Startup Spain: a slowdown in growth

Spain’s innovation ecosystem strives to keep pace with global rivals, according to the new ‘Tech Scaleup Spain. Keeping the pace of innovation in an evolving global scenario 2024 Report’ that Mind the Bridge (with the support of ACCIONA and Crunchbase) presented at Tech Spirit Barcelona, shedding light on the state of Spain’s innovation ecosystem and its positioning in the global race for technological leadership.

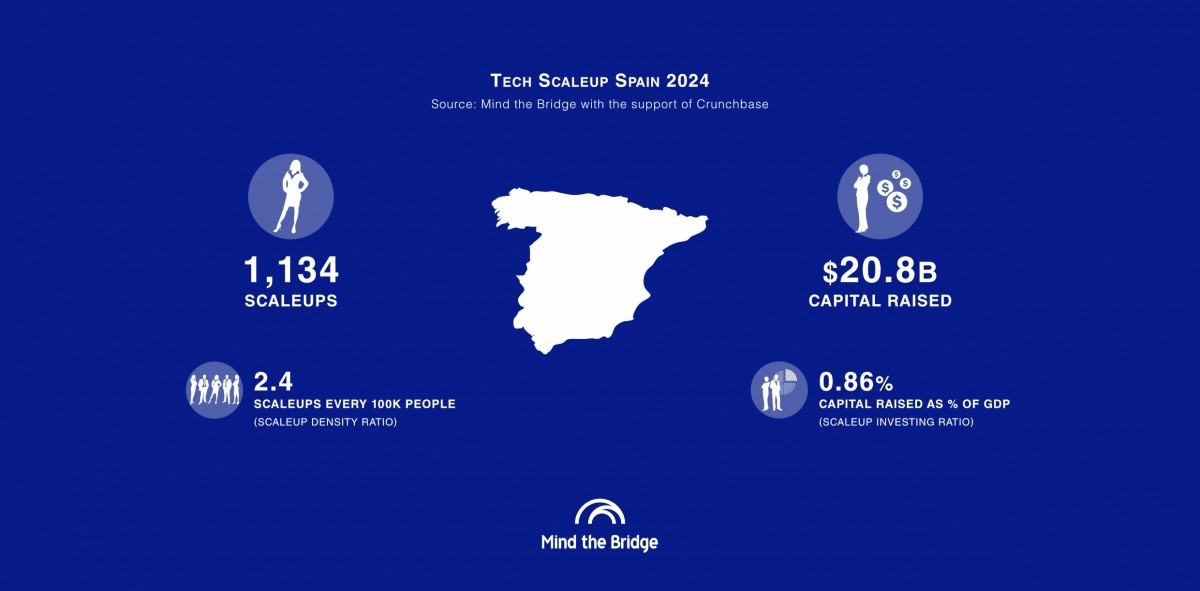

Data reveals that Spain is still the leading ecosystem in Southern Europe with 1,134 scaleups and $20.8 billion in capital raised. Yet, it is growing slower than comparable emerging hubs such as South Korea and Australia. Key findings of the report emphasise the need for Spain to strengthen policies supporting innovation, attract investment, and reduce the gap with leading European ecosystems like France and Germany.

“Spain has reached a critical juncture,” commented Alberto Onetti, Chairman, Mind the Bridge. “While it continues to lead Southern Europe, has seen a relative slowdown in growth. Then it is crucial to continue developing and expanding effective policies to strengthen global connections, attract corporate and investor interest, promote diversity, and support industrial transformation.”

Main evidence of the report include:

