.