CloudFO forecasts a brighter future for small business finance

CloudFO co-founders, Adrian Stamp and Afiya Chohollo, have been family friends for over 20 years, brought together at family gatherings due to their joint backgrounds in engineering.

Chohollo led a varied career before co-founding CloudFO, trying out a variety of industries. She began working at a manufacturing firm as a project manager and business analyst, and continued her journey in retail, and then moving on to work for startup Onfido. She worked her way up the ranks, and by the end of her time at the company, she was VP of Engineering and Technical Programme Management.

Stamp’s background is in mechanical engineering, and he completed his PhD in robotics. After this, he began working as an actuary, and this is where the idea for CloudFO began. Spending time consulting and going into larger organisations to create models that manage cash flow, it was at the point of billing that he realised how expensive this was, and that something could be done.

“I realised how expensive we were as a team of consultants, and it seemed strange that the companies who can afford a team of consultants to come in and help them manage their cash flows are the ones that actually don't have the most cash flow issues. The bigger issue is on the smaller side,” Stamp explained. “That’s where CloudFO came from. Really trying to democratise that and make finance accessible for everybody.”

“When you look at the smaller organisations, they just don't have any of this [ability to have outside help to manage cash flow]. It's usually a couple of people running a business that's making good revenue, but they need insights to make decisions or understand where they are,” Chohollo mentioned. “Forty-six percent of SMEs aren't budgeting at all, and therefore are underprepared for the future.”

When discussing their backgrounds and their founding of CloudFO, Chohollo said: “We saw the same problem from different points. We both like building things. So, we decided to come together to work on that.”

The company and its mission

Having seen the amount of time and money that larger organisations spend on their cashflow management and working out the underlying narrative of what it means and what can be done, the co-founders knew something should be done for the smaller companies that don’t have access to this.

“Our overall mission is to keep good businesses in business, and allow good companies to become great,” explained Chohollo. “We saw that poor financial management was a reason why a lot of these companies weren’t growing.”

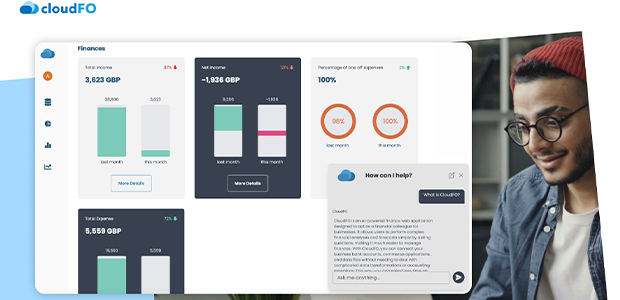

“The mission that we’re solving is democratising intelligence around finance and making it more accessible. We see CloudFO as an AI finance colleague, so it works with you as a member of your team. Just like you might have had Adrian and his team come into your business as consultants, instead, you'll have a fully-fledged team member that just happens to be AI that works with you.

“We see it more like a GPS for business finances. So, telling you where your company has been, and where you’ve been going, where you are now in relation to your business goals, and how you can navigate to get there,” continued Chohollo.

Stamp further explained: “When it comes to the business intelligence side of things, I think there’s a big disconnect in what you’re provided and what you need to know as a business. One of our sayings from early on was ‘information is not knowledge.’

“A lot of companies will give you lots of fancy graphs and data, but don’t tell you why. On the other side of things is, what is the meaning behind this? What does it actually mean for the business? There's not really anything that links all of those together. Having a colleague that can help guide you through and say, ‘maybe we need to look at this’, and go through it, and find the reasons why we might be seeing those factors.”

Raining on the parade

All startups experience their fair share of challenges. Coming from senior positions at their former companies, the co-founders took a leap of faith in CloudFO.

“We both had very senior roles in our organisations, so that in itself took a while to transition out of. We're very lucky that we had very supportive leaders in our previous organisations that were aware of our journey and wanted to support that transition, but it takes time. We're really proud that all three founders of Onfido are angel investors in our company. Doing this in the evenings to doing this full time was definitely something we had to manage,” Chohollo mentioned.

The early stages of startup life was especially difficult. Stamp recalled: “A lot of my job was building the product, and doing that when you're bootstrapped, and when you have another full-time job is not something I would recommend to anybody.

“It’s very good from the perspective that you know your product inside out. I know every single issue or crack, but it’s a lot for one person.”

Chohollo continued: “I think if you know what it takes before you do it, you wouldn’t do it. But once you’re on the journey, you’re driven by your mission.”

On cloud nine

With the challenges come the highlights, and CloudFO has experienced its fair share.

“FCA approval was definitely the point in which things kicked off,” Chohollo recalled. “Other highlights have included transitioning from our roles last year, attending conferences like CogX, but I think a big highlight for me is our team. We’re starting to form a really excellent and high performing team.”

She continued: “From a product perspective, we did a beta and that has given us what we needed to invest in the [area] where are we niching down, who we are targeting, what the problems in the workflow are. We have to make sure we are catering for the needs of our users. We've taken all of those learnings to what we are building now, and our next highlight is our launch which is coming imminently.”

Stamp added: “On a more personal level, when you come up with an idea, you always think you're a bit crazy. Afiya was one of the first people who I told about the idea, and the fact that she was willing to quit her job to come and do that it’s really touching that people will believe in you and your ideas.”

The forecast

CloudFO’s future is looking bright, as a product launch is imminent. With the product launch comes the fulfilment of its mission of helping good businesses thrive.

After launch it plans to “get as many businesses using it and working with their AI finance colleague every day. We’re really excited to have CloudFO as part of people’s business teams,” commented Chohollo.

After launch will come refinement of the product, as the startup plans to take a proactive approach to refining the programme. Stamp added: “There are lots of exciting things in the background, but the main priority is to make it as useful as possible for businesses.”

This article originally appeared in the September/October 2024 issue of Startups Magazine. Click here to subscribe