Small businesses apprehensive of Autumn Budget impact

Across the UK, 86% of small businesses fear the possibility of Autumn Budget announcements that, in their view, would adversely impact their plans for growth – with rises to taxation and fuel duty topping the list of concerns – according to new research from Novuna Business Finance.

The findings come at a time when the percentage of small business owners predicting growth has fallen for the fourth consecutive quarter to a new five-year low (25%) – and in every industry sector, the percentage of enterprises predicting growth in the countdown to Christmas has fallen since the start of the year. With the new Novuna Business Finance data also revealing a rise in the percentage of small business owners that fear contraction or collapse in the three months to Christmas (23%, the highest level since 27% in Q1 2021), the widespread fears over the Autumn Budget are a reflection of the fragile confidence of small business owners, many of whom feel they would be unable to absorb any further financial burdens on costs or from taxes.

The Budget announcements that would hurt small businesses the most

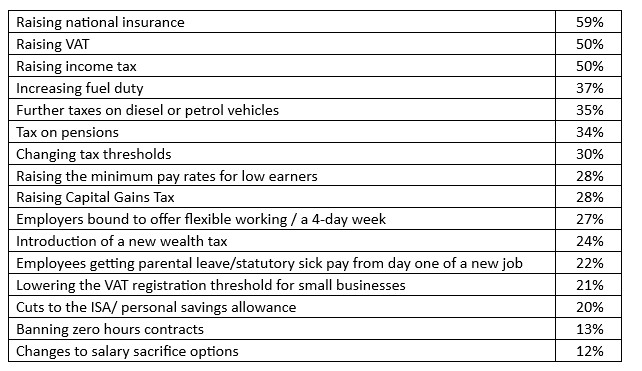

Whilst nobody knows what will be announced in November’s Autumn Budget, the Novuna Business Finance poll gives an indication of the announcements that might be most damaging to small business confidence. The poll asked a nationally representative sample of 1,000 small business owners which, if any, Budget announcements would negatively impact the growth outlook and finances of their business. Following the impact of last year’s National Insurance rise, many small businesses (59%) fear the impact of further rises here. The prospect of increases to VAT (50%), income tax (50%) and fuel duty (37%) were also top concerns – with 37% also fearing the business impact on any further taxes on diesel or petrol vehicles. With rumours already circulating on possible Budget raids on pensions, this is also a major worry to more than a third of small business owners (34%).

Findings by industry sector

Autumn Budget announcements feared the most varied by industry sector:

- Changes to tax thresholds was the biggest concern for small businesses in the agricultural sector (45%)

- Further rises to National Insurance were most feared in the transport and distribution sector (68%)

- The possibility of rises to Income Tax and Capital Gains Tax were the greatest cause of concern in the real estate sector (68% and 51% respectively)

- The prospect of rises in VAT and the lowering of VAT thresholds worried small businesses the most in the retail sector, where growth outlook has been fragile (63% and 37% respectively)

- Small businesses in the construction sector were the most worried about the possibility of increases to fuel duty (55%) and any further taxes on diesel or petrol vehicles (55%)

Findings around the UK

- In Scotland, small businesses were most likely to fear rises in VAT (58%) and changes tax thresholds (42%)

- East Anglia was the region where enterprises most feared the prospect of hikes to Income Tax (56%) or Capital Gains Tax (32%)

- Further rises to National Insurance troubled enterprises the most in the South East (65%)

- In the North East, the possibility of increases to fuel duty was the top concern (48%)

- Small businesses in the North West were most concerned about further increases to the National Minimum Wage (38%)

Jo Morris, Head of Insight at Novuna Business Finance comments: “For the last 11 years, Novuna Business Finance has been tracking small business growth outlook every quarter. Major events such as Brexit, COVID, the Scottish Referendum and Budgets are all moments when we have captured the impact of events on small business outlook. The latest findings are not about double-guessing what will or won’t be in the Autumn Budget, but the findings tell us a lot about how small business owners see the world and what may help or hinder their growth. The last four quarters have seen consecutive falls in small business confidence, and this is perhaps the long-tail of the cost-of-living crisis – such as rising supplier costs, the burden of energy and fuel costs and mounting staff costs. What our new research tells us is small businesses cannot keep absorbing market pressures to their cost-line and cashflow. We are all committed to growth in this country, but small businesses need a ‘Budget for Business’ – one that eases the tax burden, helps with the operating costs and makes hiring people more affordable. Help here will do a lot to power growth into 2026 and beyond.”

For more startup news, check out the other articles on the website, and subscribe to the magazine for free. Listen to The Cereal Entrepreneur podcast for more interviews with entrepreneurs and big-hitters in the startup ecosystem.