Southeast Asia's digital economy

Imagine a market that adds as many new digital consumers each year as the entire UK population – creating unparalleled business opportunities for tech companies.

Southeast Asia's digital economy is not just growing; it's exploding, with its value set to soar from £240 billion today to a staggering £800 billion by 2030. And, for UK tech companies feeling the squeeze of saturated domestic and international markets closer to home, the region presents a digital frontier brimming with potential.

The digital gold rush: why Southeast Asia matters

The adoption rate of digital solutions in Southeast Asia is currently below that of markets like China, Europe and North America, and this has historically led many British firms to put less priority on the region.

But Southeast Asia’s governments have announced ambitious plans to catch up and become a leading global digital economy in the next five to 10 years. And combined with the rapid growth expected, its markets are not yet saturated with home-grown or overseas competitors.

In addition, while more the world’s more developed economies had completed their urbanisation process by the end of the 20th century, Southeast Asia – with the exception of Singapore – has significant urbanisation still ahead. An estimated 100 million people are set to move from rural areas to cities by 2030, placing significant demand on public services, with digitalisation key to managing this demographic shift.

Digitalisation will also play a pivotal role in increasing the ability of Southeast Asian SMEs to compete with multinational corporations. It will not only level the playing field, but unlock growth opportunities and foster innovation. And the impact of new technologies such as artificial intelligence will be particularly significant: AI is forecast to contribute a whopping £665 billion in economic benefits to the region by 2030.

Government agenda

Government support for Southeast Asia’s digital economy is also robust. Across the region, national governments are not just welcoming digital innovation with warm words – they're subsidising it.

For instance, Singapore’s Productivity Solutions Grant covers 50% of the cost of businesses’ investment in digital and ICT solutions up to around £18,000 per company per year. Similarly, Vietnam’s Digital Transformation Plan is designed to promote the widespread adoption of the latest tech.

While Singaporean companies are often proactive in adopting digital solutions, companies from many other markets in the region rely more on such government initiatives to drive their digitalisation efforts.

And government programmes in these countries not only help businesses access the tools and resources they need to thrive in a digital economy; they create a favourable environment for innovation, attracting both domestic and international companies to invest.

Which tech segments ... and which markets?

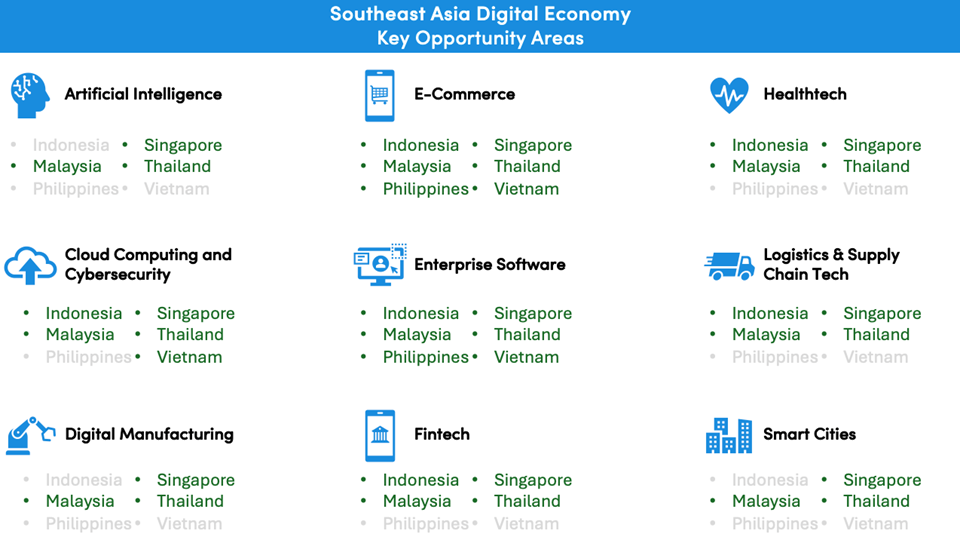

So, Southeast Asia is set to be a £800 billion digital economy by 2030 – and this presents openings right across the region. But there are markets where certain technologies are in particularly high demand, as this table indicates.

For example, while e-commerce and enterprise software are booming region-wide, in areas like digital manufacturing and smart cities, Singapore, Malaysia and Thailand are leading the way.

For fintech, Cloud computing and cybersecurity, you can add Indonesia to that list.

Also, not included in the table above are niche areas such as call centre systems, where the Philippines is prominent, or agritech solutions, where Indonesia, Thailand and Malaysia come into their own.

Above all, Singapore stands out amongst the world’s most digital-ready economies, setting a benchmark for digitalisation in the region.

