Improvement in number of SMEs in significant distress

Following on from the easing of national lockdown restrictions in April, Real Business Rescue have released their quarterly Business Distress Index for Q2 (April - June 2020), uncovering a post-pandemic health check on SMEs in the UK. You can view the full report here.

SMEs across England and Wales are fighting back after COVID-19 lockdowns, according to the latest Business Distress Index from Real Business Rescue. New data from the Q2 insolvency and business distress report – which focuses on the three-month period April to June 2021 – demonstrates a real change for most UK SMEs following the easing of the national lockdown restrictions in April.

69,500 SMEs moved out of significant distress in Q2

Many businesses reopened their doors in April 2021, which seems to have had a positive impact on the number of SMEs in significant distress with an almost ten percent decrease since Q1. Standing at 643,500 SMEs in distress in Q2 - 69,500 fewer than Q1 - this is the first quarterly decrease seen since before the pandemic hit the UK in early 2020.

However, the Q2 figures also represent a bittersweet picture with business insolvency on the rise. In total, there were 3,116 company insolvencies in Q2, representing a 31% increase versus Q1 figures (2,371 insolvencies) – the highest quarterly insolvency figure since before the pandemic began.

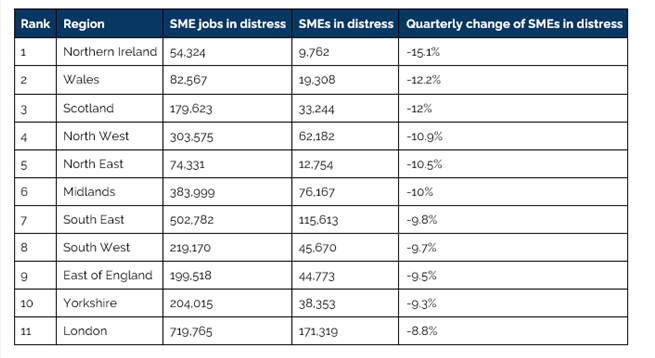

The regions that have seen the biggest reduction in SME distress following the easing of COVID-19 restrictions

Despite the rise in insolvencies, the overall picture is positive with 69,500 SMEs out of significant distress and decreasing levels of regional distress. In fact, since many UK businesses reopened in April, the report shows a drop in significant distress across all regions in the UK.

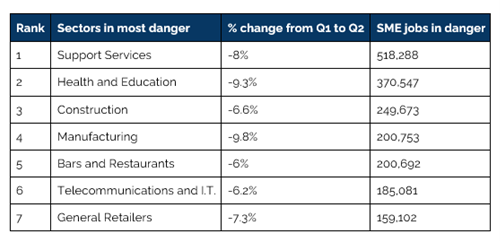

Top seven SME jobs in danger

Despite there still being 3 million SME jobs in danger in the UK, the data shows a six percent decrease since Q1 where 3.2 million SME jobs were at risk. The lockdown easing has played a major part in helping to stabilise the UK economy, but certain sectors have benefitted more than others.

Manufacturing has seen the biggest improvement, with a 9.8% decrease in jobs in danger compared to Q1. Whilst support services saw an eight percent decrease, they have the highest number of SME jobs in danger at 518,288 in Q2.

Commenting on the research, Shaun Barton, National Online Business Operations Director at Real Business Rescue said:

“This Q2 data represents a different story to what we’ve seen in the last 18 months; portraying a brighter picture with distress levels decreasing thanks largely to lockdown-easing in April and trade resuming for many businesses.

"But while that’s positive, there are two stories to tell here. The second being that corporate insolvencies (companies entering into insolvent liquidation) are on the rise which seems to contradict the overall picture of positivity, but we feel there’s a reason for this.

“While many businesses opened their doors in April and started getting back on their feet, this led to a decrease in levels of significant distress levels. But some businesses quickly realised they couldn't manage the accrued liabilities over the previous 12-15 months.

"Many SMEs saw arrears building up throughout the pandemic such as landlord and rent payments, VAT, PAYE, and on top of this we saw Bounce Back Loan repayments beginning in Q2 as well. You can understand why an increasing number of SMEs were simply unable to cope with the heightened cash flow pressure upon re-opening which has led to a rise in voluntary liquidation processes.

"So the overall picture is healthier with the caveat that some businesses, that just about kept their heads above water throughout the pandemic, are now starting to fall away.”