Start Up Loans Passes £90m Funding Milestone in South East England

Start Up Loans, part of the British Business Bank announces that the programme has delivered over 9,000 loans worth £90 million to startups in the South East of England. The figures point to the spirit of entrepreneurship in the region, with the average loan being just over £10,000.

The Start Up Loans programme was established in 2012 to reduce regional imbalances by helping people - wherever they are in the UK and whatever their background - to achieve their ambitions of starting their own business.

One such loan recipient is Chloe Bruce, founder of Chloe Bruce Academy, a business offering virtual martial arts classes and tutorials for people across the globe. The academy, which offers on-demand and live classes, has taught hundreds of thousands of people, ranging from beginners to professionals, including actors and actresses learning new skills for action roles.

Before launching her business, Chloe was a stunt double for some of Hollywood’s leading actors such as Zoe Saldana in Guardians of the Galaxy and Daisy Ridley in Star Wars. However, after having had her fair share of being thrown around on wires and fighting some of Hollywood’s biggest baddies, she decided to take on a new type of challenge – launching her own business.

As a mum of two juggling work and childcare, having an online business has been essential in ensuring she maintains a work-life balance. Her dream was always to launch a virtual platform and when COVID-19 meant that people were forced to stay at home, it felt like the right time to formally launch to the public, after years of planning.

Below she shares the challenges she faced on her entrepreneurship journey and offers tips for others who might be considering starting a business of their own.

Chloe Bruce, founder of Chloe Bruce Academy, said: “One of the scariest things I have done in life is invest in my business. I put my whole heart and every last penny into it. I was so anxious that no one would sign up, but I had 64 people sign up within the first two days of going live. I was so inspired to give back to the sport of martial arts, and empowered to grow and work harder than ever before.

“I think the hardest part about being an entrepreneur and the face of your own business, is learning to market it as a serious venture and really sell yourself. I never used to like talking about myself, but that’s all I seem to do these days! I implore any women considering starting their own business to just go for it.”

Richard Bearman, Managing Director of Start-Up Loans, said: “Start Up Loans was established to help people across the UK achieve their ambition of becoming their own boss and I am very proud to say that since its inception, Start Up Loans has now delivered more than 9,000 loans worth over £90 million to businesses in the South East alone.

“The experiences of our Start Up Loans business owners suggests that no matter where you are from, one of the keys to starting a business is having the encouragement and support to do so.”

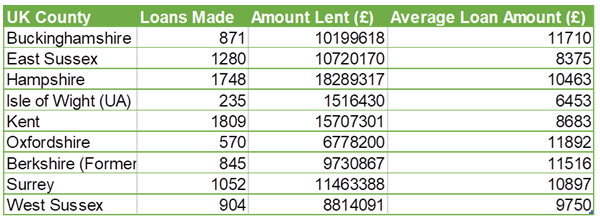

Loan amounts for South East Counties