Unlocking SME growth: the role of SaaS startups in digital transformation in the UK

I am Zeeshan Bukhari, Co-Founder of Bitaffix and I am leading my startup with a commitment of advancing global innovation using automation. With years of experience in helping business in achieving efficiency, I’ve seen firsthand how automation can transform business performance. In this article, I am going to explore the UK SME sector and the huge potential it has through digitalisation and automation with the right support and policies in place.

In this article, I will explain why SaaS startups and companies should target SMEs instead of large enterprises. Both political and business prospectives will be the part of context.

SMEs in the UK, Problem and Govt Initiative

-

SME significance for the UK economy and fluctuating growth:

As per government sources, the UK has 5.5 million SMEs which accounts for approximately 53% of UK private-sector turnover, totalling about £2.4 trillion. These companies also account for 61% of UK jobs making them essential to the country's economy. The estimated total private-sector revenue is about £4.47 trillion putting SMEs in a key position to drive the UK's economic growth.

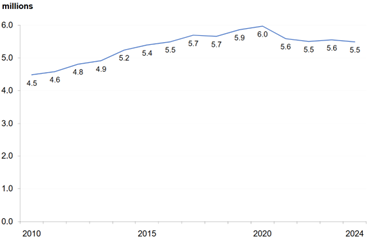

Number of Private sector business in the UK, 2010 to 2024 as per Govt records.

Despite a strong growth trajectory, SMEs face multiple challenges year after year: rising costs, labour shortages, regulatory compliance pressures. Economic uncertainties, including inflation and interest rate hikes, have increased operational costs and made financing more difficult to secure. Labour shortages, particularly in skilled sectors, add to these difficulties by limiting SMEs' ability to meet demand and pursue growth.

The trends mentioned earlier caused a small drop in SME numbers: For instance, the UK had 5.6 million SMEs in 2023, but this figure fell by 1.0%, with about 316,000 companies shutting down – an 11% business 'death rate.' Even so, 65.3% of small businesses stayed in the black showing their toughness in hard times

The above-mentioned tendencies led to a slight decrease in the number of SME: For example, in 2023, the UK counted 5.6 million SMEs, but the number dropped by 1.0%, with around 316,000 businesses closing – an 11% business 'death rate.' Despite this, 65.3% of small businesses remained profitable, demonstrating resilience amid adversity.

-

How the UK government responses:

The UK government is working to address these challenges in various ways.

Take the Autumn Budget 2024 as an example. It includes important steps to address labour-related problems, like boosting the Employment Allowance and offering targeted money help to ease the load on SMEs. But growing costs in areas such as manufacturing, retail, and professional services still pose problems for businesses that employ almost 13 million people.

At the same time, the UK government seems to grasp how crucial automation is for SMEs. You can see this in how much they're backing AI. They've put in over £2.3 billion since 2014 and plan to spend another £900 million on a cutting-edge supercomputer to push AI projects forward.

The government also runs several important programmes to support SMEs, such as 'Made Smarter' and Innovate UK grants, which promote digital adoption to boost productivity. These efforts have contributed to the UK ranking third in the 2023 Global AI Readiness Index, leading Western Europe.

However, in the current environment, SME growth appears to require more strategic planning and the adoption of strategies to remain competitive.

-

The need for a comprehensive Digital Adoption Plan

According to TechUK, to foster digital transformation across SMEs, the UK requires a robust, cross-departmental digital adoption strategy. This includes a coordinated forum involving industry and government stakeholders, as well as a dedicated Minister to oversee digitisation efforts nationwide.

Implementation Steps:

- Establishing a digital adoption forum: this industry led forum would include SMEs, trade bodies and key government departments such as Department for Business and Trade, Department for Science, Innovation and Technology and Department for Levelling Up, Housing and Communities. The initial objective would be a 6 months review to identify the key barriers to digital adoption with actionable recommendations to form the basis of a Digital Adoption Strategy

- Ministerial leadership: a single Minister, ideally in the Department for Science, Innovation and Technology (DSIT) would lead the digital transformation agenda, implement the forum’s recommendations and hold accountability. The role would include technology diffusion and economic security, reporting to Department for Business and Trade, HM Treasury and No. 10

Cost and Benefits:

- Costs: the forum's work can be handled by our current tech and AI groups in the DSIT and Business and Trade Dept., without adding any more money to the government's budget

- Benefits: enhanced administrative supervision, augmented cooperation with the commercial sector, and more precise policy measures would contribute to fulfilling SME needs. Motivated by the recent triumph of the AI Taskforce, the assembly might elect a “Digital Innovation Leader” to champion the expansion of SME digital advancement

-

A comprehensive digital adoption plan for 2030:

To fully capitalise on the benefits of digitalisation, the government should develop a long-term digital adoption plan with a 2030 target. Key elements include:

Implementation steps:

- Digitalisation targets: establish targets modelled after the European Commission’s Digital Decade policy, encouraging tech adoption and enhancing productivity

- Policy commitments: complete initiatives like Making Tax Digital by 2026 and introduce phased electronic invoicing to support SME productivity and address late payments

- Incentives for digital investment: introduce tax incentives, grants and funding programs such as the Made Smarter Adoption Programme, which has demonstrated strong ROI for both SMEs and the government

Estimated Costs and Anticipated Benefits:

Costs:

Making Tax Digital is expected to cost HMRC approximately £1.3 billion.

A Small Business Digital Growth Fund would cost £300-350 million annually, in line with the £295 million budgeted for Help to Grow: Digital.

