Seedrs Secondary Market Sees Record Breaking Activity Levels

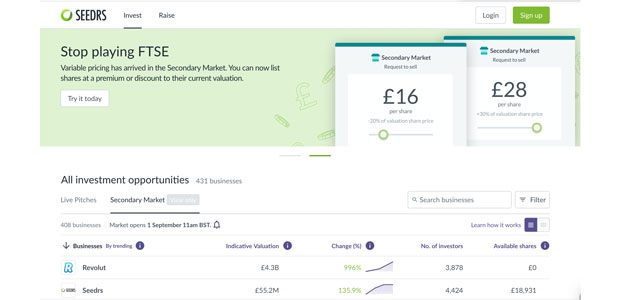

Online investment platform, Seedrs has announced record-breaking activity levels on its Secondary Market, following the introduction of variable pricing in the August trading window. The introduction of variable pricing offered sellers the opportunity to list their shares at either a premium or a discount of 10%, 20% or 30%, relative to the mark-to-market share price and was developed in consultation with Seedrs entrepreneur and investor communities.

Prior to this, investors were only able to sell shares on the Seedrs Secondary Market at the set price (which is usually determined by the business’s latest valuation).

The dynamic offering has proved extremely popular with users in the August window, driving substantial activity on the Secondary Market. Notable firsts include the highest volume of share lots ever listed, the largest value of share lots ever listed, and the greatest number of sellers listing share lots.

In addition, the total number and total value of share lots traded rose by almost 20% compared to the average numbers in the January to July 2020 markets.

Share lots listed at either a premium or discount were significantly more likely to sell than shares listed at the mark-to-market share price. Over 35% of the share lots listed in the August market took advantage of this feature, with 16% of share lots listed at the 30% premium. Of the £5m+ worth of shares listed in this market, 27% took advantage of variable pricing. Share lots listed at a 20% discount were most purchased with 74% of share lots (by volume) and 71% (by value) sold. This was followed by share lots listed at a 10% premium, with 37% of share lots (by volume) and 27% (by value) sold.

The variable pricing feature was released to provide greater liquidity to the Secondary Market market and allow more investors to trade, improving efficiency in matching buy-side and sell-side demand, and therefore enabling more trades and greater customer satisfaction.

Jeff Kelisky, CEO at Seedrs said: “The introduction of variable pricing is a major step in the continued development of our Secondary Market, and represents an important milestone in our quest to be a full-scale marketplace for private investments.

"We wanted to create a better and more flexible experience for investors while continuing to make the process completely hassle-free for business, so I’m delighted to see the popularity of this feature in its market-debut.”