Keeping protection close to your heart

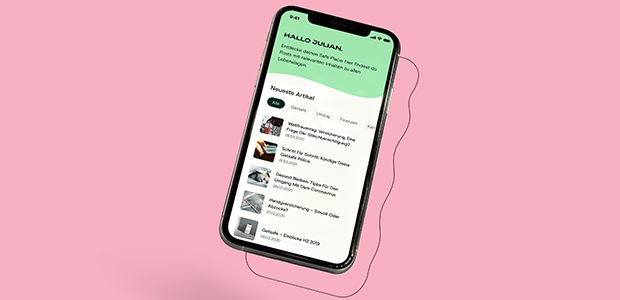

Even with the help of price comparison sites, finding the insurance that is right for you can prove to be the proverbial needle and haystack conundrum. However, Startups Magazine speaks to Johnny Stubbs, Head of UK Insurance and Business Development at digital insurer Getsafe, who are using technology and AI to enable customers to learn about, buy, and manage insurance conveniently from their smartphone, all without any paperwork, and within just a few clicks.

The company was initially founded in 2015 by Christian Wiens and Marius Simon, the company’s current CEO and CTO, as a digital insurance broker. However, over the last two and a half years Getsafe has focused more on developing its own insurance products to sell in its native Germany, and now in the UK.

“In essence, Getsafe is about using technology to support customers in all elements of their insurance - whether that be their buying journey, managing their insurance on an ongoing basis, and simplifying the process of making a claim,” commented Stubbs.

An industry on the go-slow

Stubbs highlighted that the insurance sector has been slow to adapt to the opportunities that emerging technology is providing in other industries. At the same time, technology has led us all to increasingly expect a certain level of customer service across all other aspects of our daily lives. This has presented a gap in the insurance market, as Stubbs added: “We’re aiming to revolutionise the industry by bringing the insurance experience in line with what customers see on a day-to-day basis elsewhere.”

Getsafe became what it is today basically due to a lucky coincidence: via a Facebook group. Simon was searching for similarly ambitious founders with whom he could exchange ideas. And Wiens was the only one who attended the personal meeting in Heidelberg.

At that time, Wiens already had startup experience and a clear goal in mind - to digitise the insurance world. A physicist and techie together with a mechanical engineer and industrial engineer, the pair were able to form a team with a diverse skillset.

“The way that Getsafe would think about itself is a technology business in insurance rather than the other way around,” added Stubbs. “So, it’s key that we are able to leverage experiences outside the world of insurance while also having that expertise in the room to make sure that we’re making the products as relevant for our customers as possible.”

The company has thus far raised in excess of €20m of Seed and Series A venture capital funding and can count Earlybird, CommerzVentures, BtoV, GFC, Partech, and Capnamic as its investors.

Differentiation

In terms of getting access and being able to buy insurance, Getsafe aims to make it far easier than traditional insurers. “The journey is very intuitive, seamless, and just takes a few minutes. We do that through our chat bots or through the online flow,” Stubbs continued.

“It’s very easy to buy and then in terms of managing your insurance on an ongoing basis, once you have access to the Getsafe app, it’s very simple to update and either change your personal details, or if you want to amend your insurance or add on additional elements to it, that process is very straightforward. Then we try to remove some of the more traditional issues that crop up, like how easy it is to claim. Our chatbot is available 24/7.

“So, in the unfortunate situation where you do have to claim, we want to make that as straightforward as possible because we know it’s a very stressful time. You don't want to be calling a phone line where there’s no one available, or having to wait for the following day to report the issue, so we’ve made that as easy and as customer centric as we can.”

Product offering

Germany is the company’s more mature business model, as it’s been running for longer. And in that market Getsafe has built out the product portfolio with the customer in mind – both in terms of the product itself and how it is developed, and so customer engagement is at the centre of that process to ensure that customer expectations are being met.

Germany currently has a broader portfolio which includes personal liability, dog liability, home insurance, travel, and legal protection, plus a recently launched accident insurance offering. “We’ve been trying to identify areas that are relevant to our customers,” added Stubbs, “so that they can have a one-stop-shop solution which is looking to simplify the whole insurance experience so that you can have one provider that is handling a number of different areas.

“In the UK, we’re very much at the beginning of the journey so we launched contents insurance a couple of months ago as our first product, but we’ll be looking to develop that roadmap of product development, again, very much in line with the engagement that we’re having, and will continue to have, with our customers.”

Feedback

Getsafe has received some very positive feedback thus far, from a target audience who are very much digital natives and the millennial group, who undoubtedly have expectations around the seamlessness of service, and the ease of product purchase.

“We’re able to respond very well to those expectations because we have a very customer centric way of thinking about business growth and product development,” Stubbs added. “That side of the business is really strong, and it’s something that we’re really conscious of - we need to make sure we’re getting that right and delivering on customer expectation. We have a number of different modes of engagement with customers to make sure that we’re performing in line with expectations.”

Future growth

Although the company started in Germany, the UK is an extremely exciting and challenging market for Getsafe, as it is well down the road in terms of digital adoption.

Stubbs continued: “The primary focus initially was more in the FinTech space but obviously InsureTech is becoming a much bigger scene in the UK. We are keen that there is a strong overlap between the Getsafe proposition and smartphone adoption and app usage for the kind of FinTech / InsureTech space.”

Stubbs added however, that the UK is an incredibly competitive market but it’s an environment where Getsafe are keen to test its proposition. “We’re still at an early stage of the journey,” he continued. “I would say that in the first few months of being live and active, we’ve seen good response from customers, both in terms of our growth but also the engagement we’re seeing with the Getsafe proposition. That’s something that we need to monitor closely and we’re obviously in unprecedented times as it is, so that has created its own challenges.

“So, in terms of getting into the UK market it has been challenging for sure, but it’s something that the team has really risen to and achieved in a relatively short space of time, which is a testament to a lot of hard work.”

The current situation and future

Stubbs concluded that it’s very early to take any kind of firm conclusions from the current COVID-19 situation. From an overall business perspective, Getsafe has continued to see really strong progress, whether that’s in terms of actual new customers (March was the company’s best month on record), or whether it’s internally where Getsafe are continuing to hire at a strong rate through purely virtual means.

He added: “In the UK (which we launched in January) we will be wanting to develop the product proposition further. Right now, we’re really focused on making sure that our first product launch is as optimised as possible and that we’re really focused on making sure that everything is working for the new customers that we’re seeing in the UK. From there it will be very much in line with what we’ve done previously in Germany - we’ll be looking to build that product pipeline with Hiscox, our partner in the UK, and very much in line with the need from the UK audience.”