The huge £12.9bn Cost of Bad Business Advice

Bad business advice has cost the UK’s microbusinesses an estimated £12.9bn, new research has revealed.

The research, conducted by independent digital insurance broker PolicyBee, surveyed more than 500 small and micro-business owners to ask what the best and worst business advice they had ever received was, and what the impact of such advice was.

The research discovered that almost two thirds (62%) of the UK’s small and microbusinesses have received bad business advice in the past. This included a range of topics, across finances and investments, admin and bookkeeping, contracts, tax, hiring, and so on.

The findings also revealed that bad business advice has resulted in two in five (42.7%) small businesses losing money. Across those that cited some level of financial loss for the business, the research reveals that bad business advice cost an average of £9,225.00, with 1 in 20 losing more than £25,000.

Accounting for 95% of all businesses, there were 5.3 million microbusinesses (0-9 employees) in the UK in 2021. Using our finding that 62% of the sample had received bad business advice in the past, this equates to a potential 3 million (3,286,000) microbusiness which may have experienced the same. Assuming 42.7% saw a negative financial impact (percentage based on the sample), bad business advice has cost the UK’s microbusinesses an estimated £12.9bn (£12,943,800,450).

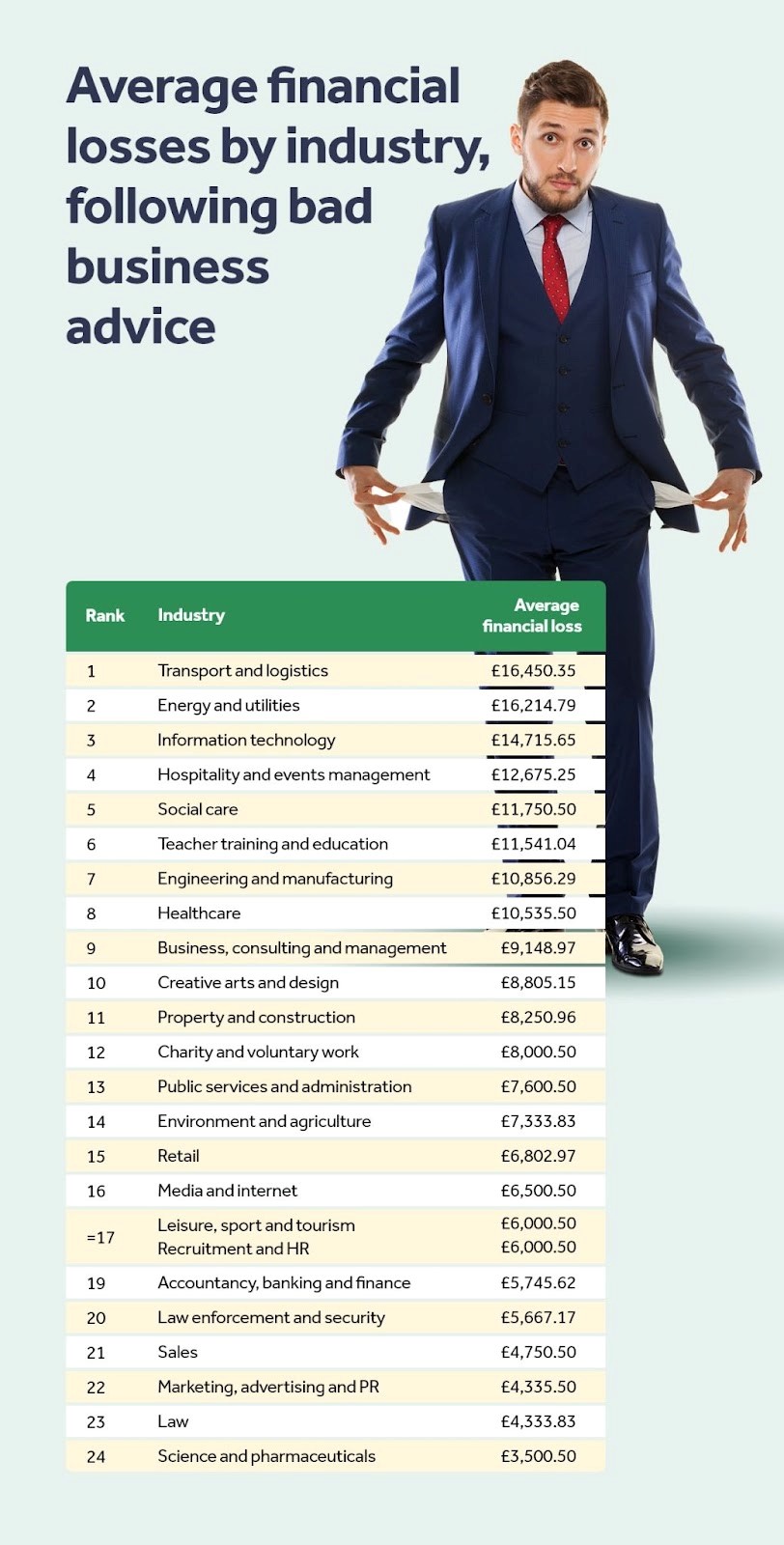

Transport and logistics saw the biggest financial impact from bad business advice in actual figures, with an average loss of £16,450.35 per business. The top five based on actual financial losses also included energy and utilities (average loss of £16,214.79 per business), information technology (average loss of £14,715.65 per business), hospitality and events management (average loss of £12,675.25 per business) and social care (average loss of £11.750.50 per business).

