SEIS/EIS Tax Relief

Having made the decision to raise equity funding, and assuming that you know how much you are looking to raise, you must then decide the best place to raise that funding. This will depend on the stage of your business, the amount you are looking to raise, the type of business, and various other factors. This will be explored in more detail in future articles.

For the vast majority of early-stage businesses that raise finance, at least some of the funding comes from private individuals, either as larger angel investors or smaller investors via a crowdfunding platform. As such, obtaining SEIS/EIS Advance Assurance can make the difference between a successful raise or an unsuccessful one. But what is SEIS and EIS and why is it so important?

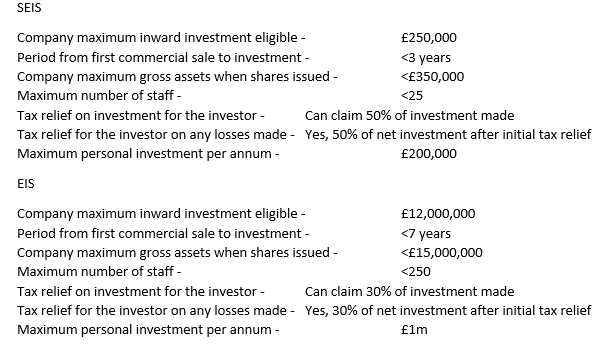

SEIS stands for Seed Enterprise Investment Scheme and EIS is the Enterprise Investment Scheme. They are government tax incentive schemes to encourage individual UK tax paying residents to invest in early-stage businesses. Essentially, they are the same type of scheme as each other but SEIS is more advantageous and is aimed at earlier stage business that are smaller.

Whilst there is no direct benefit to the business raising the finance, the very fact that two thirds of UK angels will only invest in early-stage businesses that are eligible for SEIS/EIS demonstrates its importance. If your business does not offer investors these tax reliefs then you are instantly significantly reducing your potential investor base.

According to HMRC, in the 2021-2022 tax year alone, a record £2.5 billion was invested through SEIS/EIS investment schemes into British early-stage businesses. This was a rise of 16% through SEIS schemes and a rise of 39% through EIS schemes. The money went into 2,270 businesses with SEIS and 4,480 with EIS. The number of private investors that claimed tax relief was 55,105 in total.

So, what exactly are the main terms and tax breaks, and how do they differ from each other?

Under both schemes all income and capital gains are exempt from tax as well as any shareholding being exempt from inheritance tax on shares held for a minimum of two years.

It is best for the company raising finance to obtain Advance Assurance. That is, getting confirmation from HMRC in advance that the company is eligible for the scheme. The good news is that the vast majority of normal trading businesses are eligible.

Advance Assurance can be done directly and is not excessively difficult, however, it will take time, and knowledge of how best to complete the process is beneficial. Many accountants or lawyers will also offer this service but typically charge a considerable amount. Others, such as BOOM & Partners, offer a more cost-effective solution.

The benefits of obtaining SEIS/EIS Advance Assurance are indisputable for most early-stage businesses raising equity finance. However, some of the rules are complex and do change periodically and, as such, it is recommended that the HMRC rules are closely studied, or advice is sought.