The agetech revolution in Japan & Korea: a call to UK innovators

Japan and South Korea are at the forefront of a demographic shift that will define the coming decades, as both countries grapple with rapidly ageing societies and declining birth rates.

The resulting strain on labour markets, healthcare services and community infrastructure present significant challenges for the two nations – but also major opportunities for UK tech firms that can help.

The silver tsunami

By 2065, nearly 40% of Japan’s population will be over 65, with the proportion in Korea reaching 42% the same year – making them two of the world’s most elderly countries.

It’s striking that even Japan’s construction industry reported that 36% of its workers were over 55 in 2022, and the age continues to rise.

This shift in population dynamics is bringing significant changes to the nations’ societies and economies. Businesses have access to fewer entry-level workers, families need to care for their elders for longer, and industry and agriculture are being hampered by labour deficits.

Added to this is the rapidly increasing tax burden on Japanese and Korean workers as people age and access their pensions – making funding for infrastructure, public services and welfare systems harder to source.

But the ‘agetech’ sector – producing technological solutions to support ageing populations – is coming to the rescue and growing at an extraordinary pace in both countries.

In Japan, the overall elderly market is expected to be worth £591 billion this year, with high demand across healthcare, smart living and financial services. Similarly, South Korea’s ‘silver economy’ is forecast to expand from £407 billion in 2020 to £698 billion by 2030.

Technologies that improve health are naturally in high demand, with around 61% of South Korean elders having three or more chronic illnesses. But agetech has a role to play across the whole of society, bringing opportunities for UK tech firms specialising not just in healthtech but in robotics, AI, smart living, edtech, fintech and social support.

Japan: embracing technology

Japan’s government has enthusiastically embraced technology to address its ageing crisis.

Policies such as the Basic Act on Measures for an Aging Society and the Healthcare Service Social Implementation Project provide funding and support for integrating ICT, robotics and AI into elderly care.

In addition, companies like Xenoma – makers of smart apparel for elderly healthcare – and organisations like The National Institute of Advanced Industrial Science & Technology (AIST) – creators of PARO, the ‘world’s most therapeutic robot’ – exemplify Japan’s commitment to using technology to enhance quality of life for older people.

Key areas in Japan seeing agetech expansion include:

- Healthcare & remote monitoring: solutions like NTT Docomo’s Rakuraku Phone cater to older users with intuitive interfaces and health monitoring features

- Smart living & robotics: nursing robots, IoT-enabled monitoring and AI-powered home assistants are experiencing widespread adoption

- Agritech tools: Komatsu’s ICT-enabled bulldozers are improving farming techniques to combat the rapidly shrinking and ageing farming population

- Financial & end-of-life planning: digital platforms including Yorisou and Famitra streamline estate management and financial planning for older people

The Japanese government’s commitment to supporting these enabling technologies through subsidies and grants makes it an attractive market for UK firms, particularly those offering AI-driven health monitoring and remote care solutions.

South Korea: a rapidly expanding silver economy

Korea’s demographic trends mirror those of Japan, with one crucial difference – while its ageing crisis is more recent, it’s accelerating faster.

With the world’s lowest fertility rate of just 0.74 and rising healthcare costs, the South Korean government has prioritised agetech development through initiatives such as the Fourth Industrial Revolution for Senior Care. And President Yoon Suk-yeol’s administration announced plans to support “a 100-year life era with improved health and care systems”.

Key initiatives encompass a programme for 883,000 senior jobs with attached benefits including reduced medical expenses, and adoption of IoT and AI for emergency and monitoring services.

Other notable segments of Korea’s agetech sector include:

- Ageing in place technologies: AI-driven smart home solutions, personalised nutrition management and telemedicine services are expanding rapidly

- Elderly nutrition: AI is being harnessed to monitor food intake, identify required nutrients and provide medicinal foods. Korean manufacturer TopTable’s 4D food printing system ‘iink’, for example, was released in 2024 to produce personalised nutritional supplements for older people

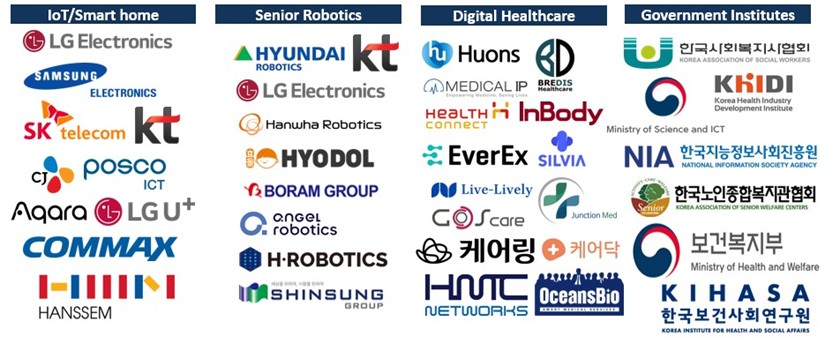

- Elderly care robotics: companies including Hyundai Robotics and Hanwha Robotics are pioneering wearable mobility aids and care robots

- Integrated care systems: Korea’s pilot projects in medical and long-term care integration provide avenues for UK tech companies to introduce smart healthcare solutions

Major Korean corporations are already designing agetech products (see graphic below). But, with an expected annual growth rate of 23% and elderly spending on care technologies set to rise to £350 million by 2030, the country needs both domestic and overseas innovation and its agetech market is a ‘blue ocean’ opportunity for international companies.

Appetite for collaboration

The good news is that corporations in both countries are highly open to working with UK tech firms.

Japan’s position as a long-standing agetech research partner with the UK is particularly notable.

In 2019, Theresa May’s government signed a £30 million joint research programme with the Japanese government to advance treatments for serious chronic diseases including diabetes, heart disease and arthritis. This was taken further forward in 2024 through a UK-Japan grant scheme for research into novel therapies for diagnostics.

Korea, too, recently announced funding for business-led collaborative R&D projects to deliver economic and health benefits through digital innovation.

There are also examples of collaboration beyond the UK. In 2024, US housing operator Thrive signed a joint venture with Seoul-based property manager GH Partners to provide supportive living environments for older people throughout Korea.

And, last month, Belgian company Nobi, developer of AI smart lights that detect and predict falls to help elderly living and care homes, attracted investment from Japanese firm 15th Rock and will now expand into the market.

Challenges and considerations for UK companies

Despite the huge potential and openness to collaborate, entering the Japanese and Korean markets inevitably comes with challenges.

Both Japan and Korea have stringent healthcare and technology regulations. Partnering with local entities and obtaining the necessary certifications are often crucial.

Consumer trust can also pose an obstacle. Elderly consumers are typically hesitant to adopt new technologies, so solutions must be as intuitive and accessible as possible – and tailored to cultural preferences.

UK companies must also pick their market entry approach wisely.

They must navigate local distribution channels, collaborate with established players and make use of government-backed initiatives to ensure successful market penetration.

A strategic growth avenue for UK firms

So, the ageing crisis in Japan and South Korea is not just a societal challenge – it is an opportunity for UK tech firms to help drive innovation, expand into high-growth markets and contribute to solutions that will define the future of global ageing.

With strong government support and rapidly increasing consumer demand, now is the time for UK businesses to explore the vast potential of the agetech sector in these Asian nations.

By forging partnerships, aligning with government initiatives and offering culturally adaptive solutions, UK companies can establish themselves as key players in one of the most promising tech sectors of the 21st century.