Getsafe launches digital accident insurance

Around nine million accidents happen in Germany every year – sometimes with lasting health consequences for those affected. Personal accident insurance helps to cushion the financial burden. Getsafe has decided to offer its customers a digital accident insurance product. This marks an important step for the company towards life insurance and shows that even personal, complex insurance products work on the smartphone.

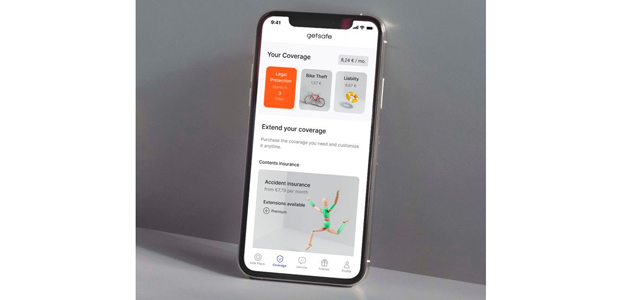

"Skeptics believe that people are only buying insurance policies online that are exchangeable and quite cheap, i. e. only basic products in the property and casualty sector. With our digital accident insurance, we are proving the opposite. Insurance should be fun – this also applies to products that require explanation, such as accident insurance," says Getsafe founder and CEO Christian Wiens. With just a few clicks, customers can take out insurance on their smartphone, manage their coverage or file a claim. The Getsafe app is available to customers 24/7, 365 days a year, and allows them to change their data and coverage in real time.

Getsafe has set out to offer its customers a comprehensive service for all situations in life. To achieve this, the company follows a twofold approach. On the one hand, Getsafe applied for a licence from the German Federal Financial Supervisory Authority (BaFin) for property and casualty insurance in February. This allows Getsafe to implement products and innovations even quicker and with more freedom. Getsafe expects to start with the newly licensed insurer in early 2021.

On the other hand, the company is still pursuing a platform approach: the self-developed platform enables Getsafe to bundle differentiated products for different life phases and markets under a strong brand and with a consistent user experience. Even with its own licence, Getsafe will continue to develop products in cooperation with other risk carriers in order to provide comprehensive protection for its customers.

So far, the Covid-19 pandemic has not affected the company – on the contrary. With over 10,000 policies sold, March was the strongest month in the company's history; April could even exceed this figure. Christian Wiens says: "The current circumstances require us to do as much from home as possible. Taking out insurance via smartphone was convenient before the crisis; now it has almost become a necessity."

Getsafe is already growing faster in absolute terms than traditional insurers in the segment of first-time insurance buyers and has a market share of almost 10 percent. Yet, if Getsafe primarily appealed to people between the ages of 20 and 35, the coronavirus crisis could change that. "People of all ages are now learning that they can buy insurance online – just as they order goods or food online. This shift on the insurance business towards the digital space will likely remain," says Wiens.

Christian Wiens is optimistic about the coming months. The need to digitise processes and meet new customer expectations has not only existed since the coronavirus pandemic. Now the advantages of a digital business model are becoming apparent. For the first time, there is a realistic possibility of founding a global company in the insurance sector where sales are 100% digital. Christian Wiens is convinced: "In five to ten years, we will no longer be talking about insurtechs and traditional insurers, but only about technology-driven insurance companies. Getsafe wants to set the tone here."

A few weeks earlier, Getsafe had already expanded its product portfolio to include digital dog owner’s liability insurance. In the coming months, Getsafe will launch further property insurance policies on the German market. The company intends to enter the life insurance segment with its own product range by the end of the year.