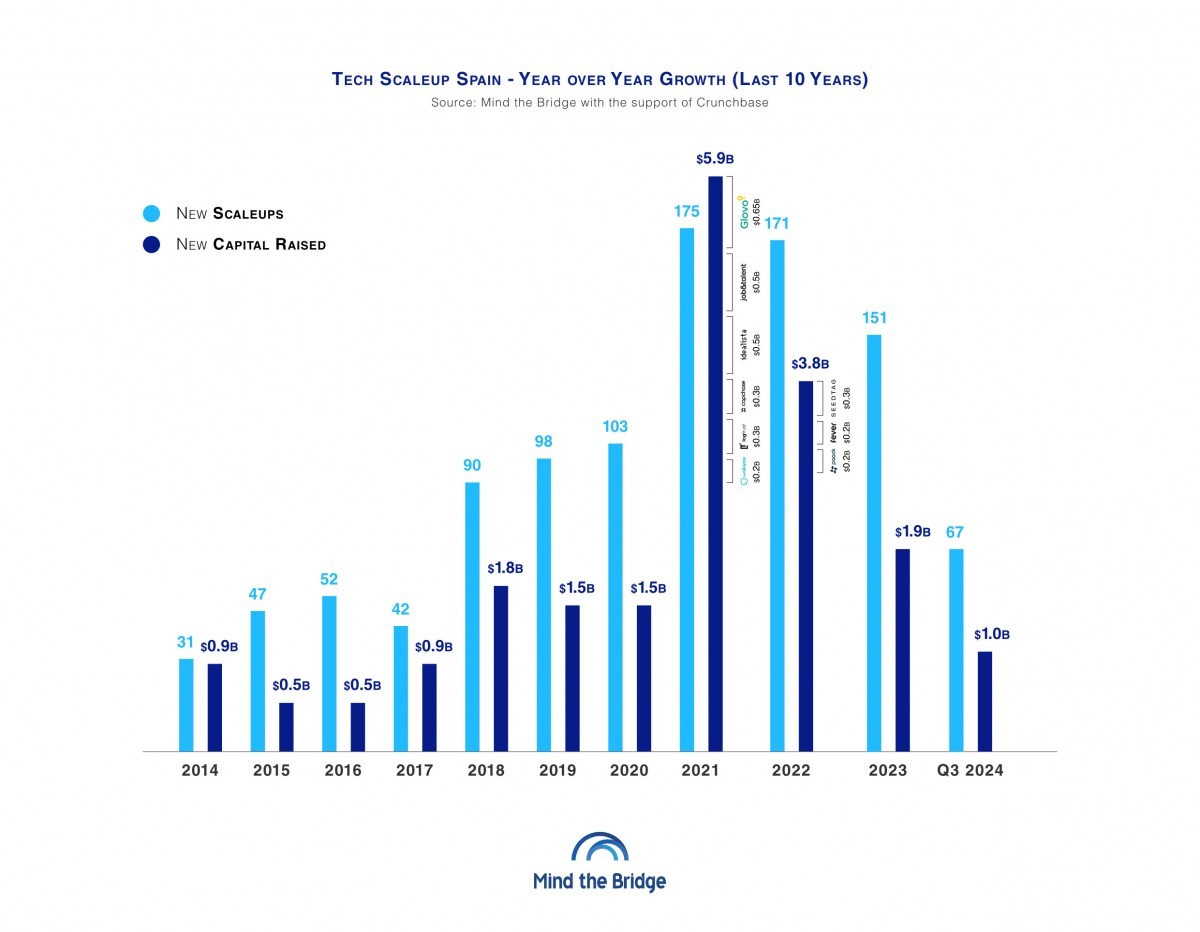

- Key milestones: in 2023, Spain surpassed 1,000 scaleups for the first time, marking a major achievement for its innovation ecosystem. Additionally, by the end of Q3 2024, 67 new scaleups had been recorded, and $1 billion was raised, pushing Spain's total funding beyond the $20 billion mark. These achievements underscore the resilience and potential of Spain's startup and scaleup ecosystem

- Global comparison: Spain’s scaleup density ratio (2.4 per 100k population) and capital raised as a percentage of GDP (0.86%) fall below global leaders and emerging hubs such as South Korea and Australia, highlighting areas for improvement

- Regional hubs: while Barcelona (476 scaleups) and Madrid (373 scaleups) lead the Spanish ecosystem (capturing 50% and 40% of total funding with $9.7 and $8.4 billion respectively), emerging regions like Valencia, Seville, and Malaga show promise in driving distributed growth

