Over 110,000 UK small businesses at risk of going bust

A recent SME insights report by Dojo, a specialist in card payments for independent and enterprise businesses, has highlighted a concerning trend: approximately 110,940 SMEs are at risk of insolvency due to depleted cash reserves.

The study indicated that over 30% of SMEs identified rising inflation and high interest rates as their primary challenges for 2024. Additionally, one in six SME owners admitted to a lack of confidence in understanding the term ‘cash runway’, which refers to the number of months a business can continue to operate before running out of cash.

Dojo also consulted business accounts expert Mya Akbar to provide insight into the ideal length of cash reserves that SMEs should maintain. According to the survey, 30% of businesses considered soaring costs their biggest hurdle for 2024, with 36% having increased their prices in response.

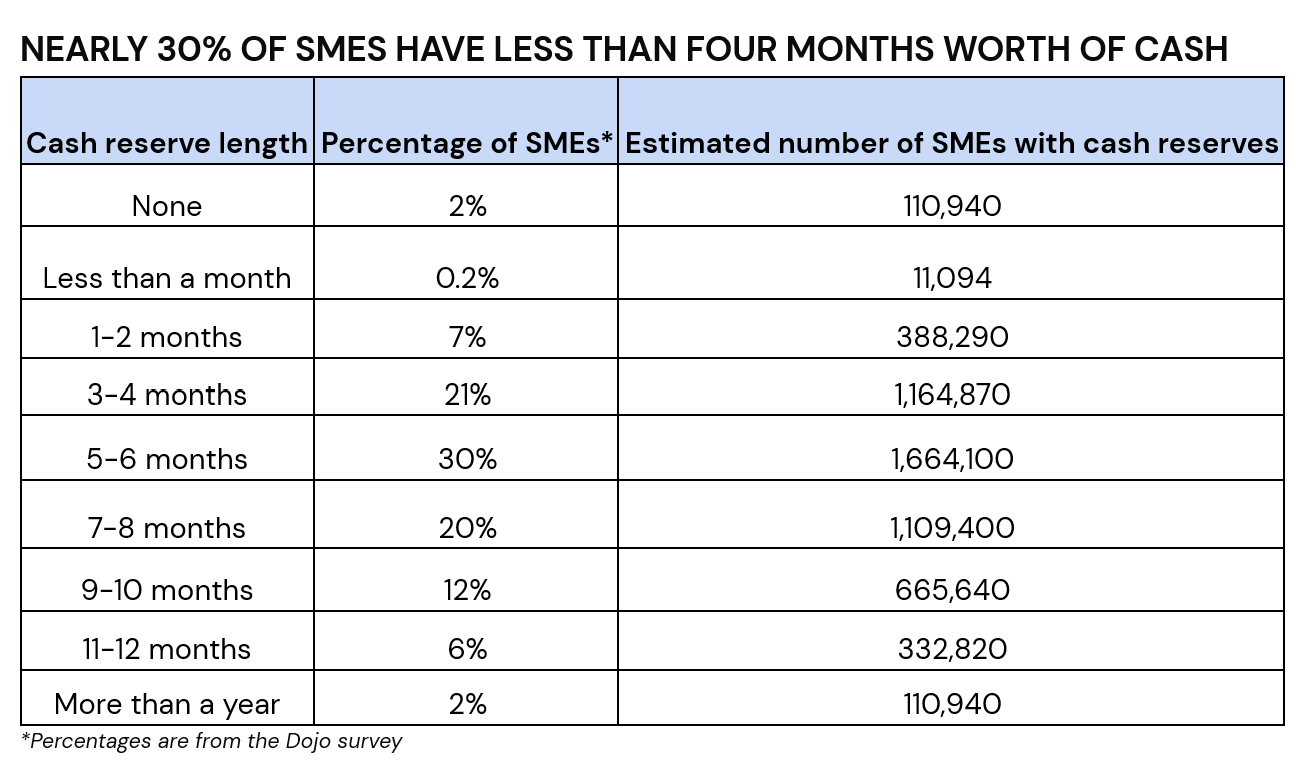

A troubling 2% of businesses reported having no cash reserve, placing approximately 110,940 UK SMEs in a precarious financial position. This lack of a cash runway was most common among smaller businesses with 1-9 employees, with 10% of such companies reporting this issue. For these businesses, financial stress was the top challenge, affecting 41%.

Nearly 30% of business owners revealed they had less than four months of cash remaining to support their operations. This situation was most prevalent among businesses with 10-49 employees, with 56% of them having up to four months of cash reserves.

On a more positive note, 30% of the UK’s small businesses reported having five to six months' worth of cash reserves, which is considered a healthy buffer. This reserve level was most common among businesses in the education sector (41%), those with a turnover of £1M - £9.99M (35%), and companies with 50-99 employees (34%).

However, the report also found that only 2% of businesses have over a year’s worth of cash reserves, indicating a significant vulnerability in long-term financial stability for the majority of SMEs. This highlights the urgent need for support options to improve financial resilience.

Speaking about cash reserves, exclusively with Dojo, Mya Akbar said: “It’s generally recommended that a small business maintains a cash reserve of at least 3-6 months' worth of operating expenses, however, businesses in volatile industries may need a longer reserve, 6-12 months.”

Explaining the importance of cash reserve, Akbar shared: “Cash reserve is very important for businesses to have, consistent operations, buffer for unforeseen expenses, provides decision making freedom, negotiation leverage, protection within economic downturns, attracting investment and reduced financial stress. Financial stress is the most common challenge (30%) that SME owners are facing at the moment, according to Dojo’s study, further emphasising the final benefit listed.”

For small businesses seeking funding support, various grants are available for different sizes and sectors, accessible through resources like the UK Government’s business finance and support finder. In addition to grants, the UK government has pledged to address late payments – an issue affecting 49% of UK SMEs according to Dojo’s poll – to help improve cash flow for small businesses.