Selecting the ideal country for your initial launch

When businesses venture into new markets, some encounter obstacles stemming from past failures, while others grapple with uncertainty regarding where to start or which direction to pursue. This challenge isn’t limited to startups; it also impacts medium and large companies alike.

For startups, selecting the ideal country for their initial launch is important to swiftly showcase positive traction. Often, they base this decision on factors like the CEO’s convenience in residing there or if a team member possesses some familiarity with the country. Mid-sized companies often enter new markets without a clear understanding of the situation. They try, fail, conclude that the whole idea doesn’t work, and then avoid trying again for a long time.

Established companies usually aim to pinpoint 1-3 new markets (depending on their business type) for expansion, relying on metrics such as GDP, GDP growth rate, startup density, corporate tax rates, employment rates, and regulatory conditions. These types of companies tend to make other mistakes, like choosing a product name that sounds inappropriate or even offensive to the locals or run marketing campaigns that don’t align with local customs and cultural norms (e.g., using inappropriate imagery or slogans).

Let’s delve into some fundamental principles guiding our country scoring approach.

Why expansion may fail

Introducing a company or product in a new market demands meticulous planning and initial investigation. The aim is to identify the optimal use for the product or service, aiming to minimise the necessity for extensive alterations, adaptations, or region and customer-specific tweaks.

The secondary objective is to steer clear of scenarios where either demand for the product/service is low or the market is inundated with multiple offerings, necessitating substantial marketing investment to establish a foothold. Otherwise, the company’s expansion efforts may falter due to one of these factors:

- Insufficient market research can cause misunderstandings about demand, competitors, or cultural differences, leading to inappropriate strategies and product offerings

- Without thorough product research, the company might launch products or services that don’t align with the specific needs or preferences of the new market

- Neglecting customer research may result in ineffective strategies for attracting and retaining customers, harming brand reputation and hindering the establishment of a loyal customer base

- Failing to research the business model and commercial viability can result in overly optimistic revenue forecasts, unsustainable expenses, and ultimately, an inability to achieve profitability in the new market

Let’s take a detailed look at three key components of effective country assessment: Market Research, User and Product Research, and Commercial Viability. This thorough examination aids in steering clear of unsuccessful product launches and mitigates the requirement for significant initial marketing expenditures.

Three steps to successful country scoring

For every chosen country, you should compile a set of evaluation criteria. This list comprises both fundamental parameters essential in all cases and tailored parameters specific to each business. For instance, if the solution caters to multiple industries within a country, we also conduct individual assessments for each industry.

Level 1: market research

During this phase, it is important to evaluate which markets exhibit significant size and growth potential, while identifying ‘red oceans’ where entry might prove prohibitively expensive. Although certain markets may seem saturated initially, we delve deeper to uncover concealed niches or innovative opportunities that could pave the path to success.

Examine:

- Market size by evaluating the total revenue potential and growth rate to understand the financial scope and prospects of the market

- Demographics by analysing the age, gender, income, and education levels of the target population to tailor marketing strategies effectively

- Adoption of the services by assessing how quickly and widely the target market is embracing the services to gauge market penetration and user engagement

- Competitors by identifying key players and their market shares to understand the competitive landscape and strategic positioning

- Industry data by examining multiple industries within a country and assessing each industry individually to identify growth opportunities and market dynamics

- Trends via monitoring shifts in consumer behaviour and technological advancements to stay ahead of changes that could impact the market

- Audience segments by categorising the market into distinct groups based on behaviour and preferences to develop targeted marketing and service delivery strategies

- Market entry barriers by evaluating factors such as legal requirements, accounting standards, government support, compliance, technological development, and service development to understand the challenges and costs associated with entering the market

Level 2: product & customer evaluation

Our strategy is geared towards cost and time efficiency. When assessing countries, it is important to prioritise those where minimal adjustments are needed in the product, target audience, and communication strategies. Countries requiring either no changes or only minor adaptations in these areas receive higher scores.

Here’s how the scoring process unfolds: countries demonstrating strong performance ascend in the rankings. Minor issues that are easily rectifiable result in a slight drop in ranking. However, significant challenges necessitating substantial alterations to the product and business model lead to lower scores, relegating the country to the bottom of the ranking.

There are instances where seizing market dominance is important. In such scenarios, a robust strategy is imperative, transcending mere scoring. Scoring, however, serves as a tool to pinpoint the most favourable market entry opportunities, particularly when resources are constrained.

