What's Best to Go Public in 2024: IPO, Direct Listing, or SPAC?

Marking a resurgence after a prolonged period of sluggish activity in the public market, IPO deals made in January 2024 alone exceeded the $1 billion mark.

One of the most exciting and anticipated IPOs this year is Reddit, currently seeking a valuation of up to $6.5 billion. The company plans to price its shares somewhere between $31 and $34.

When Reddit goes public, it will become the first major tech IPO of the year and the first social media company to do so since Pinterest's Wall Street entrance in 2019.

IPO: how it works, trends, and recent exits

An initial public offering (IPO) marks a startup's transition from private to public ownership. The company lists its shares on the stock exchange and makes them available for purchase to other investors and the masses.

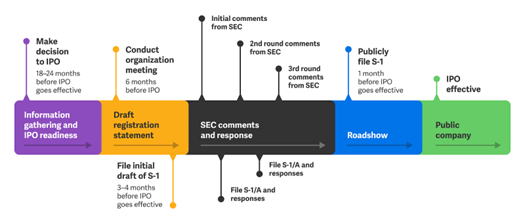

Once the IPO commences, shareholders can openly sell or trade their shares. However, The IPO itself is a tedious process that takes anywhere from 6 months to over a year to complete.

It involves due diligence, regulatory filings, and a roadshow where founders pitch their shares to potential investors.

Workviva provides a great visualisation of a typical IPO timeline:

The most important step to conducting an IPO is partnering with an undertaker: an investment bank that will advise and guide the startup in filing the S-1 form to the SEC and going public.

An investment bank can either commit to purchase all of the company's shares and resell them to the public, or they can agree to try and sell as many shares as possible without any guarantees.

Most of the time, startups turn to 'the bulge bracket banks' in investment banking:

- Bank of America Merrill Lynch

- Barclays Capital

- Citi

- Credit Suisse

- Deutsche Bank

- Goldman Sachs

- J.P. Morgan

- Morgan Stanley

- UBS

Private companies have the option to submit a draft registration statement to the SEC staff for confidential, non-public assessment.

The outcomes of IPO exits may vary with founders and investors ending up rags or riches. Early investors seek significant gains from the share value increase. However, it's the market conditions and the startup's performance that decide the size of the returns.

Pros and cons of going public with an IPO

The key incentive for companies to launch an IPO is the possibility for early investors to cash in on their investments. Having their capital locked up for years makes them eager to reap the rewards from their early faith in the company.

Among the other benefits are:

- Big capital potential: Despite the initial high costs, IPOs can significantly boost a company’s financial stature.

- Exposure: An IPO can become a media magnet, creating a buzz, and attracting lots of attention in the company’s future prospects, earning it industry reverence and favourable terms for future funding.

- Easily traded shares: IPOs attract more traders with the ease of buying public shares over private ones.

On the other hand, IPOs also have certain drawbacks:

Compared to other forms of going public, IPOs are more restrictive in terms of the company's adherence to regulatory rules. The startups are forced to disclose sensitive information such as their financials, accounting, taxes, property, and profits.

Such complete and utter transparency may not be in the interests of founders who fight to protect their intellectual property and trade secrets.

Also, IPOs can be costly and may necessitate further funding, and possibly in extreme amounts, if the shares underperform on the public market.

Recent IPO startup exits: 2023 to 2024

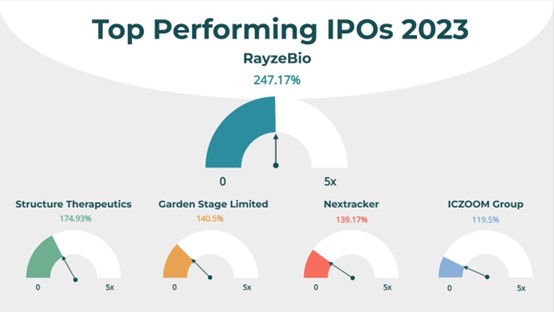

In 2023, the US stock market saw 154 IPOs. 39% of them have positive returns (based on the share price at the time of writing the article sourced from Stock Analysis).

Here are the top 5 performing IPOs of 2023 (current share price captured at the time of writing the article) that showed the most stability over time, with minor fluctuations compared to other unstable stocks:

In addition to these top IPOs, software tech startups can relish and be inspired by the fact that 2023 saw the long-awaited and breakout IPO of Instacart.

