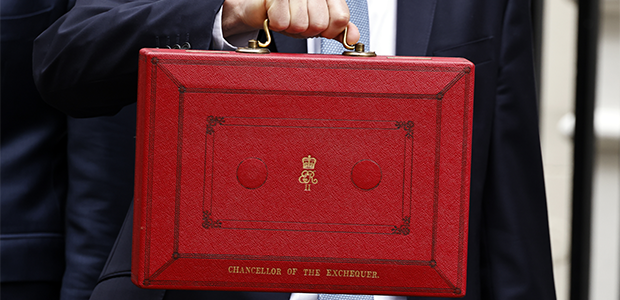

The spring budget 2024: mixed reactions from the industry

On the 6th March, the highly anticipated Spring Budget was unveiled. Chancellor Jeremy Hunt disclosed a series of initiatives that have been designed to support startups and SMEs, as well as providing support for technology adoption.

Within the budget, it claims “Spring Budget goes further to support SMEs by increasing the VAT registration threshold from £85,000 to £90,000 to cut their taxes and help them grow.”

So, what else has been announced to help the tech sector and SMEs?

SMEs

The biggest talking point of the budget for SMEs has been the reversal of the January amendments to the definitions of High Net Worth and Sophisticated Investors, which would have drastically narrowed the pool of potential investors in startups, which would impact female investors, other underrepresented groups, and those outside of London and the Southeast.

Other points:

- Extension of the Recovery Loan Scheme to support SMEs to access the finance they need and renaming it as the “Growth Guarantee Scheme”

- Published updated HMRC guidance on the tax deductibility of training costs for sole traders and the self-employed to provide certainty to those who want to invest in boosting their productivity

- Increased the VAT registration threshold to £90,000 from 1 April 2024. This ensures that the UK continues to have one of the highest thresholds in the OECD

- The government is also announcing a new £7.4 million upskilling fund pilot that will help SMEs develop AI skills of the future, unlocking the new opportunities that AI brings. This will complement the SME Digital Adoption Taskforce

Technology

In regard to the technology aspect of the budget, Hunt has announced initiatives for tech adoption, as well as improvements that will help the sector.

Some of the points made:

- Doubling the size of i.AI, the AI incubator team, ensuring that the UK government has the in-house expertise consisting of the most talented technology professionals in the UK, who can apply their skills and expertise to appropriately seize the benefits of AI across the public sector and Civil Service

- Committing £14 million for public sector research and innovation infrastructure. This includes funding to develop the next generation of health and security technologies, unlocking productivity improvements in the public and private sector

- As the UK’s national institute for AI and data science, the Alan Turing Institute drives economic and scientific advancements, impacting millions through its cutting-edge research. The government is announcing that it will invest up to £100 million in the Institute over the next five years

Industry reactions

The industry has reacted, with many weighing in on the impact the budget will have.

Sarah-Jayne van Greune, Chief Operating Officer at Payen & ILIXIUM said: “The levelling up investment is welcomed but we need to see this come to fruition. In the last budget, Jeremy Hunt promised an additional £500 million investment in artificial intelligence to ensure the UK is an AI powerhouse. In addition, the government’s AI Whitepaper announced the allocation of £80 million to establish nine new AI research hubs. Yet, as Tech UK rightly pointed out, limited details have been published on where these hubs will be located.

“The UK industry has many tech and business pioneers spanning the country. And with access to the right funding, will be able to create solutions that will drive the government’s long-term growth plan beyond expectation. If investment and support aren’t distributed equally, that goal may not be achievable as some of the brightest members of society won't have the tools to bring their ideas to life. Ultimately, equality in investment will, in turn, ensure that the Chancellor can put the UK on the path to becoming the next Silicon Valley.”

Andrew Martin, who has recently founded SMEB, commented: “SMEs account for three-fifths of the employment and around half of turnover in the UK private sector, which is why it is so important the budget included key commitments to help SMEs continue to invest and grow.