The success of a product in one market doesn’t guarantee its success in another. Products and technologies crafted may not always align with the needs of the intended country or audience segment. Hence, it’s crucial to incorporate in the country scoring framework an assessment of the product by prospective clients.

This evaluation aids businesses in comprehending whether the product resonates with the audience and if they are inclined to invest in it. If not, it prompts a reassessment, potentially leading to adjustments in the product or target audience to achieve a better product-market fit. This iterative process ensures that businesses align their offerings with the specific demands of each market they intend to enter.

Product parameters to evaluate

When evaluating market strategy effectiveness, it’s essential to consider several key parameters to determine whether the product effectively meets the needs of the target audience:

- The target audience exhibits a demand for the product

- The target audience seeks to address a problem and is willing to pay for a solution

- Existing solutions fail to meet the target audience’s requirements

- The solution meets the target audience’s needs in terms of pricing

- A product fulfils the target audience’s requirements concerning features

- A product satisfies the target audience’s expectations regarding service provision

- A product meets the target audience’s standards for user experience (UX)

- A product effectively communicates with the target audience

- A product appeals to the target audience visually

- A product aligns with the cultural values of the target audience

Methods and frameworks

In evaluating a market entry strategy, we employ established and customised methodologies such as Customer Research, User Studies, and focused assessments of Product-Market Fit. Aligning these methodologies is critical for pinpointing countries where product launch can occur with minimal adjustments, guaranteeing it resonates effectively with the target audience’s requirements and preferences.

User research plays a vital role in determining the product’s ease of use and intuitiveness, thus reducing the necessity for extensive design iterations. Customer research yields valuable insights into the target audience’s needs, preferences, and behaviours, empowering us to tailor products and services to precisely meet their expectations.

It is effective to enrich this step with social listening and semantic analysis. These techniques offer valuable insights into market sentiment, user preferences, and potential demand for the product or service. By monitoring and analysing online discussions, reviews, and mentions relevant to the industry, competitors, and target audience, we can gather critical data to build an effective product strategy.

Here’s an example on how we assist brands with social listening:

- We assess social media platforms, forums, and review sites to track mentions of a brand, competitors, and relevant keywords. We analyse the sentiment – be it positive, neutral, or negative – associated with these mentions. This approach helps us uncover valuable insights into potential social barriers present in different markets

- We also conduct semantic analysis using natural language processing (NLP) tools to delve into the content and context of online conversations. This helps us gather detailed insights into user preferences, expectations, and key factors that influence their decision-making

For instance, Duolingo tailored its product and marketing strategy for the Brazilian market with social listening method. By tracking mentions of language learning, competitor apps, and relevant keywords in Portuguese, Duolingo was able to gather insights into the preferences and pain points of Brazilian users. The sentiment analysis showed that while there was a strong desire to learn English, many users were frustrated with the high cost and rigid structure of existing language learning programs. Additionally, there was a positive sentiment towards gamified and flexible learning solutions but concerns about the effectiveness of free apps were also noted.

The evaluation process incorporates an assessment of Product-Market Fit aspects directly related to the product (read more about finding PMF here) to identify countries where minimal changes are needed for a successful product launch. Some companies overlook the important step of in-depth product and user evaluation. They might rely on surveys, feedback from personal connections, and sometimes AI tools, but they often miss out on gaining deeper, actionable customer insights. There’s a common belief that this process is too time-consuming and expensive. However, aligning this process with the company’s objectives can be cost-effective in the short and long run. It helps avoid unsuccessful product launches and reduces the need for substantial initial marketing budgets.

Level 3: commercial viability

During this phase, it is critical to assess the cost-effectiveness of entering particular markets for the company. We evaluate whether the expected benefits outweigh the costs and endeavours, pinpointing the countries where launching would generate the most substantial returns. This analysis encompasses Customer Acquisition Cost (CAC), Price Comparison, and Profitability Assessment. For example, Customer Acquisition Cost (CAC) is determined retrospectively, primarily serving as an estimated CAC for scoring countries. However, it’s an iterative process requiring strategic planning, thorough market research, and alignment of goals with financial constraints.

