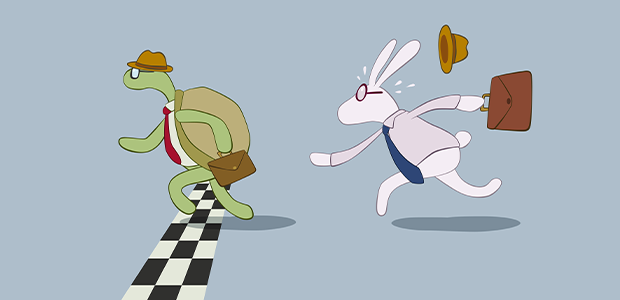

The Great Wealth Transfer: Why smart insurtech investors are betting on the tortoise, not the hare

The investment and wealth space is entering an exciting period of change driven by the significant transfer of wealth from one generation to the next. Boomers to millennials. This has been labelled as the Great Wealth Transfer, and will be the largest generational transfer of wealth in history.

To put some numbers to this, it is estimated that about £5.5 trillion of assets will transfer before 2050, of which £1 trillion will transfer before the end of the decade. This is a huge transfer of wealth, almost twice the UK’s domestic GDP.

The interesting dynamic that has excited WealthTech investors and founders is that the inheriting generation manages their finances and interacts with the financial products in a completely different way to their parents and grandparents. The service demands that they have are not met by the incumbent advisors; perhaps this is why 90% of people switch advisors on inheritance.

In the WealthTech and FinTech spaces, we are already seeing a number of startups positioning themselves to cater to the next generation of ‘High Net Worth’ (HNW) individuals. Companies like Sidekick, Cadro, and Monument Bank, for instance, are developing digital-first solutions that align with the preferences of digital native clients.

However, managing and investing their money is only one part of the equation, the second, is to consider what they will spend this money on. Where will they live? What will they buy? So, how will this be protected?

Today accessing high-value home insurance is accessed through traditional insurance brokers, with client bases that are built on long standing personal relationships. In practice, dealing with them entails an admin-heavy and lengthy process.

Insurtech companies are well-positioned to “disrupt” this space, offering the seamless, user-friendly experience that is expected today by consumers.

Traditional insurance brokers are restricted by their legacy software and also in part the preferences of their existing customer base. In comparison, insurtech companies can offer tailored, efficient, and transparent insurance solutions, with customer experience at the heart of the proposition.

This is now where the “tortoise, not the hare” mindset holds true for those that will gain the most in the long term. While the insurtech space is ripe with opportunity, it is still insurance, and carries the reputation with it. That’s the insurance sector that does not reward rash moves, or “growth at all costs” strategies. Attention always needs to be made to the underlying underwriting profitability of the insurance risks, a lesson the first wave of insurtech startups have now learnt.

The wealth transfer will take another 26 years to complete, so the greatest value will be there for those companies that still exist at the end of it.

Smart investors in the insurtech space understand this. They are not looking for the next unicorn that will disrupt the market overnight. This has been attempted. Instead they are betting on companies taking a measured, strategic approach to innovation. These are firms that understand the nuances of the insurance industry, respect its regulatory complexities, and are focused on creating sustainable value rather than just disruption for disruption's sake.

This measured approach is particularly crucial when it comes to insuring high-value assets. Insuring a multi-million-pound property, a collection of fine art, or a portfolio of classic cars, requires specialised knowledge and bespoke coverage. Insurtech companies that can combine deep industry expertise with cutting-edge technology are likely to be the real winners in this space.

The opportunities in the insurance sector extend beyond just personal insurance. As wealth is transferred, many inheritors will be taking over family businesses or starting new ventures. This creates opportunities in the commercial insurance space as well, particularly for solutions that cater to small and medium-sized enterprises (SMEs).

However, it's important to note that while technology will play a crucial role, the human element remains vital in insurance, especially for high-value and complex risks. The most successful insurtech companies will likely be those that can strike the right balance between automation and personalised service. This will be particularly true when insuring the more-complex lives of High Net Worth, when considering multiple homes, classic cars and art collections.

As we look to the end of this decade and the two following it, it's clear that the great wealth transfer will be a catalyst for significant change in financial services. For insurtech investors, the key to success will be identifying companies that can navigate this change thoughtfully and strategically. It's not about being the fastest or the loudest, but about building sustainable solutions that truly meet the evolving needs of the next generation of wealth owners.

It’s the steady tortoise that will likely finish first in the end.

For more startup news, check out the other articles on the website, and subscribe to the magazine for free. Listen to The Cereal Entrepreneur podcast for more interviews with entrepreneurs and big-hitters in the startup ecosystem.