A modern eCommerce platform, Instacart sells and delivers various products including food, alcohol, health items, pet care, and ready-made meals. Services are accessible via its app and website, and it also offers SaaS solutions to retailers.

Although not as performing as the top IPOs, Instacart managed to pull off a successful entrance into the public market with an impressive positive return (10.57%). The company shows consistent growth, stability, and vision for future development.

The 154 IPOs in 2023 is a 15% drop from 2022’s 181 and an 85% plunge from the flourishing year of 2021 with its jaw-dropping 1,035 IPOs.

However, there's no reason to feel blue as, at the time of writing the article, there have been 31 IPOs on the US stock market which is 24% more than the same time in 2023. 45% of those came out with positive returns to date. So we're gearing up for a public market revival!

Direct listing: how it works, trends, and recent exits

IPOs are not the only useful exit method: another way startups can go public is via direct listing. Many see the direct listing as a shortcut as it allows to avoid intermediaries as well as some of the key IPO events, including the roadshow and lock-up periods.

At the same time, the end game does not change: same as IPOs, direct listings transform a private company into a publicly traded entity, broadening ownership from a few private investors to many institutional and retail stakeholders.

How is a direct listing different from an IPO then? Well, the key lies in how the shares are priced:

In an IPO, new shares are priced by bankers and the company before public trading, based on roadshow orders. After that, the first public trade is openly auctioned. In contrast, a direct listing doesn’t price shares until the auction, allowing everyone to participate in transparent pricing.

Why would a company do a direct listing?

For the most part, startups opt for direct listings due to the ‘democratisation’ of pricing and lower costs for legal and banking services. These factors are quite enticing, especially for developing businesses.

The absence of a lock-up period offers another layer of freedom. Founders and their investors who opt for direct listings are swayed by the opportunity to sell their shares immediately.

Among the other reasons startups consider going public via direct listing are:

- Avoiding dilution: Well-capitalised companies favour direct listings to prevent share dilution by avoiding primary share issuance.

- Increased liquidity: Direct listings’ enhanced liquidity allows any investor unrestricted share purchases from day one and free-floating prices, unburdened by the non-existent lock-ups.

- Lower expenses: Companies that want to do a public listing may not have the resources to pay underwriters. Direct listing may be the optimal route in this case.

Without an intermediary, however, there is no safety net ensuring the shares will sell and provide high returns.

Direct listings, not underwritten by investment banks, may suffer from greater volatility. Also, the stock availability relies on the employees' and investors' willingness to sell, and the price is solely market-driven.

So the shares' performance on the public market, the amount of stock, and the range in which it is traded are highly unpredictable.

Recent direct listing activity and performance

Not many startups have gone the dangerous but liberal route of direct listing. Not to mention, Not many have come out on top.

Spotify opted for a direct listing instead of an IPO back in 2018 for reasons including enhanced liquidity, enabling shareholders to sell shares publicly, and transparent, market-driven pricing.

Following the daring first step made by Spotify, other notable players like Coinbase, Roblox, and Palantir were inspired enough to follow. However, at best, this route gained them only temporary success.

For instance, only Roblox, a video game platform, managed to gain positive returns in its first few days on the public market (7.8% gains with a $64.5 opening and $69 closing price). Currently, its shares' price dropped to $40 (a more than 37% loss).

Moreover, among all of the 18 companies that went public via direct listing from 2018 to 2024, only a couple witnessed significant returns on the first day of trading, and most of them fell prey to extreme volatility and collapsing share prices.

A vivid example is reAlpha Tech which offers an AI-powered platform for real estate investments. It went public via a direct listing at the end of 2023.

The company’s shares soared on the first day, reaching an intermediate high of $575. It ended the day just shy of $407. Most of the company's initial gains were wiped out by the end of day two, as shares fell 75% to $100. Currently, the company's stock is sold at a little more than a dollar a share.

Concluding from this, we can say that direct listing is a risky but viable alternative when in need of a shortcut to the public market and if the goal is a plausible short-term success.

SPAC: how it works, trends, and recent exits

SPACs (special purpose acquisition companies) are used as another shortcut for a startup to go public instead of a full-blown IPO.