Evaluation process includes additional factors:

- Exploring potential financial support opportunities through grants can foster business growth and development

- Assessing the advantages of operating within designated special economic zones can offer tax benefits and regulatory advantages

- Evaluating government incentives can encourage investment and expansion in specific industries or regions

- Analysing the efficiency of establishing and managing business operations in different locations can provide insights into the ease of business establishment and operations

- Examining the regulatory landscape helps understand its impact on compliance and operational flexibility

- Assessing the ease of obtaining necessary certifications and licenses is crucial for smooth business operations

- Considering the optimal team size for servicing, remote sales, and service options compared to establishing a physical presence can help in strategic planning

- Analysing labour costs, laws, and associated risks related to workforce management is essential for cost-effective operations

- Forecasting cash flow and determining the timeline for reaching the break-even point and profitability is critical for financial planning

In this phase, it is important to delve into revenue streams, pricing strategies, distribution channels (like direct sales or online platforms), and customer acquisition tactics. For example, when it comes to pricing, our aim is to maximise revenue while remaining competitive, considering strategies like cost-plus pricing, value-based pricing, or penetration pricing. It’s essential to evaluate the financial viability and profitability of the business model by examining costs, revenue projections, profit margins, and return on investments. For instance, in revenue forecasting, we set realistic targets to enable startups to make well-informed decisions regarding resource allocation and growth strategies. It is critical to assess risks to mitigate their impact on scaling success, considering factors such as political stability and upcoming global events that might affect business operations and growth strategies. Our approach is adaptable, addressing specific factors depending on the industry and other company particulars.

Based on our experience, companies often employ rapid testing to swiftly assess the feasibility of their business concept in new markets. This approach enables companies to conserve marketing budgets, time, and resources, empowering startups to refine their strategies before fully committing to a comprehensive launch.

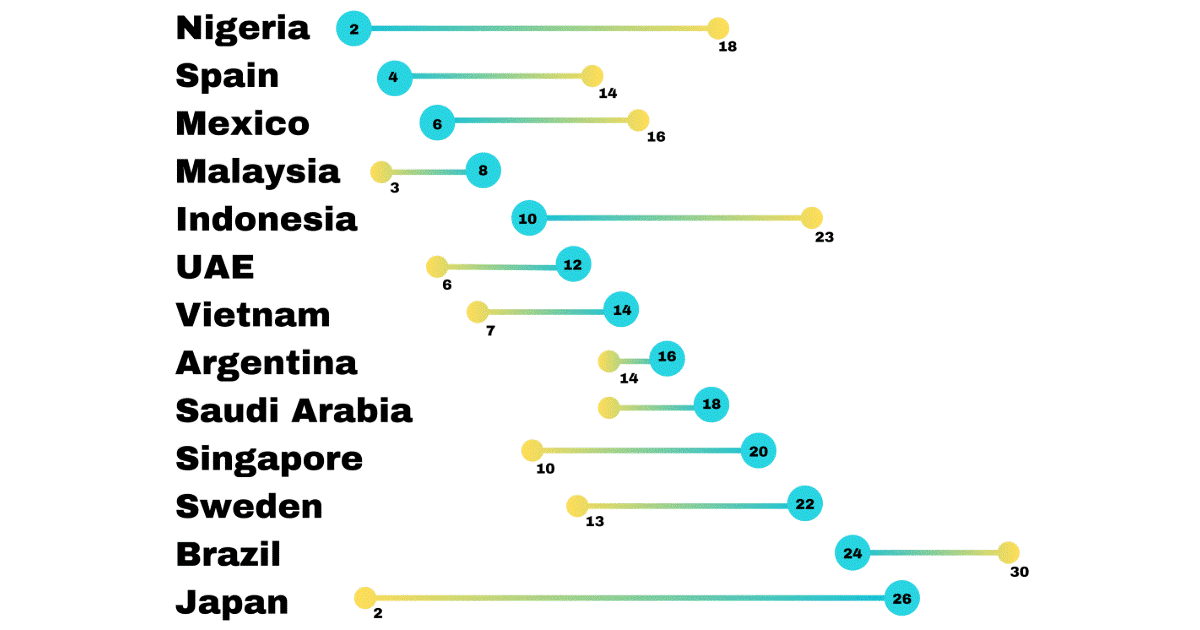

We consistently offer a variety of scoring options across 20 industries and 35 countries. This greatly streamlines the scaling process for companies since we utilise data already available in Duamentes Insight Database and tailor it to the specific needs of each company.