FinTech tools for UK startups

Financial management for startups is of paramount importance. The instruments utilised in financial planning empower startups to preserve their financial wellbeing and strive for sustainable growth.

It is essential for the financial models adopted by a startup to be precise to attract investor interest and secure funding.

Despite the proliferation of startups, including those with intricate ownership frameworks, there is a notable scarcity of services capable of delivering sufficient financial support to this segment of the market. Deficiency in transparency dissuades many conventional banks and FinTech companies from extending banking services to enterprises categorised within this niche.

Payrow, a British FinTech specialising in financial solutions for entrepreneurs and gig economy workers, has unveiled its latest offering aimed at supporting UK startups.

The company assists emerging businesses in managing and scrutinising their financial flows, alongside providing sophisticated digital resources for meticulous expense tracking across all financing dimensions. These resources prove invaluable during audits and when compiling tax documentation.

Payrow carefully considers various startup-specific factors when providing its suite of financial and payment instruments:

Routine management

Typically, in their initial stages, startups operate with lean teams yet face an abundance of routine financial responsibilities – from company incorporation and categorising revenues and expenditures to payroll, tax computations, and more. As the venture grows, the volume of these tasks inevitably increases.

Payrow can offer a profound insight into providing financial and growth-oriented services to startups. To boost a company’s operational efficiency, Payrow streamlines financial processes through automation. This includes handling regular billing, managing recurring and pre-scheduled transactions, compiling reports, preparing income statements, overseeing both inflows and outflows and cash flow management. By addressing these time-consuming tasks, Payrow frees up valuable time and reduces the likelihood of errors.

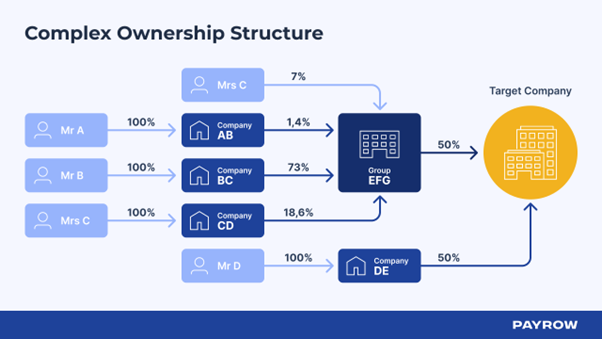

Complex structures

Startups often have complex ownership structures, evolving as new investors and stakeholders become involved throughout the project’s progression. Businesses characterised by such complexity find a ready partner in Payrow, which boasts a team equipped with over three decades of expertise in navigating the nuances of the corporate and FinTech sectors for companies with multifaceted ownership patterns.

Addressing a notable void in the market, this initiative aims to simplify operations for entities encumbered by elaborate ownership schemas. Leveraging a cadre of seasoned professionals and robust Know Your Customer (KYC) protocols, the approach facilitates the seamless incorporation of the requisite number of proprietors at the business registration phase, ensuring a smooth provision of essential financial services from the outset.

Expense management

Startups frequently navigate through numerous recurring costs, such as server fees, email services, and customer relationship management (CRM) tools. These payments are often processed through credit or debit cards, complicating the oversight of expenditures.

Addressing this challenge, the FinTech Payrow now offers services aimed at optimising expense management, specifically through subscription management features.

International accessibility

For startups aiming at a global market, the necessity to facilitate international transactions is paramount. A FinTech solution enables businesses to execute Eurozone and worldwide money transfers efficiently, requiring just a couple of clicks.

Pricing

Startup companies prefer to utilise cost-efficient services to make payments and manage their finances.

Payrow offers flexible, tailored pricing for businesses of all sizes, with plans that accommodate varying transaction volumes and no cap on amounts. Its pricing structure includes options for businesses with high turnovers but fewer transactions and those making more frequent payments, ensuring lower fees in each case.

Additionally, Payrow introduces a Custom Plan for businesses with unique needs or complex structures, standing out by offering unlimited transaction amounts. The model is adaptable, with transparent pricing that includes a one-month free trial, no deposit or withdrawal limits, and reduced commission rates, catering especially to the evolving financial needs of SMEs.

A representative of Payrow commented: “As a startup ourselves, we deeply understand the needs of other emerging businesses. For the development of a startup, ensuring that all processes, particularly the financial ones, are transparent, is crucial. Payrow simplifies the management of essential activities for a nascent company. With Payrow’s tools, you can effortlessly schedule deferred recurring payments, directly pay incoming invoices, or tailor the templates you utilise, obtain comprehensive payment details for specific periods and download statements in a user-friendly format, view your latest transactions and perform other functionalities.”