SPACs (also called “blank check companies”) are created to raise capital through an IPO and later merge with a promising startup. They exist for the sole purpose of assisting other companies in their journey from private to public status.

In this case, the SPAC's team becomes the startup's newfound partners and shareholders (usually claiming 20% ownership). In exchange, the startup is basically being carried to the public market in a cradle.

The actual method of going public via SPAC mergers is called de-SPAC transactions. Post-merger, the acquisition company dissolves and the newly formed combined company shares are publicly traded.

SPAC transactions usually have extended lock-up periods compared to regular IPOs, but deal terms may permit early partial cash-outs.

The pros and cons of going public via de-SPAC merger

The key benefits of choosing a SPAC merger over an IPO include:

- Operational Expertise: SPAC sponsors, often seasoned professionals, can leverage their networks for management insights or even join the board themselves.

- Agility: a SPAC merger, typically finalised in 3-6 months, is quicker than an IPO's 12-month average period.

- Capital Boost: SPAC sponsors can raise additional funds through debt and other instruments to finance the transaction and spur the merged company’s growth. This safety net of funds ensures transaction completion, even if some SPAC investors cash out their shares.

- Early price negotiation: unlike IPOs, where pricing depends on market conditions at the listing, SPAC mergers allow for pre-closure price negotiation, offering an edge in unstable markets.

- Lower expenses: A SPAC merger doesn’t need to generate interest from investors in public exchanges with an extensive roadshow.

The downsides of going public via a SPAC merger are:

- Capital risks: If a large number of SPAC investors instantly redeem shares, it can lead to a cash shortage, feeding the need for more financing to cover the deficit.

- Dilution: SPAC sponsors typically hold a serious stake in founder shares or warrants. They can gain additional shares through an earnout if the stock price hits a certain target, potentially causing even more dilution.

Besides that, the new SEC regulations for SPAC mergers align de-SPAC transaction legal requirements with those of standard IPOs, making it a less attractive alternative. Following the proposal of these rules, most Wall Street giants distanced themself from blank-check company deals, leading to a SPAC dry spell.

Recent de-SPAC deals and their performance

2020 and 2021 were booming years for de-SPAC IPO mergers with over 260 deals made. 2021 was the peak year with 199 de-SPAC transactions. As, expected, both SPAC deal volume and value dropped significantly during the venture market’s stagnation in 2022.

2023 saw 98 de-SPAC deals registered by the top exchanges. At the same time, at least 21 bankruptcies registered in 2023 came from companies that went public by merging with special purpose acquisition companies.

Taking it further, same as companies that go through direct listing, de-SPAC mergers also have poor long-term performance and higher post-merger failure rates as compared to those in post-IPO firms.

Grab Holdings was the target firm involved in the largest de-SPAC transaction of 2021 with a deal value of over $34 billion.

Grab Holdings is a Singapore-based super app company with ride-hailing, food delivery, and payment services, operating in over eight countries in Southeast Asia.

The company's stock price, which was trading around $13.31 when the deal was announced in April 2021, witnessed a steep decline (more than -77%) and was trading at $3 by the end of 2023. It remains at the same level to this day.

In 2023, VinFast Auto Ltd. was the largest de-SPAC acquisition of the year, valued at $23 billion. The company was leading in the auto and components industry, producing premium-class electric vehicles.

Its stock was trading at $10.36 when the de-SPAC merger was announced in May 2023 and peaked at $82.35 in late August 2023 (an impressive feat). By the end of the year, it dropped to $7.88. Currently, it's trading at $5.28 a share (-49% from the original price).

A traditional IPO is a great fit for startups that need additional funding and can afford the time and cost associated with the process. It's the safest and most promising (in terms of returns) way of entering the public market.

However, the recent economic climate has made IPOs more challenging, with higher interest rates and bleak valuations. Direct listings and de-SPAC mergers are great alternatives, providing shortcuts to the public market with ways to avoid dilution, provide better liquidity, higher valuations, and greater speed to capital.

Both direct listing and SPACs have seriously underperformed in recent years, with many startups failing to secure positive returns. These exit methods seem to work best as an agile way to possible short-term public market success. In the long run, however, they prove to be less and less effective.

A startup’s exit strategy is chosen based on its unique situation, such as financial requirements, investors, market trends, and goals. To successfully enter the public market in 2024 and beyond, startups need to be on the pulse of the changing economic and tech environment.