6 Ways to Manage Debtors More Effectively: An Ultimate Guide

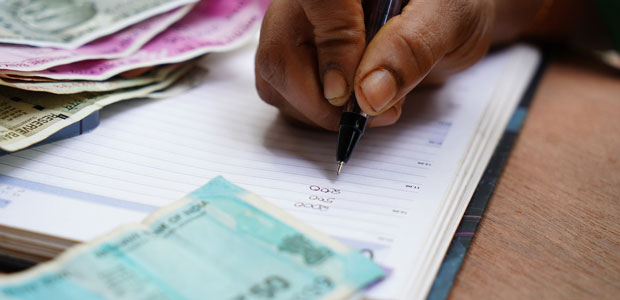

As a small business owner, you undoubtedly understand the importance of collecting payments from your customers on time. Debtors are the bane of any business owner's existence. They can hold up payments causing cash-flow problems, which can be a headache to most business owners. However, with a bit of organisation and planning, you can manage your debtors more effectively and minimise the negative impact on your business. This blog post will discuss six ways to do just that.

-

Keep Detailed Records

The first step to effectively managing debtors is to keep detailed records. This means having a system to track invoices, payments, and outstanding balances. As a company, you should clearly understand who owes you money, how much they owe, and when the payments are due. This can be challenging for some, but with debtor management software, this can be easily achievable. This software will come in handy as it can track all the information you need in a central location to easily accessible to everyone on your team.

By keeping accurate records, you can more easily identify which customers are behind on payments and take action accordingly. It will also help you negotiate payment plans or settlements with debtors when it comes time.

-

Implement a Late Payment Policy

If you want your customers to take your business seriously, you need to implement a late payment policy. This policy should outline the consequences for late payments, such as interest charges or late fees assessed for payments made past the due date. Having this in place will not only help you enforce your terms and conditions, but it will also help you maintain a good relationship with your customers. It will also help you to establish credit limits for your customers.

-

Use Automated Reminders

One of the best ways to manage debtors is to use automated reminders. You can do this by email, text messages, or even phone calls. Automatic reminders are an effective way to keep tabs on customers who are behind on payments without having to chase them down yourself constantly.

You can set up your reminders to send out payments that are due automatically based on the payment due date. This will help you stay on top of things and ensure no missed charges.

-

Get Help From a Collection Agency

If you're struggling to collect payments from your customers, you may want to consider enlisting the help of a collection agency. Collection agencies specialise in collecting payments from debtors and can be an excellent resource for businesses with trouble getting paid. This way, you can focus on running your business while the collection agency collects payments.

There are a few things to keep in mind when working with a collection agency, such as the fees they charge, and the impact collections can have on your customers' credit scores. But, if you're at your wit's end, a collection agency may be worth considering.

-

Set Payment Terms

When negotiating a sale with a customer, be sure to set payment terms. This means agreeing on a date by which the customer will pay for the product or service they purchase. Having payment terms in place can help to ensure that payments are made on time, and it can also help establish credit limits for your customers.

Also, when you send an invoice, be sure to include the payment terms. This will let your customer know when they are expected to make a payment and how much interest will pay if the money is late. By setting clear payment terms, you can help reduce the chances of late payment.

-

Offer Early Payment Discounts

One final way to manage debtors is to offer early payment discounts. This can be a percentage of the total invoice or a flat fee amount, done by providing a discount for payments made within a specific timeframe. For example, you may give a value of $50 for settlements made within 30 days of the invoice date.

You can encourage your customers to pay their invoices on time by offering early payment discounts, which can help reduce the number of late payments you receive. This is a win-win for both you and your customers.

Debtors can be a big challenge for businesses. But by following these tips, you can manage them more effectively. By keeping accurate records and implementing a late payment policy, you can more easily manage your debtors. You can also use automated reminders and get help from a collection agency. And lastly, be sure to offer early payment discounts. This will help you get paid on time and reduce the number of late payments you receive.