Startups breaking away from the 'boom-or-bust' cycle

New data from SeedLegals, the UK’s largest legal platform for startups, has revealed a rise in the frequency of smaller funding rounds for UK startups, with a tech-enabled model of ‘agile funding’ enabling companies to raise money on-demand.

The data, which was collected from companies raising money via the SeedLegals legal platform, shows that UK startups are now raising money four times more frequently than the traditional 12-18-month cycle. The figures demonstrate a wider trend in the startup investment space as a greater number of early-stage companies look to move away from traditional funding rounds in favour of more opportunistic ‘agile funding’. Thanks to funding automation technology which gives founders the flexibility to raise funds for their startups in a fraction of the time, early-stage companies are now completing an average of 2.7 funding events per year.

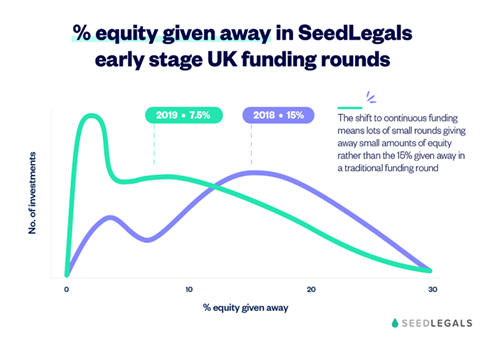

The rise of technology-enabled fundraising – which is making the startup investment process cheaper and easier than ever before for founders – means that companies are now seeing more frequent round raises than ever before. The data from SeedLegals also reveals that the median average amount of equity given away by early stage companies per funding round has halved – indicative of the dramatic rise in the frequency of smaller round raises.

This halving of the median amount given away – from an average figure of 15% in 2018 to 7.5% in 2019 – comes as a direct result of the increased number of early-stage companies securing pre- and post-round investment. According to SeedLegals data, 70% of companies who do funding rounds via the SeedLegals platform now include a ‘rolling close’ as part of their round.

Founders of smaller companies in particular are raising more money ahead of a formal funding round via SeedFAST agreements (a type of Advanced Subscription Agreement) – which allow founders to get investment now, while delaying doing a funding round for up to 12 months while still being SEIS/EIS compatible. According to SeedLegals data, startups with a valuation of under £2.5M are twice as likely to raise money ahead of their first funding round using SeedFASTs as those with a valuation of over £4M. Of the companies who issued SeedFAST agreements when raising via the SeedLegals platform, 44% were valued at less than £2.5m, in comparison to 21% with valuations of over £4m.

SeedLegals gives companies the ability to both raise money ahead of a funding round using a SeedFAST and also allows them to top up a funding round afterwards via Instant Investment.

When companies top up with Instant Investment, the median amount of equity given away is just 0.8 % per Instant Investment, showing how companies are now doing multiple small top-up investments, as they either need money or meet with interested investors.

The data demonstrates how the nature of UK startup investment is becoming truly continuous. Funding automation platforms are powering an ‘always-on’ model of fundraising, allowing founders to secure investment opportunistically – whenever and wherever they meet prospective investors – and at any time of day. Figures have shown that 5% of all funding rounds completed via the SeedLegals platform in the last year were closed at 1am – the same proportion of deals that were finalised at 10am during business hours.

Anthony Rose, CEO and Co-founder SeedLegals, commented: “This new data shows that the way founders are raising funds for their companies is fundamentally changing. Until now, the traditional approach for startups looking to secure investment has followed a 'go-big-or-go-bust' logic. Because of the high costs associated with using a law firm to finalise a funding round – plus the difficulty of coordinating all of your investors, negotiating deal terms and getting everyone to sign the documentation – founders have traditionally sought to avoid the cost and hassle of fundraising as much as possible by raising larger amounts on a more infrequent basis.

“The trouble is that while raising every 12-to-18 months softens the blow of exorbitant legal fees, it presents a whole host of additional, unnecessary problems. The fear of running out of money before closing the next big round of investment is immensely stressful for founders, and the logistics of a traditional round means taking time out from actually running the business that they’re trying to grow. More importantly, the process of securing more money than they realistically need in the short-term means giving away a larger chunk of their company at a lower valuation, diminishing their returns in the long run.

“At SeedLegals, we’ve pioneered the model of agile funding to solve this. Rather than feeling forced to raise rounds via the costly, cumbersome 12-to-18-month process, founders are now being empowered by technology to raise money when they need it, on a more frequent basis, and at a time which suits them. With our SeedFAST and Instant Investment options, we’re enabling founders to fundraise in a way that meets their company’s needs – before, during or after a formal funding round – all while saving them time and money in the process.”