Angel investors will invest more in startups during 2025

Despite a complex global landscape, angel investors are planning to invest more in startups in 2025 than last year, with cautious optimism the prevailing mood. This is the key finding from the latest global survey of investors from Angel Investment Network (AIN), the global online angel investment network.

An impressive 40% of respondents said they will invest more in 2025 than the previous year, while a further 39% will invest at the same level. Just 12% said they would invest less. The findings highlight the resilience of the early-stage ecosystem and its ability to deliver innovation and returns.

When asked which sectors created the most excitement at the moment, HealthTech topped the list, with 54% of respondents interested in this sector. Next came AI with 49%. Despite a changing political climate, sustainability (39%) also remains a key area of interest, reflecting a growing awareness of impact alongside financial returns. This was followed by FinTech at 30% and ClimateTech at 27%.

Overoptimistic financials – biggest startup flaw

Amidst this cautious optimism, the all-important funding pitch faces a more rigorous assessment than ever. Over-optimistic financials were the most cited flaw in the current climate, according to 21% of respondents. This was followed by an unrealistic path to profitability, according to 20% of investors. Next came overvaluing the company (17%) and a lack of competitive differentiation (11%).

Thinking about recent startups they’d backed, a clear value proposition came out as the top reason investors decided to commit, named by 70% of investors, followed by the transparency of the founders (59%), and the relevant experience of the team (56%).

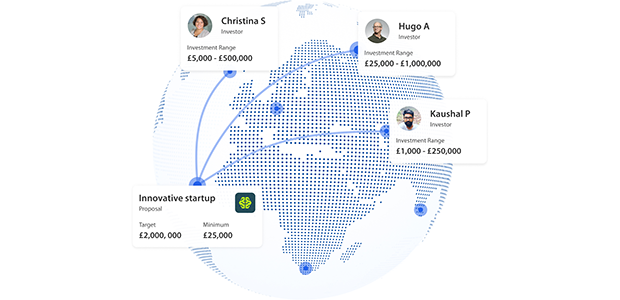

These insights highlight the need for startups to present well-researched, realistic, and transparent pitches to secure investment. The average initial investment accurately reflects the early-stage nature of angel investing, with 65% of angels typically investing £25,000 or less per startup.

1 in 2 have had a successful exit

While the majority of angels (62%) have invested in under five businesses, nearly half (49%) of those surveyed have witnessed a startup they backed achieve a successful exit, reinforcing the potential rewards of early-stage investment.

The survey of investors across AIN’s global network revealed a significant 57% of investors have been founders themselves, giving them a valuable understanding of the challenges and opportunities facing startups.

Recession biggest risk to investment

While cautious optimism is the prevailing mood globally, an uncertain macroeconomic climate could impact the willingness to invest. When asked what potential factors might influence their investment decision this year, 80% of angel investors cite uncertainty about the economy or potential recession. Next came potential increases in taxes (39%), followed by consumer sentiment (35%).

According to Mike Lebus, Founder of Angel Investment Network: “The current sentiment among angel investors in 2025 is one of carefully considered optimism, which is good news for the global startup ecosystem. Their backing of more startups, coupled with their focus on high-potential sectors like AI and HealthTech, shows that the early-stage funding landscape remains strong and resilient.”

He continued: “However, this enthusiasm is tempered by a clear-eyed understanding of fundamental requirements and a new mood of realism amidst economic headwinds. Startups must recognise that the era of overinflated valuations is over, and focus on robust business plans and realistic financial projections to enhance credibility and secure funding. Those that do will be well-positioned to capitalise on the capital and experience currently available in the angel investment community.”