Getsafe now has 10,000 UK customers

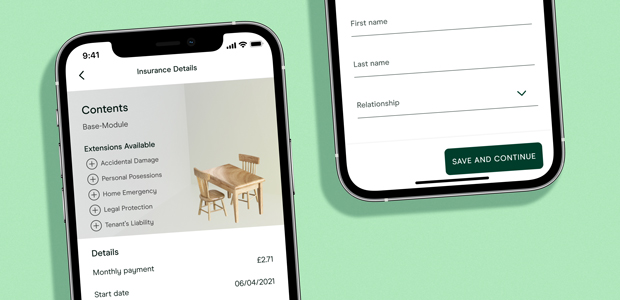

Digital insurer Getsafe recently reached two significant milestones: With 10,000 customers in the United Kingdom and close to 200,000 customers in its native market, Germany, Getsafe is now the largest neo-insurer in Europe. The company currently offers contents insurance with five extensions in the UK and a larger product portfolio in Germany.

Since its foundation, Getsafe has always seen insurance differently. As one of very few companies, Getsafe offers daily cancellation that is free of charge and has no hidden administration fees – making insurance more flexible, transparent and, above all, enjoyable. Christian Wiens, founder and CEO at Getsafe, says: “Even before the pandemic, many people were used to doing everything on their smartphones. COVID-19 has intensified the demand for this. Getsafe fulfills the needs of digitally minded target groups like hardly any other insurer in Europe.”

Getsafe recognises constant innovation as vital and therefore continuously invests in developing and improving its mobile app. Since April, German customers can follow the status of their claim in the app – just like they can track their package or food delivery. Additionally, all important insurance documents are issued and saved in the app.

These new features may sound like small additions, however they are not a given in the insurance world. While many insurance policies are purchased via the internet, the rest, such as managing policies and filing claims, is still usually done over the phone, by post, or by email. “Our technology-based platform brings speed and flexibility to one of the slowest and inflexible industries in the world. This differentiates us from other providers on the market,” says Wiens. He continues: “From day one, Getsafe was always a technology company that provided insurance – not the other way around. As a neo-insurer, we take our inspiration from companies like Airbnb, Spotify, or Netflix. We want to build a Europe-wide insurer and drive digitisation in the insurance sector.”

The numbers don’t lie: More than 75 percent of Getsafe’s customers are taking out insurance for the first time in their lives – typically belonging to Generation Y. Many customers use the app almost every month. This is high for the insurance industry, with app-based insurance being rare among conventional insurers. Around a quarter of customers have more than one policy – meaning there are more than 250,000 active Getsafe insurance policies. Despite rapid growth, the company’s profitability significantly increased over the last three years. For example, loss ratios – which an insurer’s profits largely depend on – have more than halved.

In terms of investment, Getsafe received support from well-known venture capital firms, including Earlybird and CommerzVentures as well as renowned insurer Swiss Re in the autumn of 2020. In the last 12 months, the team has grown by 40 percent in its two offices in Heidelberg and London – even with the challenges caused by the pandemic. From 2022 onwards, Getsafe will be focusing on further European markets.