Volume raises $2.4m to drive online payment fees to zero

Volume, the transparent checkout startup, has closed a pre-seed round of $2.4m, in an oversubscribed deal led by firstminute Capital and joined by SeedX and Haatch Ventures. Other participants include angels Christian Faes (LendInvest), Russ Carroll (ex-Klarna), as well as angels from MADE.COM, Mastercard, Visa and American Express. Volume improves on current open banking capabilities to reduce the long checkout process, while simultaneously killing hidden fees charged by payment intermediaries.

Current online payment methods are expensive and outdated, putting brakes on the growth of the $5tn ecommerce market. Today, merchants pay between two percent and eight percent of every sale to debit and credit card, ewallet and BNPL facilitators. This ultimately affects end consumers as they end up paying higher prices. In addition to a generally flawed checkout experience, today’s complex, slow and mistrusted payment technology contributes to a global cart abandonment rate of 69%.

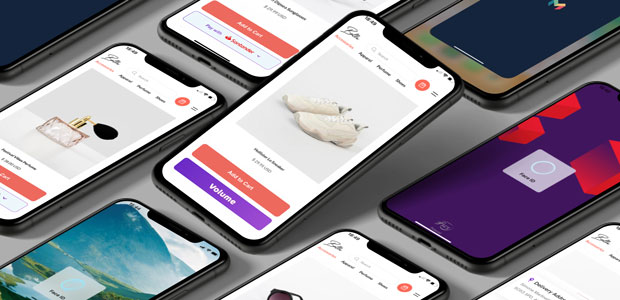

Volume radically upgrades today’s broken customer experience by creating a more transparent payment infrastructure that drives transaction costs to zero. At the same time, it provides a seamless checkout experience for online shoppers. Volume is the first to leverage the Variable Recurring Payment mandate to significantly speed up open banking-enabled direct account-to-account (A2A) online payments. As well as doing away with the need for payment processing intermediaries and expensive third-parties, it eliminates a number of steps in the checkout process. Volume detects the preferred bank shoppers pay with and relays them to a biometric security check in their banking app in order to finalise the purchase. The end-to-end payment process is a personalised checkout experience that takes less than one second, making it five times faster than conventional ecommerce payments.

Simone Martinelli, founder and CEO at Volume, said: “Instead of yet another one-click checkout, Volume is building the world’s first-ever transparent checkout. Ecommerce has a ‘hidden tax’ in the form of payment commissions to cards and ewallets, and consumers don’t know this ultimately impacts on the prices they pay. We want to finally bring transparency to this enormous market and kill all hidden fees. What Transferwise did for cross-border payments, we’ll do for online payments. We estimate that if every merchant were to implement our solution, the ecommerce industry could save $800bn in fees.”

For merchants, integrating with Volume’s solution is seamless and instantaneous. Once integrated, Volume enables consumers to pay online from any device straight from their bank accounts. After their biometric check, their payment is instantly settled with the merchant, without any need for a card, user ID or password. The breakthrough low, flat-rate cost model for online payments replaces fees based on a percentage of the total basket. To do so, it capitalises on open banking rails provided by its infrastructure partner Yapily, which enables connectivity to thousands of banks.

Volume was founded by fintech veterans Simone Martinelli and Krzysztof Tarnawski, who spent the last ten years working at Level39, Mastercard, HSBC and WorldRemit. The startup has already onboarded more than 50 merchants across retail, food delivery and digital marketplaces in the UK. The fintech will use the new funding to expand its UK business, before it looks towards the rest of Europe and North America. Volume is headquartered in London and has an office in Kraków, Poland.

Arek Wylegalski, Partner at firstminute Capital, commented: “Volume is seizing the opportunity created by open banking to enable a new, improved ecommerce payment experience. The high interchange fees that have long been regarded as normal in this $5tn market are finally about to disappear. Having backed Revolut at a similar stage in the past, I believe in Krzysztof’s and Simone’s unique mix of fintech know-how, technical talent, relentless customer focus and ambition to get the job done. Operating between London and Krakow they can tap the world-class fintech talent London is renowned for as well as the excellent engineering talent in Poland. We’re excited to play a part in enabling their future success.”