The impact of COVID-19 on UK small business revenue and employment

Global small business platform, Xero has announced its new analysis has revealed the extent of COVID-19’s impact on UK small business employment and revenue between March and May 2020, showing a 28% drop in revenue and a six percent decline in employment. Late payments to UK small businesses increased by 7.8 days between February and May 2020.

Based on anonymised and aggregated data from Xero customers in the UK, Xero’s Small Business Insights (SBI) reveals a significant downturn in revenues and jobs during the period and examines the data across industries and regions. The new findings underpin Xero’s Roadmap to Recovery manifesto, launched today to call for extra government support to help SMEs rebuild.

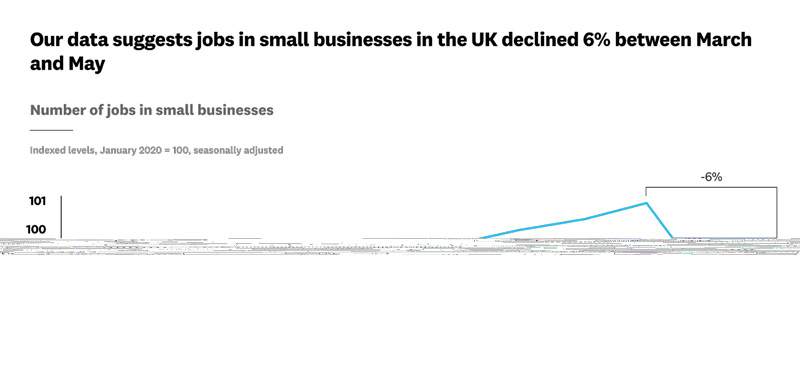

Xero SBI payroll data indicates that small business employment has fallen by six percent on average between March and May 2020, even before the Government’s Coronavirus Job Retention Scheme reduces its support over the coming months. Small businesses in the hospitality sector saw the largest number of job losses of 10.8% in April and a further 3.1% in May, followed by the rental, hiring and real estate sector which saw job losses of 3.2% in April and 6.9% in May.

Although the impact of COVID-19 has been felt across the country, the data showed that small businesses in the East Midlands suffered from the most job losses, with a 3.7% fall in April and 8.5% fall in May. Comparatively, small businesses in the South of England saw a 6.3% fall in job losses in April, and a 0.1% fall in May.

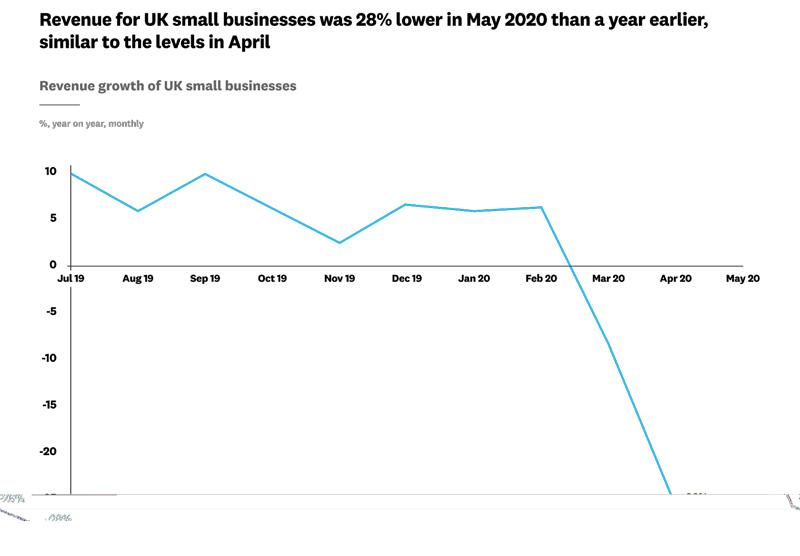

Xero Small Business Insights research team found that revenue for small businesses was 28% lower in May and 26% lower in April, when compared with the previous year.

Analysis of customer data showed that the hospitality sector (57% revenue fall in April, and a slight improvement to 54% revenue fall in May) and the arts and recreation industries (41% fall for both April and May) were hit the hardest.