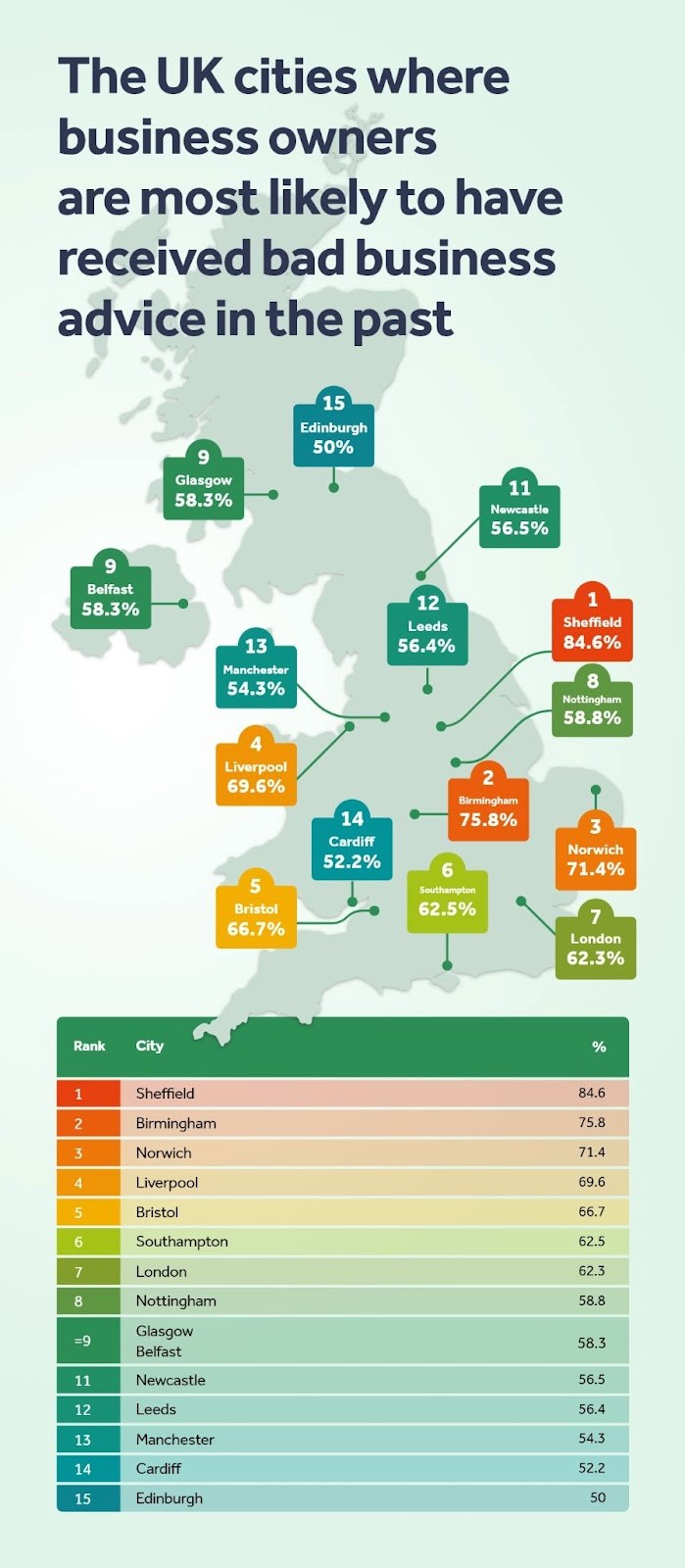

Looking at city-level locations, business owners based in Sheffield were most likely to have received some form of bad business advice in the past (84.6%), followed by Birmingham (75.8%) and Norwich (71.4%).

Kerri-Ann Hockley, head of customer service at PolicyBee, commented: “Bad advice can make businesses more vulnerable. It can increase the risk of mistakes being made, things not going to plan, and a claim of negligence, wrongdoing or worse landing on your doormat.

“Dealing with legal claims takes time, money and expertise. That’s why it’s worth protecting your work, reputation, and bank balance with professional indemnity insurance.

“It pays for a legal expert to defend a claim against you and picks up the tab for any compensation or damages you have to pay. That means it offers not only solid business protection, but valuable peace of mind.”