High street re-opening provides lifeline for retailers

With non-essential shops beginning to open in the UK, the latest Opinium-Cebr Business Distress Tracker shows things are already looking up for retailers, as less than a fifth (18%) now see themselves at risk of insolvency. This has fallen from 40% since the last Tracker two weeks ago.

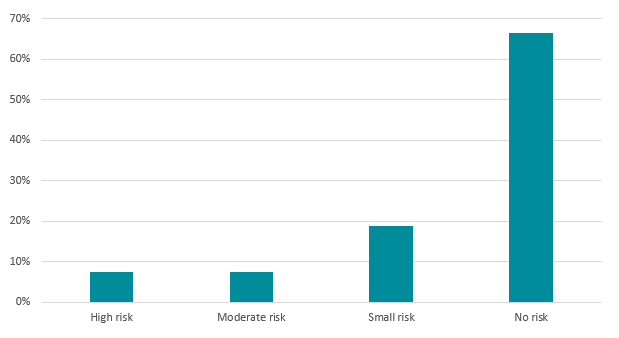

There is further positive news as the number of business overall that believe they are safe from insolvency has increased in the last two weeks, from 41% to 67%.

Business Distress Tracker topline results

- As the economy continues on its transition towards a 'new normal', there have been some tentative improvements in the Business Distress Tracker. The number of businesses that state they are safe from entering insolvency has risen by 235,000 over the past two weeks, taking the total share to nearly two-thirds (67%). This compares to just 41% in mid to late April.

- Compared to other sectors, retail remains in a highly distressed state. However, news of non-essential shops re-opening this week has provided a lifeline to thousands that have been pushed to the brink of collapse during the lockdown. The share of retailers at a high or moderate risk of entering insolvency as a result of the coronavirus pandemic has fallen from 40% to 18% over the past two weeks.

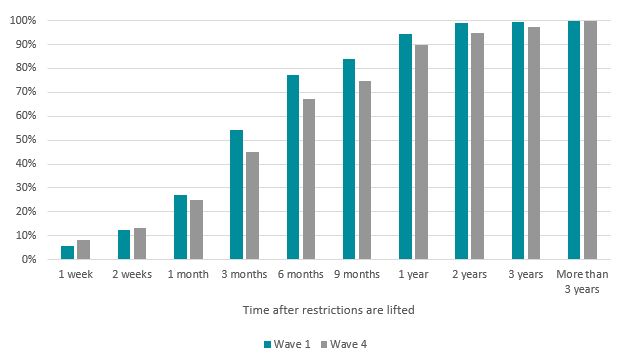

- While the immediate pressure has eased for some businesses, the long term damage continues to accumulate. Businesses on average say they will need 34 weeks after restrictions are lifted to return to full production. This compares to 25 weeks in the first wave of the Business Distress Tracker in mid-late April.

- Firms have gradually begun to wind down the emergency employment measures taken during the height of the crisis. An average of 25% of employees are working reduced hours as a result of the coronavirus outbreak - down from 29% two weeks previously.

James Endersby, CEO at Opinium said: “As we continue to transition towards a post-coronavirus world, glimmers of hope are beginning to appear for UK businesses and the economy as a whole, with fewer companies fearing insolvency, worker’s hours starting to normalise and a greater proportion of firms feeling confident about the upcoming twelve months.

"It is essential, however, not to get carried away as uncertainty remains rife throughout the economy and fears around a second peak still abound. The reopening of the high street will provide some much-needed normality for the country, and we will pay close attention to see whether this can act as an initial catalyst to reignite the economy.”

Pablo Shah, Senior Economist at Cebr said: “Over the past two weeks, an extra 235,000 businesses stated that they are no longer at risk of entering insolvency as a result of coronavirus-related disruption, bringing the total share to nearly two-thirds (66%). This compares to just two-fifths (41%) that felt they were safe during the depths of the lockdown in April.

While recent weeks have brought a trickle of encouraging developments regarding the economy, it is important to remain cognisant of the extremely challenging trading conditions that millions of businesses continue to operate in. Profits are still 30% below where would be expected for this time of year - a figure that has remained fairly consistent throughout the lockdown.”

Business Distress Tracker full findings

Business insolvency risks

An extra 235,000 businesses believe they are no longer at risk of entering insolvency as a result of coronavirus-related disruption. Between 5th and 10th June, it is estimated that nearly two-thirds (66%) of UK businesses feel they are safe from insolvency - up from 41% between April 23rd and April 28th.

The prospects for the retail sector received a sizeable boost when it was announced that non-essential shops could re-open this week. In the latest wave of the Business Distress Tracker, 18% of retailers said there was a moderate to high risk of them entering insolvency as a result of the lockdown - down from 40% two weeks previously.

Employment impacts

Over the past few weeks, we have seen a steady decline in the proportion of staff on furlough from the peak back in April. However, the latest wave of the Business Distress Tracker suggests that progress stalled in the first weeks of June, with a considerable proportion of employees still paid via the job retention scheme and slightly upon on late May. The fact that businesses still feel unable to employ a considerable proportion of their workforce as another factor contributing to a delay in a speedy recovery.

Part of the delay appears to be down to anticipation of changing lockdown rules. The next wave will indicate whether the shops brought their staff back to work after non-essential retailers re-opened or if a return to normality remains some way off.

Business activity rates

Although there has been a steady trickle of encouraging news emerging from the employment and insolvency indicators of the Business Distress Tracker in recent weeks, business’ profits have remained stubbornly low.

Indeed, in the latest wave, businesses on average said that profits over the past month were 30% lower than would have been expected for this time of year under more ordinary circumstances.

This highlights that while the plans to re-open the economy have given more businesses confidence that they can survive the current crisis, the gradual lifting of restrictions has not yet begun to feed into companies’ bottom lines.

Economic recovery

While the immediate threat of bankruptcy is receding for many businesses, the time they will need to recover continues to climb. On average, businesses expect they will need 34 weeks after the lifting of restrictions for them to return to pre-crisis levels of production. This compares to 25 weeks in the first wave of the Business Distress Tracker, highlighting that, for each day the lockdown persists, more and more long term damage accumulates. The primary factors contributing to the delay continue to be a weakening of relationships with customers, difficulties accessing inputs, and reduced levels of demand.