“We know that it is challenging for SMEs to access capital, which is why we welcome the announcement of the extension of the recovery loan scheme (changing to the growth guarantee scheme) and the addition of £200. This will crucially help 11,000 SMEs access the finance they need to invest and expand.

John Pearce, CEO of Made in Britain, the trade association uniting 2000 British manufacturers, of which 90% are SMEs: "Our skilled workforces are the backbone of the UK manufacturing sector, so at Made In Britain we support the Chancellor's decision to reduce the tax burden on British workers via the second reduction in National Insurance in a year. At the same time, inflation and the cost-of-living crisis have produced wage pressures that affect the competitiveness of UK businesses across the economy. As such, we welcome any effective measures to bring, and keep, inflation within the government’s target and it is very welcome that the OBR forecasts that this is being achieved.”

Mike Smeed, Managing Director, InMotion Ventures, commented on the budget: “It’s very positive to see plans announced by the UK government to boost investment in our national tech scene.

“Extending the full expensing tax break can only encourage more entrepreneurs to launch, grow and list their businesses here, and the combination of £110 million in levelling up funding and more pension capital flowing into our tech industry will ensure the UK retains its position as the leading innovation and investment hub in Europe.”

Babs Ogundeyi, Group CEO and Founder, Kuda, mentioned: “The UK is the largest tech hub in Europe and on track to become the world's next Silicon Valley. For the UK to achieve Chancellor Jeremy Hunt’s aims in which innovative entrepreneurs not only start their companies here, but also stay and list here, we need to encourage fintech. Fintech and collaboration with the Government will drive growth and such growth is key to fostering a prosperous economy. A favourable regulatory environment for fintech will both cement the UK as a global leader in technology, but will also help the burden of the cost of living crisis. Financial inclusion and initiatives aimed at promoting this and digital literacy will benefit people and the economy.”

Jamie Roberts, Partner at YFM Equity Partners at YFM Partners comments: “In recent research, YFM Equity Partners revealed that entrepreneurs in the UK generate £950 billion in annual revenue, making them the backbone of the UK economy. It is therefore critical that we create a business environment where these smaller businesses can thrive and importantly, grow.

“This was overlooked by the Chancellor in an Autumn statement which laid out business tax cuts that benefited profitable, asset-heavy businesses and overlooked those in the scaling up stage. As a result, it is extremely reassuring to see the importance of scaleups, and growth recognised in today’s announcement and we hope that it is a sign of more to come.”

Dr Roeland Decorte, CEO and founder of Decorte Future Industries: “The government's commitment to making the UK the world’s next Silicon Valley remains encouraging. While the UK’s tech ecosystem is ahead of the rest of Europe, more needs to be done to attract private investment into early-stage and growing AI startups. The R&D tax credit process, recently fraught with difficulties, must be optimised yet was noticeably absent in the Chancellor’s speech. There was also very little for AI companies grappling with ongoing regulatory uncertainties. Free support for navigating legal and ethical complexities would empower startups to build a sustainable future in this space, and help establish an internally consistent economy in which competitive AI startups can thrive.”

Mark Nichols, Senior Associate - IP Solicitor at Potter Clarkson, mentioned: “It’s encouraging that venture capital investment is further incentivised to fund our high growth companies with the Mansion House reforms. Together with the proposed simplified R&D development tax relief and the making permanent of relief on capital investment by businesses, Jeremy Hunt is trying to promote an economy which grows through innovation. We now need to see related regulatory developments, particularly in relation to the fast moving AI sector, in which the UK’s regulatory reforms are lagging behind those of the EU, China, and the USA.”

Emma Sinclair MBE, Founder and CEO of Enterprise Alumni, reacted: “By reversing legislation on the definition of high net-worth individuals that would have disproportionately affected female entrepreneurs and female angel investors, the government has listened to the voices of women in business and acted swiftly. My hope is that we channel this momentum to continue pushing for real change in favour of women led businesses in terms of funding.”