Meanwhile, the construction (45% fall in April, with an improvement to 31% fall in May) and manufacturing industries (28% fall in April, compared with 18% fall in May) both saw smaller declines in May, potentially pointing to some signs of recovery.

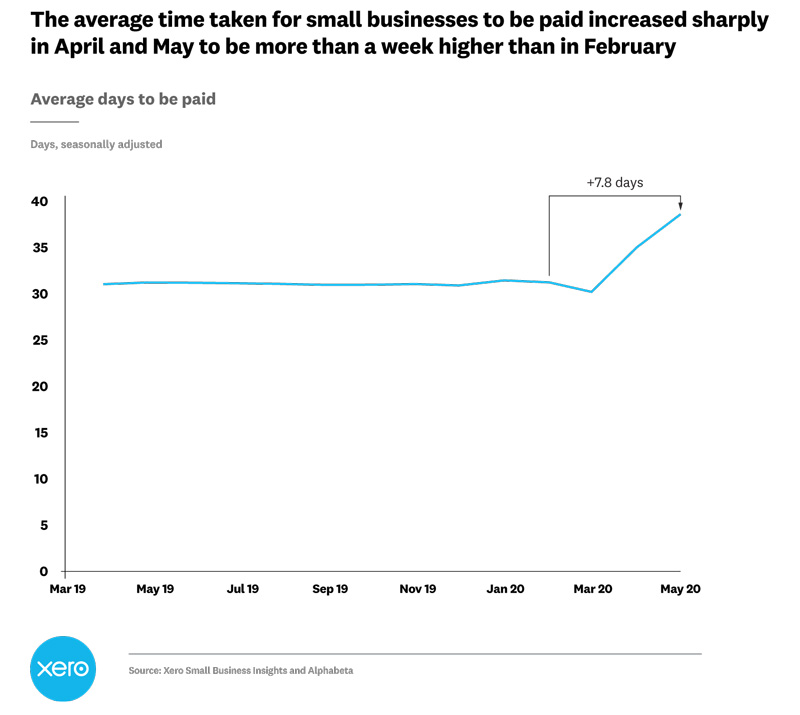

The data found that invoices are taking longer to be paid, with the average time for small businesses to be paid increasing sharply by 7.8 days since February (from 30.7 days to 38.5 days). With late payments already a point of concern for small businesses, longer payment times are likely to compound the cashflow stress.

Roadmap to recovery

Following the analysis of this customer data, Xero has identified the key areas of government support needed by small businesses in order to rebuild. The Roadmap to Recovery policy recommendations, covering technology access, digital skills development and strengthened local communities, include calls for 30 days payment terms as standard, digital tools tax relief, improved regional internet access and an offset of technology expenses against tax.

The launch of the manifesto is the first step of a campaign to support small business recovery, and calls for the government to meet the ‘levelling up’ agenda as part of its election promise.

“The pandemic has had a devastating impact on business. As our customer data shows, jobs are being lost and the creation of new ones will depend on how quickly the economy can be rebooted.” said Gary Turner, UK Managing Director of Xero.

“As a digital service provider to more than half a million small businesses in the UK, we have a unique perspective on the areas where the government needs to create a more supportive environment over the coming months if the economy is to regain the lost ground. We’re sharing our Roadmap to Recovery manifesto today which calls on the government to provide this support and to lead the upgrading of small business infrastructure to support recovery and enable SMBs to be better prepared for new threats.

“With the right support, small businesses will be able to provide much-needed job opportunities and a vital economic boost for the UK.”

Philip King, Interim Small Business Commissioner commented: “Making payment promptly through the supply chain during the current climate is vital for the immediate survival and future of small businesses. The impact on small businesses receiving payment faster than they might have expected cannot be overstated but the consequences of late payment can go far beyond financial to affecting wellbeing, mental health, and more.

"It is imperative that businesses work together as partners and create a culture of good payment practice. Looking at their supply chain to identify the most vulnerable and ensure they are supported will mean those suppliers are still there to support them when the crisis is over. This will reduce damage to the economy and will eliminate the risk of reputational damage.”

For more information about Xero’s Roadmap to Recovery manifesto, click here.