FX brokers pocket nearly £1,000 per transaction from SMEs

This year the FCA has explicitly labelled hidden FX markups imposed by legacy brokers as poor practice rooted in poor communication – yet new data analysis from Glyde has revealed the true scale of the issue worldwide for smaller businesses.

Analysis of more than 3,400 past transactions over the last three years via Glyde’s free FX rate calculator reveals how much traditional brokers are skimming from global and European trades, often far exceeding what is disclosed to their unknowing customers.

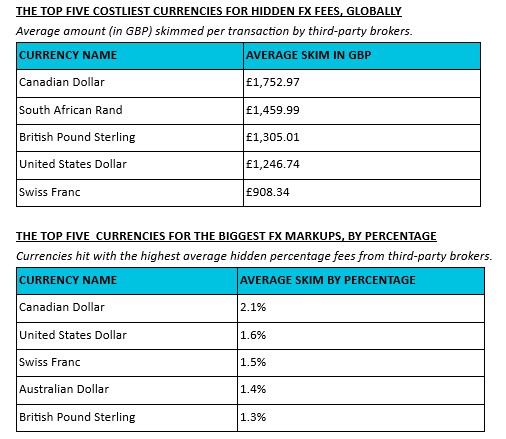

The analysis reveals that businesses globally are losing an average of £992.20 per transaction due to hidden FX markups, based on the average transaction value of £222,025.93, a figure which has been found to balloon depending on the currency involved.

Transactions involving the Canadian Dollar (CAD) were found to result in the highest losses for businesses globally, with an average of £1,752.97 per trade, due to a 2.1% markup charged by third-party brokers. The South African Rand (ZAR) also fared poorly, with an average skim of £1,459.99 per transaction

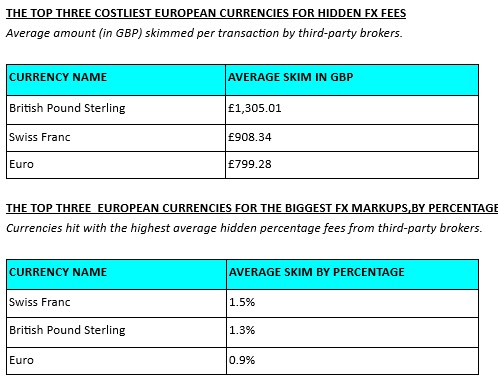

Within Europe, the data shows that SMEs are still far from immune to excessive FX skimming; with the three worst affected currencies being the Euro (EUR), British Pound (GBP) and Swiss Franc (CHF).

Transactions involving the British Pound (GBP) top the European list, with an average hidden skim of £1,305.01 per trade, the equivalent to a 1.3% markup, despite the currency’s widespread use in cross-border European commerce. The Swiss Franc (CHF) follows closely, with average losses of £908.34 per transaction and a 1.5% markup, while the Euro (EUR) – the continent’s most widely traded currency – still sees an average of £799.28 skimmed from each trade, representing a 0.9% markup. These findings underline that even in some of the world’s most tightly regulated markets, SMEs remain exposed to systemic FX markups that severely harm small businesses, despite legacy brokers claiming their services carry no ‘hidden fees’.

The research has been revealed to give SME’s and entrepreneurs visibility into the hidden costs of broker based foreign transactions, offering a real-time, transparent breakdown of exchange rates and markups. The data spans transactions made between September 2022 and July 2025, with an average transaction value of £222,025.93, a common threshold for international B2B payments.

CEO and Founder of Glyde, Ellis Taylor, a former corporate FX broker, saw first-hand how the ‘dark arts of FX’ – opaque rates, inflated margins, and industry compliance flaws – quietly strip profitability from SMEs. Drawing on over three years of direct engagement with SMEs FX workflows, Taylor launched Glyde to challenge the status quo – delivering full transparency for customers, cutting out unnecessary middlemen, and openly challenging the unethical practices entrenched in the global currency exchange industry.

Ellis Taylor, CEO and Co-Founder of Glyde, said: “This analysis is about pulling back the curtain and showing businesses exactly what they’re up against. Transparency shouldn’t be optional – it should be the baseline.

“Every day, SMEs are being quietly short-changed by outdated FX systems. They trust their brokers, but what they’re not seeing is that skim, sometimes thousands of pounds, disappearing from their pockets into those of the brokers. This flies in the face of the FCA’s own guidance on pricing transparency under Consumer Duty. At Glyde we are taking a stand against the murky world of FX, full of hidden fees, vague rates and unnecessary middlemen.”

For more startup news, check out the other articles on the website, and subscribe to the magazine for free. Listen to The Cereal Entrepreneur podcast for more interviews with entrepreneurs and big-hitters in the startup ecosystem.