UK business profits down 20% but insolvency risk decreasing due to vaccine

As the vaccine continues to be rolled out across the UK, business confidence is at its highest point since the beginning of the pandemic. Here, businesses continue to be overwhelmingly supportive of the Government’s approach to help companies through COVID-19, with nearly four fifths either somewhat or very supportive of their initiatives.

This positive sentiment, however, has not yet benefited many workers across the UK, with the proportion facing furlough, reduced hours and reduced salaries/wages continuing to increase in this wave of the Business Distress Tracker. Though perhaps the higher furlough numbers can be attributed to the extension of the furlough scheme until at least September 2021.

James Endersby, Chief Executive at Opinium said: “It is very promising to see business confidence at its highest level since the onset of the pandemic. This uptick in confidence is evidenced through the fact that the number of businesses who believe there is at least some risk of insolvency has dropped by around 200,000 since the middle of January. However, it is essential that this increased confidence trickles down to benefit workers - helping them become more secure in their employment and therefore provide multiplier effects to boost the economy.”

The share of businesses that described their prospects over the next 12 months as positive is now the highest it has been since the Business Distress Tracker began in April 2020. This development will be closely tied to the success of the vaccination programme and the decline in infection rates, which are set to facilitate a reopening of the economy in the weeks and months ahead.

However, businesses are not out of the woods yet, with an estimated 1.6 million indicating that they face some risk of insolvency as a result of COVID-19-related disruption. Meanwhile, businesses’ profits remained at a highly subdued level in late February/early March, which illustrates the precarious financial position that many firms continue to be in.

Pablo Shah, Managing Economist at Cebr said: “The latest wave of the Business Distress Tracker points to a marked improvement in businesses’ outlook for the months ahead. The success of the UK’s vaccination programme and falling infection rates have raised hopes that restrictions will be lifted slowly but steadily over the coming months. Indeed, the government’s road map for lockdown easing would see many parts of the economy re-opening in the near future, starting with non-essential retail in April and indoor hospitality venues from May. However, it is important to note that these plans are very much contingent on the path of the pandemic, and in particular the absence of vaccine-resistant variants of the disease.”

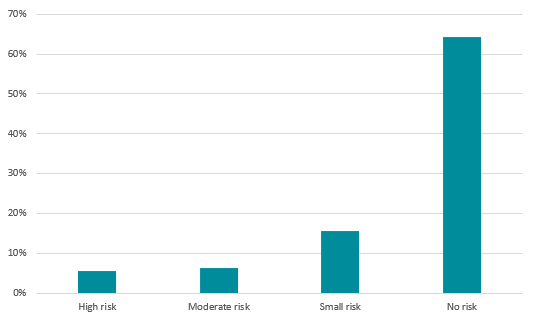

Business insolvency risks

The number of firms that feel there is at least some risk that they will go insolvent as a result of COVID-19-related disruption dropped from 1.8 million in January to 1.6 million in late February / early March. Despite the fall, this still represents more than a quarter (27%) of the UK’s business population. Moreover, the estimated share of businesses that are at high risk of insolvency as a result of COVID-19 has remained stable at 6%.

Employment impacts

The successful roll out of the vaccination programme will bring much needed respite to the millions of businesses across the country which have been forced to make fundamental shifts to their modus operandi over the past 12 months. Here, the Business Distress Tracker found that 76% of companies continue to implement changes because of coronavirus-related disruption. With the furlough scheme extension announced in the 2021 Budget, it is perhaps unsurprising that the average proportion of employees furloughed has risen from 20% in the middle of January, to 23% in mid-March.

In addition to this, 28% have had their hours reduced, and a similar proportion (28%) have experienced a reduction in their salary/wages. Concerningly, these measures have both increased since the middle of January, where the proportion of workers facing reduced hours stood at 26% and those experiencing reduced salary/wages at 24%.

Business activity rates

While the forward-looking measures that are monitored by the Business Distress Tracker showed significant signs of improvement in the latest wave (covering late February and early March), current trading conditions remain extremely challenging.

Indeed, businesses on average stated that their profits over the past 30 days were 19.9% lower as a result of COVID-19-related disruption. This is a slightly sharper decline than the 18.4% figure recorded in the previous wave in January. However, the hit to profits remained less severe than that experienced during the first lockdown in April.

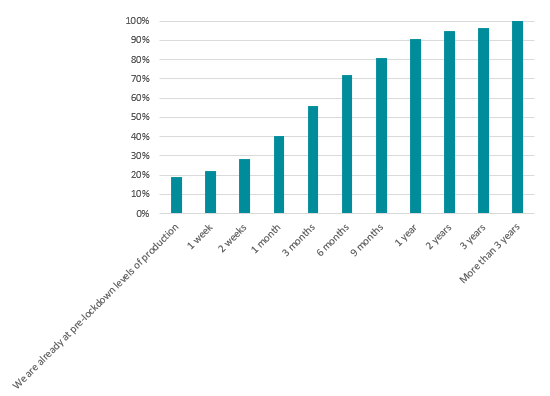

Economic recovery

17% of businesses reported that they were already operating at pre-crisis levels of production in late February / early March. This is down from 22% recorded in the previous wave of the Business Distress Tracker covering January, highlighting the financial toll that several weeks of tight lockdown restrictions have brought upon businesses. 80% of businesses expect that they will be able to return to pre-crisis levels of production within a year of restrictions being fully lifted. This compares to a figure of 75% in January.