To understand the drivers behind this, I recently conducted interviews in Singapore for a client in the digital manufacturing sector. A consistent theme from my discussions was the pivotal role of technologies – such as 3D printing, IoT sensors, robotics, and predictive maintenance – in enhancing manufacturing productivity. These tools are increasingly viewed in Singapore as essential for staying ahead, particularly as manufacturers in neighbouring Malaysia and Vietnam rapidly adopt innovations.

So, targeting established sectors like cloud computing and digital manufacturing in Singapore may ease your entry into the region, as companies there have already started their digitalisation journey and have the necessary infrastructure and resources to implement solutions – albeit in an environment of heightened competition.

Targeting emerging markets such as Vietnam and the Philippines, on the other hand, offers significant growth opportunities for first movers willing to navigate challenges including limited infrastructure and resource constraints.

Concrete examples

So, there’s great demand for digital technologies across the region, but what does that mean in practice for UK innovators?

The fact is Southeast Asian companies often source digital solutions from outside the region due to the superior technology, scalability and global expertise offered by some international providers.

Additionally, in certain less-developed markets, this preference is driven by perceptions of higher quality and more comprehensive offerings from international innovators, UK companies included.

To give a few examples of collaboration with UK companies:

- Chợ Tốt, the number one Vietnamese C2C marketplace platform, is using API solutions from British tech company TYK to handle increasing traffic and services

- Malaysian Motor Trader, the largest automotive magazine in Malaysia, has worked with UK digital publisher Miles 33 to develop an advertising portal, online marketplace and auction site

- Minor Food Group, an operator of restaurant chains across Asia, has just signed a deal with UK startup Yellow Submarine to deploy its AI-backed footfall and transaction analysis software across its Burger King outlets in Thailand

- Shook Lin & Bok LLP, one of the top law firms in Singapore, has partnered with UK cybersecurity company Darktrace to deploy its AI systems to detect cyber threats.

And, in terms of partnerships with other overseas companies:

- Singaporean systems integrator ST Engineering has expanded its investments in cybersecurity, smart transport and data centres, collaborating with overseas players including Canada’s Trapeze Group to provide telematics solutions for Singapore’s entire public bus fleet

- Grab, a super-app offering transport, food delivery, financial services and digital banking, raised £3.6 billion to fuel its digital services expansion, partnering with OpenAI to improve its customer support chatbots, enhance user accessibility and automate mapping

- Petronas, Malaysia’s government-owned oil and gas company, has joined forces with the US’ Schlumberger to adopt digital technologies, IoT and sustainability-focused initiatives such as cloud-based data repositories for carbon storage and emissions management.

Navigating the challenges

Few digital markets, then, can compete with Southeast Asia in terms of projected growth and appetite to collaborate with UK innovators.

But British companies need a comprehensive market understanding and well-defined strategy before attempting to enter the market.

Importantly, Southeast Asia has nothing like the integration levels seen in Europe. The region is fragmented, with significant differences in consumer behaviour, business culture and language between markets. And each operates its own legal and regulatory systems, including restrictions on the overseas transfer of data.

This creates complexities when seeking to enter multiple markets in the region, although its governments are aiming to conclude an agreement that will foster closer integration of its digital economies.

If a forward-looking agreement is implemented, it’s projected to drive the region’s digital economy far beyond the forecast of £800 billion by 2030, potentially even enabling it to reach double that market size.

But if such an agreement is not reached, UK companies will need to continue to deal with the fragmentation. Depending on the sector, this will most likely require tackling markets individually – for instance, by identifying a partner in each and securing separate regulatory approvals.

The suitability of infrastructure to support the digital economy also differs vastly across Southeast Asia. For example, Singapore became the world’s first country to be fully covered by 5G back in 2022, while Vietnam did not deploy its first 5G network until last October. UK companies can address such challenges by partnering with local firms and tailoring their solutions to varying levels of infrastructure maturity.

Lastly, there is no shortage of home-grown digital tech startups and established companies in Southeast Asia. They typically have a significant price advantage and, in some cases, have already achieved leadership positions. UK companies can mitigate this by securing partnerships with local system integrators and advisors – which also carries much less risk than setting up an entity as your first step – as well as playing on their product strengths.

Digital powerhouse

So, Southeast Asia is emerging as a digital powerhouse that UK tech companies can no longer afford to overlook.

With its rapidly expanding digital economy backed by government support, demographic shifts and a tech-savvy population, the region presents immense opportunities.

At the same time, addressing the market requires a deep understanding of its complexities, tailored market entry strategies and, crucially, the right partnerships.

It’s not necessarily an easy task. But those who come prepared stand to reap significant rewards.

You can get free and subsidised help to expand in Southeast Asia from the UK-APAC Tech Growth Programme, which Intralink runs on behalf of the UK Government. Find out more and apply to join at www.intralinkgroup.com/TGP.