How to Compensate Startup Advisors

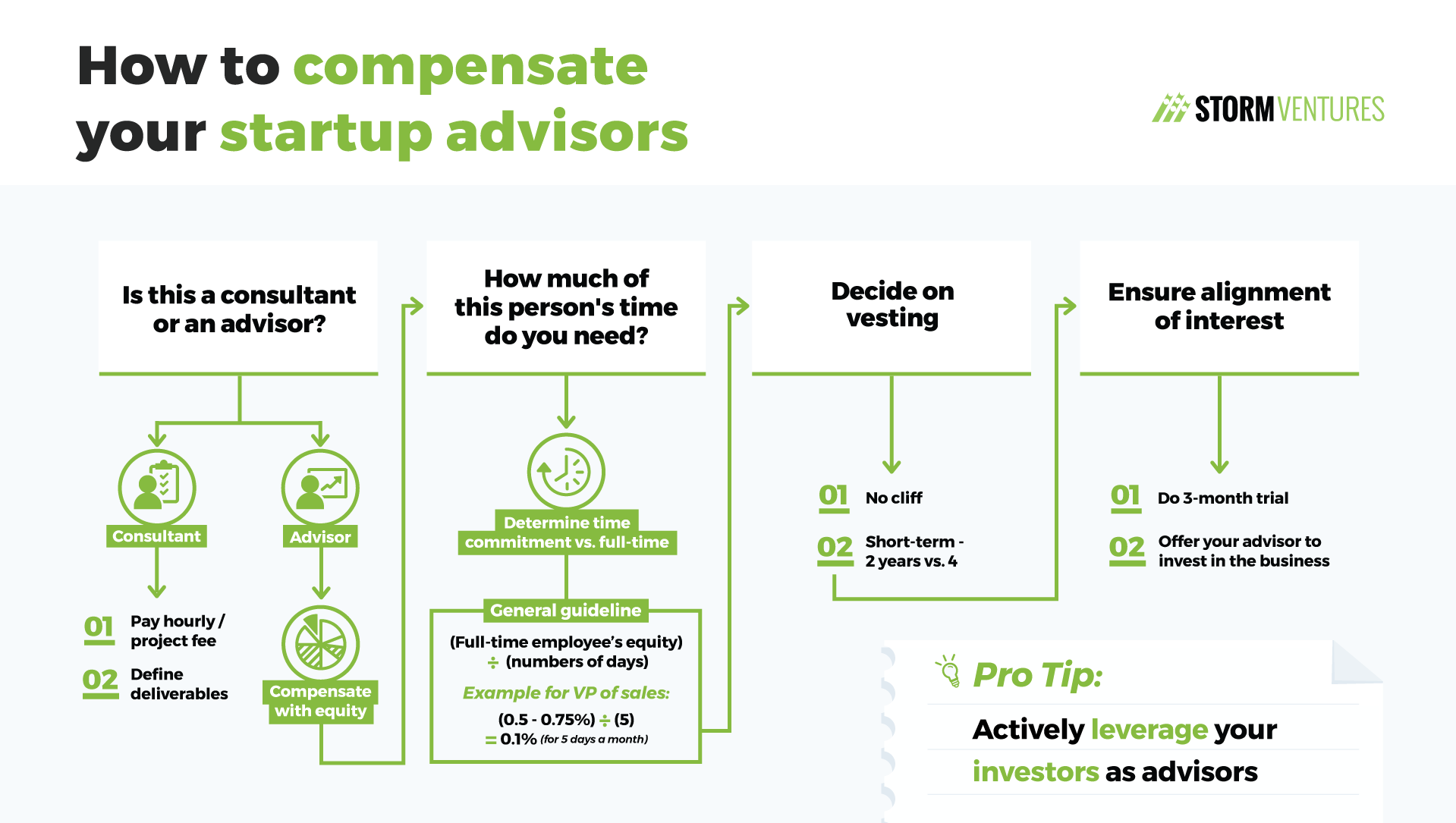

A common question from startup founders looking to bring advisors on board is how to compensate them. What framework can you use to design a suitable package for your advisors?