Women founders in Spain

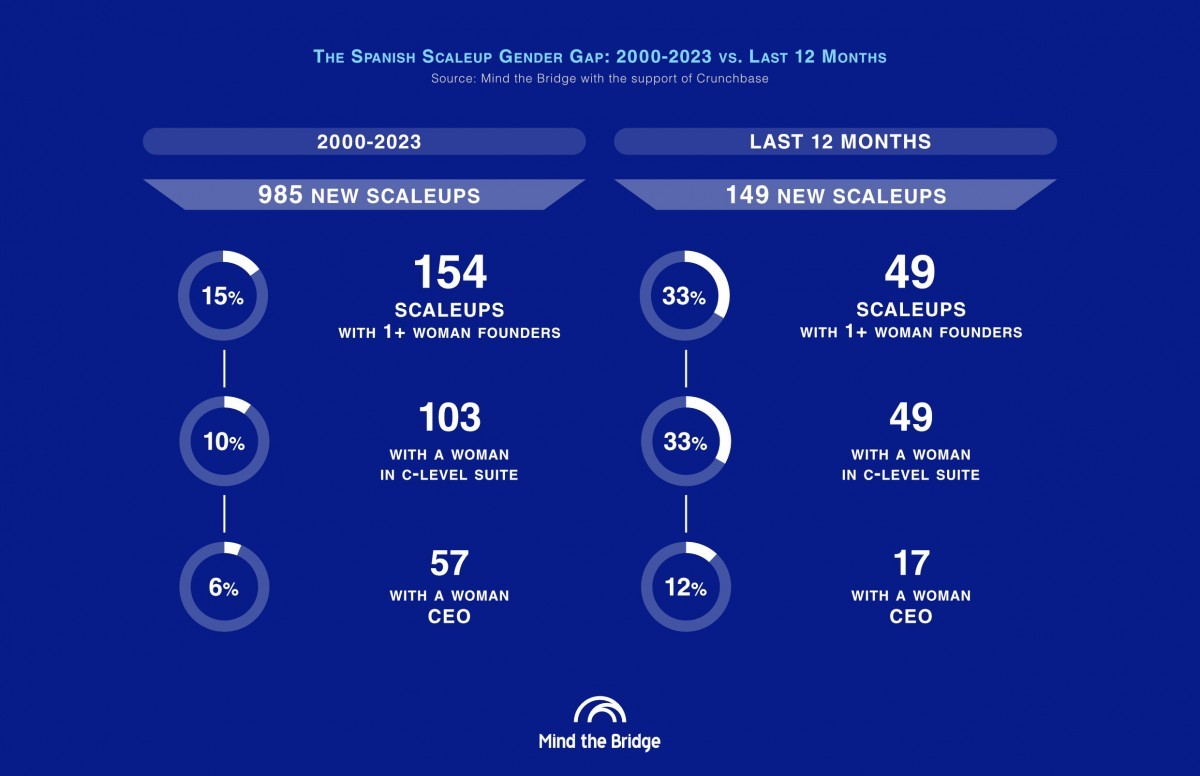

A deeper analysis concerns Women’s Leadership in the country: Spain has made significant strides in women-led entrepreneurship, with 203 women-founded scaleups out of 1,134 total – 18% of the ecosystem – and 33% of scaleups in the past year co-founded by women, placing it on par with Silicon Valley.

“On one hand Spanish corporations can be pivotal in reactivating the ecosystem, whether by strengthening client-supplier relationships with startups or through investments and acquisitions,” added Telmo Pérez Luaces, Chief Innovation & New Business, Acciona. “Similarly, just as we strive to promote gender equality and diversity within our companies, we must also support and encourage initiatives that inspire more women to pursue entrepreneurship. This will enable the next generation of Spanish scale-ups to benefit from greater female leadership.”

Healthtech emerges as the leading tech sector driven by women, accounting for a significant 24% of women-founded scaleups, with Femtech making up 21% of this domain. Interviews with leading Spanish women founders revealed gender-related barriers persist, with 40% of women founders reporting issues and 3 out of 10 facing significant limitations, such as unequal representation and subtle biases, often questioning their authority and leadership and difficulties balancing work and family needs, compounded by financial disadvantages during maternity leave. Moreover, 80% report more difficulties in raising capital due to gender biases, with one-third describing the process as significantly harder.

“Spain’s inclusive approach to innovation, particularly its progress in closing the gender gap, is commendable,” added Marco Marinucci, CEO and Founder, Mind the Bridge. “However, a continued focus on scaling its regional hubs and leveraging its distributed concentration of talent will be key to unlocking its full potential.”

The report finally emphasises the role of policies and global collaborations in shaping Spain’s innovation future. With a need for more tech IPOs (this channel remains vastly underutilised, contributing only 7% of total scaleup financing) and larger funding rounds (in 2023 and 2024, no funding rounds were recorded in emerging tech trends comparable to the significant activity seen in 2020-2021) the country stands at a crossroads to redefine its trajectory in the global innovation landscape.