A national rollout of the Made Smarter Adoption Programme would cost around £80 million, based on current estimates by the CBI.

Benefits:

Digital solutions like streamlined tax systems, digital verification, and B2B e-invoicing will relieve pressures on SMEs by improving cash flow, reducing errors, and enhancing productivity. HMRC estimates that the Making Tax Digital Programme could bring in an additional £3.9 billion in tax revenue by reducing errors, while fully digitalising SME operations could contribute an additional £232 billion to the UK economy, according to Sage.

-

SaaS based solutions, a key to success SMEs

Undoubtedly, digital transformation and the support of SMEs are impossible without government backing. At the same time, SME digitalisation should leverage tools offered by the private sector and SaaS solutions. At Bitaffix, I focus on developing tailored SaaS solutions to meet diverse business needs. Traditionally, SaaS platforms have been utilised primarily by large enterprises. However, I believe the time has come for SMEs to thrive, especially as the UK advances in this direction with its vibrant startup ecosystem.

The UK’s Software as a Service (SaaS) sector is one of the country's largest and most impactful ICT markets, with a high percentage of companies recognising the benefits of investing in advanced technology solutions to drive productivity and business expansion. The rising tide of SaaS has created an industry of products and services that require subscription-like recurring payments. The mindset of UK consumers has shifted from one-off purchases to active, recurrent purchases by many customers. Also, the vast majority of UK enterprises rely on the mobile connectivity of its workforce, which is an ideal setting for SaaS and cloud providers. Additionally, the UK datacentre market is the largest in Europe, generating new sources of demand for ICT providers.

As per Trade.gov

- $170 billion digital tech annual turnover

- Over 100,000 software companies in market

- Second largest ICT markets in ranking of ICT spending per head (US #1)

- London second most connected place for tech, right after Silicon Valley

- No. 1 top scaling tech nation in Europe

- No. 1 destination for US ICT businesses in Europe (often serving as EMEA HQ)

- Key subsectors offering significant opportunities to US tech providers include: AI, Cloud Computing and Cyber Security

- Opportunities exist to supply organisations of all sizes from SME to large corporations, with the most substantial opportunities to be found in organisations for which IT security is mission critical.

While all the big enterprises in the UK have already implemented adequate tech tools for a while now, small and medium sized enterprises have also started to direct their attention towards the right digital tools to optimise their processes.

In this context, I believe the UK is one of the most promising markets for adopting and driving SaaS innovations.

-

SaaS and AI-Powered Automation: Unlocking Growth Potential for SMEs

SaaS platforms powered by AI provide several core benefits that empower SMEs to thrive.

- Enhanced decision-making through data-driven insights: AI powered SaaS platforms analyse large data sets so businesses can make quick decisions. With predictive analytics businesses can forecast demand, optimise inventory and tailor marketing to consumer trends. This data led approach gives SMEs a competitive edge in today’s market

- Improved user experience and personalisation: AI can personalise user experiences. For example, e-commerce platforms can use recommendation engines to suggest products to individual users, marketing teams can use segmentation to deliver targeted content. Personalisation drives customer engagement and revenue growth in a market where customer experience is everything

- Enhanced security and compliance: security is key for businesses handling customer data. AI integration strengthens data protection, machine learning algorithms identify potential threats and anomalies. For UK businesses, GDPR and other regulatory requirements are simpler to adhere to as AI driven platforms automate monitoring and reporting, reducing the risk of non-compliance and increasing customer trust

Real-World Applications of AI-Powered SaaS for SMEs

With extensive experience in Business Process Automation (BPA) as the Co-Founder of Bitaffix, I’ve seen firsthand how SaaS solutions can revolutionise operations for small and medium-sized enterprises. Below are several practical applications of AI-driven SaaS platforms, highlighting their transformative impact on UK SMEs.

- Inventory management: adaptive technology in inventory management before SMEs to control stock levels allows predictive analytics to forecast demand. It contributes to minimising stock-outs and excess inventory and thus reduces costs and increases efficiency. This is of critical importance due to the intense operating pressure in retail and manufacturing SMEs

- Customer engagement and automation: AI-powered CRM systems enable SMEs to create personalised customer journeys, improving satisfaction and conversion rates. Additionally, tools like virtual assistants and chatbots enhance customer support by handling inquiries around the clock, freeing up human resources for complex tasks

- Workflow optimisation and cost reduction: SaaS platforms automate repetitive tasks, such as data entry and report generation, which reduces operational costs and allows teams to focus on strategic initiatives. Platforms like BitAffix provide robust automation features, from document management to workflow optimisation, helping SMEs achieve more with fewer resources

Challenges and Considerations

Despite of above-mentioned benefits, Implementing AI comes with its own challenges, for example Data privacy and complex integration are two primary concerns. The European Union’s General Data Protection Regulation (GDPR) requires stringent data handling practices, making compliance a priority for businesses in the UK. furthermore, integrating AI with existing SaaS platforms requires high cost technical expertise and resources, which may be consider as a barrier for smaller companies.

Furthermore, algorithmic biases can lead to unintended outcomes, which is particularly problematic in sensitive areas such as hiring or lending. To address these concerns, companies are adopting ethical AI practices and conducting rigorous testing to ensure that their algorithms operate fairly and accurately.

For more startup news, check out the other articles on the website, and subscribe to the magazine for free. Listen to The Cereal Entrepreneur podcast for more interviews with entrepreneurs and big-hitters in the startup ecosystem.