Working with an advisor is a different relationship from the one with employees or consultants. In those latter scenarios, you have people working to a set of deliverables, and you determine a compensation package accordingly.

Advisors play a different role. Although you will get the best from the relationship when you are specific about the advice you need, they don’t work to deliverables in the way that a consultant does. So, how do you compensate them for their time?

As an early-stage investor in B2B startups, here is my advice.

Cash Versus Equity

Cash compensation makes sense when you are working with employees and consultants. But it is less appropriate when you are bringing in an advisor.

Advisors share thoughts and give advice based on their previous experience and expertise. There isn’t an agreed output, as there is with a consultant so it makes sense to compensate advisors with equity.

If you are discussing cash compensation with an external expert, I’d suggest that the relationship is more akin to a consultant than to an advisor. If you decide to take this approach, think hard about what you want the person to deliver.

Designing an Equity Package

So, provided your confident they are an advisor not a consultant, how do you create the right equity package?

Start by thinking of what you would offer someone if they came on board as a senior member of your team. Take the nearest equivalent position, such as CFO, CMO, or even CEO, and consider what the equity package would look like if they were joining you in that role.

Of course, you don’t want to give an advisor the same equity that you would if they were joining you full-time. Advisors are just there to give you advice from time to time. So, consider what the likely time commitment from them will be. How often will you call on them? Will it be daily? Weekly? A couple of times a month? You can use this as a benchmark, and proportion what you would offer someone joining you full-time in a corresponding role.

Let’s take the example of a VP of Sales. If you were recruiting someone to this position in the early days as a startup, I’d expect to see an offer of half a point to three-quarters of a percentage point, assuming you would be bringing them on full-time.

Similarly, if you are bringing in an advisor who has a background in sales - maybe they have been a CRO or have held a VP of Sales position at a successful company - their advice will correspond to the role of VP of sales. You can therefore use the equity package you would offer a VP of Sales as a guide for what to offer the advisor.

Say you are speaking to them just once a week or a couple of times a month, take the package you would’d offer your VP and divide it by five to compensate your advisor for their time.

Think About the Time Horizon

Another factor to consider is the timeframe. When you offer equity to your employees, you’ll typically be using a four-year vesting schedule.

But your advisor’s involvement with your startup may be much shorter. Your needs as a company and as an entrepreneur are likely to change and the advice you need in the earlier stages will be different from what you need later on.

The circumstances and availability of your advisor may change too. They might enter a new role that leaves them less time to dedicate to your company. Since they aren’t an employee or a consultant who has made a commitment to a set of deliverables, it isn’t advisable to set long timeframes.

My advice to startup founders bringing on advisors is to think about a shorter time horizon. Instead of four years, look at two years, or even just one.

Let’s return to our VP of Sales example and add the assumption that the advisor will be working with you for two years. Perhaps they’ll spend a couple of days a month with you, helping you interview for sales roles, for instance.

For an equivalent time commitment, you might offer an employee 0.1% equity over four years. Divide that by two to allow for the shorter relationship. Now the figure should start to look like a comfortable amount.

Don’t forget that you can always offer another deal if you both decide to extend the relationship.

Consider it a Recognition of the Time They Are Investing

In my experience, advisors rarely give you time and expertise because they want to monetize the relationship. A genuine advisor gives you support because they want you to be successful. It takes a team and solid advisors to build a company. You’ll find the people who have done it themselves, want to give back because they know their own success was only possible with the support of others.

What they are looking for in return is some recognition of the time they have invested in your success.

Look for advisors who believe in you and your company’s mission. If someone you are considering is pushing hard for higher compensation, it likely indicates that they aren’t the advisor for you. That doesn’t mean they can’t be involved. But you might bring them on board as a consultant instead of an advisor. In a consulting relationship, you can be very specific about the deliverables that you want to see from them in exchange for cash compensation or a high level of equity.

Remember Your Investors

Before I finish, I want to remind you that your investors should be a great source of advice for your company too. And once they are investors, their time comes free. After all, they have reason to want to see your startup succeed