How to become an Angel investor

Whilst many people enjoy watching the sparring between business angels on TV this type of investing may feel like something for others i.e., the millionaire business owners. Because of this, rather than exploring this exciting asset class, we put our investments into safer options we are more familiar with such as mutual funds and stocks. Gavin Heys, Envestors Private Investment Club explains.

However, the reality is that angel investing is not for fat cats alone. If you have capital to invest, angel investing is an option you should investigate. Like all investments it does carry risks, but it also offers potentially exciting rewards.

Let me outline the world of angel investing and look at the potential it presents for higher returns than many other investment opportunities.

What does ‘angel investor’ mean?

Angel investors invest their personal capital into unlisted businesses in exchange for shares in that business. More than just cash, angels typically offer wider benefits to investee companies in the way of mentorship, advice, acting as a non-executive director or making vital introductions to their network of contacts.

Most angel investors are classed as ‘High Net Worth Individuals’ (HNWI). It is this terminology that likely conjures up the images of expensive suits, designer watches and luxury cars – making angel investing feel inaccessible. The reality is that to be considered a HNWI, you need an annual salary of at least £100,000 or net assets, excluding property and pensions, worth £250,000. That’s actually more people than you’d think – at least half a million in the UK according to Statista.

The other common type of angel investors is termed ‘Sophisticated Investors’. To be classed as sophisticated, you must either be a member of an angel network, have invested in another unlisted company in the last two years, have worked in a professional capacity in the private equity sector or be a director of a company with an annual turnover of £1m+.

Business angels will usually put in between £5,000 and £500,000 in a single venture and will aim to build their portfolio of investments over a period of time.

The potential for greater returns

While angel investing is riskier than other asset classes, and is less liquid, it has the potential to offer greater returns.

Data collected in the US in a 2017 Willamette University study on angel investment returns calculated that the average return is 2.5X, which alongside an average investment time span of 4.5 years indicates a gross internal rate of return of 22%.

This compares very favourably with more traditional investment vehicles:

- Mutual funds - Not even the best performing mutual funds of all time will break 20% average annual return, and most of them will not go over 15%;

- Index funds - Industry favorite, the S&P 500 has provided an average annual return of 13.6% since its inception;

- Bonds - During the pandemic, UK interest rates on bonds have been cut to 0.1%;

- Stocks - The average return on a Stocks and Shares ISA in the UK is 5.14% (April 1999 to April 2020).

A more recent study by FounderCatalyst published in January 2021 showed that angel investments yielded an average 2.77X return. Furthermore, with the additional benefit of EIS tax relief that grows to an average 3.19X return.

Under the HMRC’s Enterprise Investment Scheme (EIS) and Seed Enterprise Investment Scheme (SEIS), angel investors receive income tax relief of 30-50% on funds invested in startups and early-stage businesses. This fantastic scheme has helped to raise £1.929bn for 3,920 companies yet is still surprisingly unknown to many potential investors who could benefit.

It is worth pointing out again that averages are averages. Any experienced angel will tell you that many companies take much longer than 4.5 years to mature and exit, and more fail than have home runs. But, on average, angel investing appears to perform well in the long run versus other asset classes.

Why consider becoming angel investor?

Yes, it makes financial sense to invest in early-stage companies, as they can provide an unparalleled rate of return on your investment, and you can take advantage of generous tax relief schemes.

But many do it for more altruistic reasons. As an angel investor you offer value to a young company not just in the form of hard cash, but also in the form of advice and a strategic direction stemming from your experience. Typically, angels are evangelists for the businesses they support - the development of energy saving computers or the use of big data in medicine, for example.

Developing your own angel portfolio

According to the Willamette University study, angel investors get positive returns less than half the time they invest in a company. In fact, they register losses on around 70% of investments, and just ten percent of their exits generate 85% of all returns. Diversifying your portfolio is key when trying to improve your return rates.

Looking at the rate of return on original investment of 300 exits from 2018/19, the data shows that angels’ odds of significant returns increase with the number of investments. The FounderCatalyst report states that a portfolio of investments in three companies is likely to yield, on average, worse returns than a portfolio of investments in ten companies.

However, unless you are Dragons Den’s Peter Jones, opportunities may not always come to you. In fact, having enough deal flow to increase and diversify your portfolio can be a challenge.

One solution is to join an angel network. Well-established and properly regulated networks have investment specialists pre-screening deals, ensuring information is clearly and fairly presented and curating opportunities based on your interests. A good network will be listed on the Financial Conduct Authority (FCA) register and will follow FCA guidance which is all intended to help minimise risk.

Investors that join a network:

- Gain access to deal flow;

- Lower their risk by receiving support in the due diligence phase;

- Diversify their portfolio;

- Join a community of like-minded investors;

- Can make a more meaningful and more sizable investment through syndication.

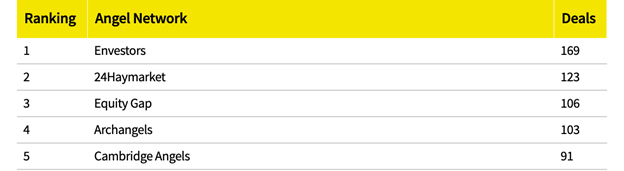

According to research firm Beauhurst, the most active angel networks in the UK right now are:

In most cases, there is no need for a recommendation in order to gain access to investment networks. Angel investing is available to you from the comfort of your own home, as the most active networks, like Envestors, will use digital platforms to share their opportunities.

Perhaps you have never thought of entering the world of angel investing. I hope you now see it is something worth taking the time to consider.