Seedrs opens up Secondary Market capability to private businesses

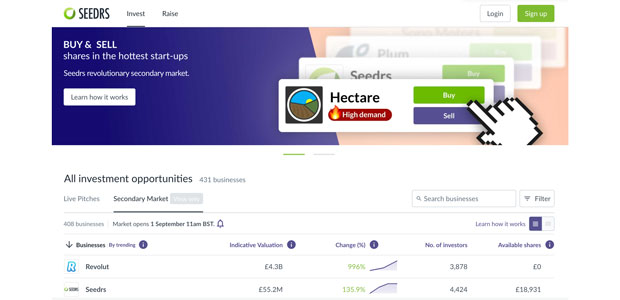

Online investment platform, Seedrs has announced the next evolution of its secondary offering. Opening up its popular secondary market platform to all private businesses, allowing founders, employees and early investors to realise secondary liquidity without having to wait for an IPO or exit event.

Investors will be able to list their shares directly on the Secondary Market in a 'direct listing' and sell to the Seedrs investor network; sell their shares via a 'secondary campaign' to a businesses’ community of customers and existing shareholders (thereby experiencing all the benefits of running a public crowdfunding campaign); or sell via a 'private listing' in our dealroom and access Seedrs network of institutional investors and funds.

Global safety-tech company, SafeToNet, is the first businesses to benefit from a Seedrs’ secondary campaign, having joined the platform through Seedrs’ exclusive partnership with leading equity management platform, Capdesk. SafeToNet secured a £2.5m primary funding round from 150 investors, followed-on with an additional £300k in secondaries made available from its founders and employees.

Richard Pursey, Co-founder of SafeToNet said: “We were delighted after hitting our £2.5m fundraising target so quickly, to be able to offer more investors a chance to join our community via a secondary share sale. It’s really important for us to provide an exit opportunity to some of our existing shareholders, while also continuing the growth journey of SafeToNet as an independent business.

"This has also been a great way for us to welcome new investors onboard, building up our customer community with passionate brand advocates, without having to part with any additional equity.”

Seedrs has been offering secondary shares on its platform for the last three years, having launched the UK’s first and only full-function private equity secondary market back in 2017. Since then the Seedrs Secondary Market has gone from strength to strength with more than 22,000 secondary transactions and over the last 6 months averaging £500k/month in secondary trades. Revolut shareholders alone in 2020 have sold over £1.5m in shares and at a whopping average 598% profit on Seedrs Secondary Market.

Seedrs continues to build out its Secondary Market service, last month adding dynamic pricing to allow shares to be sold at price premiums and discounts. This resulted in a 184% increase in total realised profit for sellers, 124% increase in value of shares sold and 80% in clearance rate of listed shares, compared to the July trading window.

Jeff Kelisky, CEO at Seedrs said: “Access to secondary liquidity is increasingly critical in the private company investment ecosystem, especially in the current climate, where we are seeing businesses staying private for longer. As we build out our full-scale marketplace for private equity investment, we see secondaries in private businesses as an essential and expected ingredient in the investment journey.

"In addition to primary raises, we have been the driving force for the secondaries opportunity for European startups for the last three years. Each month we’re adding 30 new companies to the Secondary Market, and we envision a future where the world’s most famous unicorns, such as the likes of Bulb, Gousto, Starling and SpaceX will take advantage of our platform, giving investors an opportunity to join in their growth.”

During the COVID-19 pandemic, Seeds has seen an increased demand from investors wanting to use the Secondary Market and fielded more enquiries from private businesses and their shareholders wanting to access it. Seedrs saw its largest single month of secondary transactions in May with over £1m traded and in complete contrast to the broader economic conditions.

The growing demand for secondaries appears to be a global trend. The US in particular continues to see a number of private equity service providers consolidating, innovating and maturing the market to better cater to the needs of the vast amount of wealth locked in private shareholder equity.

Seedrs is seeing this trend continue in Europe as many of its tech darlings mature and employees and early investors seek out returns pre-IPO (example: Transferwise Secondary sale).