Female entrepreneurs carry 12x less debt than men

A new report from Swoop Funding has uncovered a striking gender disparity in UK business debt.

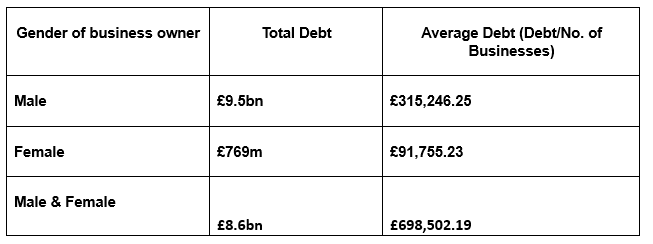

Despite the growing number of female entrepreneurs, the report, which assessed the debt of over 50,000 UK businesses, reveals that female-owned businesses have £769 million worth of business debt, compared to almost £9.5 billion of male-owned business debt, a multiple of more than 12.

This isn’t just a case of there being more male-owned companies, according to the report. Even when adjusting for the number of businesses, the average debt per female-led business stands at £91,755, compared to £315,246 for male-led businesses.

Male vs female-owned business debt in the UK

The financial gap highlighted within Swoop Funding’s report is particularly striking given that 19.1% of active UK companies are female-led, with nearly one million women-owned businesses (997,090) currently operating. Despite their presence in the market, these businesses are not leveraging debt at the same rate.

This suggests a fundamental difference in how male and female entrepreneurs access and utilise debt, and raises crucial questions: Are women more financially risk-averse? Are they facing greater funding barriers? Or are male-led businesses simply leveraging more capital for growth?

Andrea Reynold, CEO, Swoop Funding, explained: “Another way to look at these figures is that female-founded businesses are more often bootstrapped than male-founded businesses. The perception may be that by borrowing, business owners are playing with other people’s money.

“Culturally, women may be put off from using debt to fund essential purchases in their business, so there is clearly still some work we could be doing to educate female entrepreneurs at every stage of their journey that responsible, planned debt is an established route to faster growth.”

Andrea speaks to female entrepreneurs on how they avoid debt whilst continuing to grow their business.

Stacey-Rebekka Karlsson, Founder of Goho Agency explains she and her company are extremely debt averse, but that they relied on a bounce back loan to help support the PR and event company through Covid, when they were hit hardest.

“We don’t have company credit cards or anything like that. The only bit of ‘debt’ I’ve ever taken on as a business if the Governments Bounce Back loan. I took out a 25k bounce back loan which I have almost paid off now, only one of those people still work for me, but it was the right thing to do. Many other bosses would’ve just ended everyone’s contracts. I’m an empath and am far too emotional and care about people to much to get rich.”

Stacey adds that this loan made the company stronger and allowed them to grow in the long run. “We came out of the pandemic with a team who could deliver events, amazing PR and banging digital marketing so we could then offer our clients a 360 solution and we’ve managed to grow the business every single year since.”

Victoria Shnaider, Chief Operating Officer & Sales Director at KidsVip, shares how strict cash flow management and structured, seasonal inventory purchases have averted debt for the business.

“One of the most critical steps we took was establishing a comprehensive financial plan from day one. Cash flow management through detailed budgeting was the next step, wherein each and every expense had to be accounted for, with careful revenue forecasting being done prior to making any material financial commitments. For example, the decision to enter a larger warehouse in Woodbridge was subject to detailed cost/benefit analysis to ensure that said expansion would be financially feasible without too much stress on our resources.

“The other reason has been the strong rapport with suppliers and partners that has allowed us to negotiate flexible payment terms for our cash flow. Rather than borrowing large sums, we have structured inventory purchases to reflect seasonal demand and customer trends that minimise excess stock, keeping precious capital from being tied up unwisely. Also, rather than relying on substantial borrowings, we invest our profit in ways that really matter. We focus on allocating money to areas such as product development, marketing, and customer experience that earn it back in spades: Every dollar counts toward long-term growth.”

Top tips to utilising business debt for growth

Andrea Reynolds, CEO of Swoop Funding, shares her tips for entrepreneurial success.

- Business debt isn't inherently bad: in fact, business loans are vital for growth as you are borrowing to invest in your business; the debt you take on when used correctly will repay you multiple times over

- Your bank is not the only source of funding: many business owners go to their bank to borrow, but there are many reasons why a bank will say “no” that have nothing to do with whether your business is viable. Through Swoop, you can explore thousands of products that may be suitable for your needs, often with lenders who are more flexible and keen to lend than your existing bank

- Cash flow is vital to your business: borrowing may be essential to ensure that you are able to pay invoices, payroll and utilities on time. Look for products such as VAT funding that are built to address a specific need and keep your finances afloat

- It’s easy to let small loans accumulate over time: keep on top of what you owe and consider consolidating borrowing. You may be able to include these smaller debts on a commercial mortgage which will mean simpler repayments as well as purchasing a major asset for your business

- Borrow responsibly: how much you can borrow, and what it will cost you to do so, will depend on your credit score. If you have a low score, you may struggle to find a lender as you will be considered a high risk.

For more startup news, check out the other articles on the website, and subscribe to the magazine for free. Listen to The Cereal Entrepreneur podcast for more interviews with entrepreneurs and big-hitters in the startup ecosystem.