StartupBlink Index 2024: UK startup ecosystems face global decline

The United Kingdom, the second-ranked startup ecosystem that has produced success stories like Wise and Revolut, has seen a notable decline in its cities rankings according to the latest Global Startup Ecosystem Index by StartupBlink.

Despite still being the second-best startup ecosystem globally, the UK is facing more competition and signs of internal weakening. This article will focus on the latest trends experienced by the country’s startup ecosystems based on StartupBlink’s analysis of 1,000 cities and 100 countries' startup ecosystems using dozens of parameters.

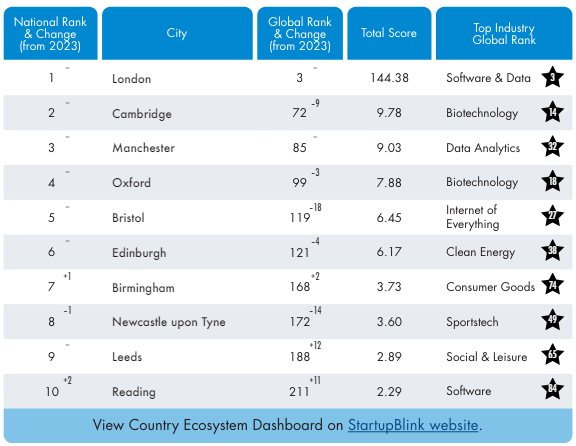

Top Ranked UK Startup Ecosystems in the StartupBlink Index 2024

UK’s global and regional position under pressure

The UK has long been a top place for startups, but this is being challenged. Despite maintaining its position as the second-ranked country for startups in the world, the UK is facing increasing competition from Israel, which is ranked third globally and is quickly closing the gap. Israel has reduced the difference in its total score with the UK from 16.6% in 2022 to 8.6% in 2024. Similarly, even though the UK is still the highest-ranked country in Europe, the gap between the UK and Sweden, its closest European competitor, has widened from 1.8 times greater in 2023 to 2 times greater in 2024. This raises the question of whether the UK's position as the second leading startup ecosystem in the world and first in Europe will be overtaken by the succeeding ecosystems.

UK’s business environment is now challenging for startups

The business environment score measures how startup-friendly a country is, using parameters like corporate tax rates, labor laws, and other factors. Adding to its global and regional challenges, the UK's business environment has become a hurdle for startups. In 2023, the UK was the third most startup-friendly nation in the world, but by 2024, it fell to 13th place. This decline is due to several European countries, such as Switzerland, Germany, and the Netherlands, becoming more favorable for startups. Additionally, factors like Brexit and rising tax rates have made it harder for UK startups and entrepreneurs to thrive, reflecting a less supportive environment for new businesses.

UK cities lose ground in the index

The impact of this decline is also seen in the performance of UK cities. The number of UK cities in the top 1,000 global startup ecosystems has been steadily declining, from 78 in 2022 to 70 in 2024. Only four UK cities managed to secure a spot in the top 100 this year, continuing a downward trend from six in 2022. Additionally, only two UK cities within the top 200 have shown any advancement, signaling persistent negative momentum in the UK's startup ecosystems. This decline in city rankings highlights broader national challenges. For the time being, the very strong position of the UK and London in the Index still suffices to prevent a decrease in the country's ranking as a result of the negative performance of many of its ecosystems. But the signs of decline can no longer be ignored.

The UK startup ecosystem is heavily centralised in London

London remains the central hub of the UK's startup ecosystem, with its total score nearly 15 times higher than that of Cambridge, the next UK city in the Index. London is a global hub, ranking third worldwide and serving as the strongest startup ecosystem in Europe. This dominance is exemplified by global unicorns such as Revolut and Wise, which have solidified London's status as a prime destination for building Fintech innovation. However, this heavy reliance on London is a double-edged sword, as the lack of significant contributions from other UK cities makes the national ecosystem vulnerable to shifts affecting London.

University cities stay in the global top 100

Despite the centralisation of the startup scene in London, university cities such as Cambridge, Manchester, and Oxford remain in the global top 100. While Manchester remains stable at 85th worldwide, both Cambridge (72nd) and Oxford (99th) have experienced declines of 9 and 3 spots, respectively, yet they continue to be the top national players, ranking second, third, and fourth in the UK. Notably, these cities are becoming global hubs for deeptech innovation due to their world-class scientific infrastructure, positioning them as key locations for the future growth of the UK startup scene.

Birmingham and Leeds advance in the global 200, Reading rejoins UK's top 10

Despite the overall downward trend, there are some positive developments worth noting. Birmingham and Leeds have shown significant progress within the global top 200, climbing 2 and 12 spots, respectively. This progress is further emphasized by Birmingham overtaking Newcastle upon Tyne, which saw a sharp decline of 14 spots. Leeds' 12-spot jump is the most significant improvement among UK cities, highlighting its growing potential.

Additionally, Reading has reclaimed its position as the UK's 10th best-ranked ecosystem, reflecting a resurgence in its startup activity. Further encouraging news comes from Stoke-on-Trent, Ashford, and Blackpool, which have all made their debut in the global top 1,000. These advancements suggest that while the broader startup ecosystem faces challenges, certain cities are demonstrating resilience and progress.

To sum up

The UK's startup scene is facing challenges, with increased competition from other countries, Brexit and internal weaknesses becoming more apparent. While London remains a dominant hub, the need to support and develop other cities remains important. To maintain its global standing, the UK should address its business environment issues and leverage its strengths across the country.

You can download the full report here.